Japan Markets ViewWhich Stocks to Be Subject to Next TOB?

Dec 04, 2023

[Nikkei QUICK News] A series of takeover bids (TOB) for listed companies are taking place. TOSHIBA (6502) passed a proposal for a reverse stock split and other measures to take its shares private at an extraordinary shareholders meeting on November 22. Japan Industrial Partners (JIP) and a consortium of companies have already conducted a TOB for Toshiba. Some in the market called it “a symbolic case of management restructuring” (Toshiya Matsunami, chief analyst at Nissay Asset Management). Which stocks will be subject to the “next TOB”? This article explores the stocks from listed subsidiaries that are dissolving cross-shareholdings and undervalued stocks with a high founder’s shareholding ratio.

In March, the Tokyo Stock Exchange (TSE) announced its “Action to Implement Management that is Conscious of Cost of Capital and Stock Price,” which is encouraging companies to invest in growth. In response to TSE’s request, an increasing number of companies are disclosing their intention to make their subsidiaries wholly owned through TOB. According to RECOF, an M&A advisory firm, there were already 70 TOB cases for Japanese companies in 2023 as of November 21, approaching the levels of 2021 (71 cases) and 2009 (79 cases). Against the backdrop of a series of TOBs, the market participants keep a close eye on the next TOB stocks.

Which Stocks Will Be Subject to the Next TOB?

In recent months, many companies have been unwinding their cross-shareholdings. Masatoshi Kikuchi, chief equity strategist at Mizuho Securities, focuses on listed subsidiaries that “have a low approval ratio from institutional investors at shareholder meetings” in order to identify the next TOB stocks. In such companies, the voices of minority shareholders are less likely to be reflected, and “the market’s harsh opinions may be reaching the listed subsidiaries or their parent companies through engagement (dialogue),” he pointed out.

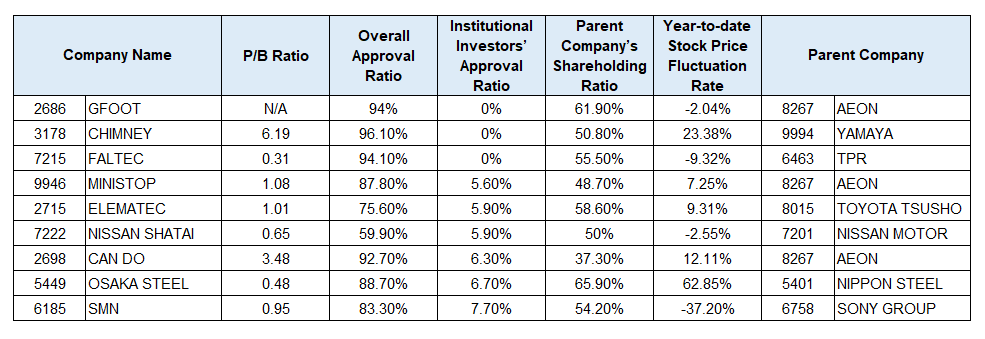

We extracted listed subsidiaries with less than 10% of institutional investors voting in favor of the proposal for the president appointment by the asset management company at the general shareholders’ meeting held in May and June. As a result, GFOOT (2686), CHIMNEY (3178), and MINISTOP (9946) were identified. Looking at the stock price fluctuation rates since the beginning of the year through November 21, FALTEC (7215) and SMN (6185), for example, have seen their stock prices remain sluggish and may be considered undervalued.

(Note) Source: Mizuho Securities; Companies with at least ten institutional investors exercised their voting rights among listed subsidiaries that had a proposal for the president appointment at their general shareholders’ meeting from May to June 2023. The year-to-date stock price fluctuation rates are as of November 21, and the P/B ratios are as of November 22.

Stocks with High Founder’s Shareholding Ratio and Low P/B ratio Are Targets for MBO

An increasing number of companies are opting for management reform through management buyout (MBO). According to RECOF, the number of delisting through MBO in 2023 was 15 cases, a high level close to that of 2021 (19 cases).

Benesse Holdings (9783) announced an MBO on November 10. Although the P/B ratio was slightly above one, which is considered the dissolution value, the founding family held a high percentage of the company’s shares. Teraoka Seisakusho (4987), which announced an MBO on October 30, also had a high percentage of shares held by the founding family, and its P/B ratio was around 0.4 as of the same day.

Mizuho Securities noted that stocks with high founder’s shareholding and low P/B ratios tend to be the targets of MBOs. Companies with P/B ratios below one and high founder‘s shareholdings include LIFULL (2120), COOKPAD (2193), and COLOPL (3668), according to Mizuho Securities.

The trend toward dissolving cross-shareholdings is expected to “further accelerate” through 2024 (Goldman Sachs). As investors see the unwinding of cross-shareholdings by companies as an important step forward in corporate governance, stock prices often react to it strongly. Driven by the TSE reforms, TOBs and MBOs are likely to be recognized as effective means of increasing corporate value.

(Reported on November 22)

NQN News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data017/