Japan Markets ViewTrading Company Stocks Gaining Stability in Dividends, Buffett Buys More

Dec 15, 2022

Despite receding concerns about U.S. monetary policy, anxiety over economic slowdown is likely to weigh on Japanese equity markets in the near term. The Federal Reserve Board (FRB) is expected to reduce interest rate hikes to 0.5% at the Federal Open Market Committee (FOMC) meeting in December, which is becoming an established scenario. While the outlook for the dot plot will still be a focus of attention for the December FOMC meeting, many believe that the upside from the September median (4.625%), if any, will be limited.

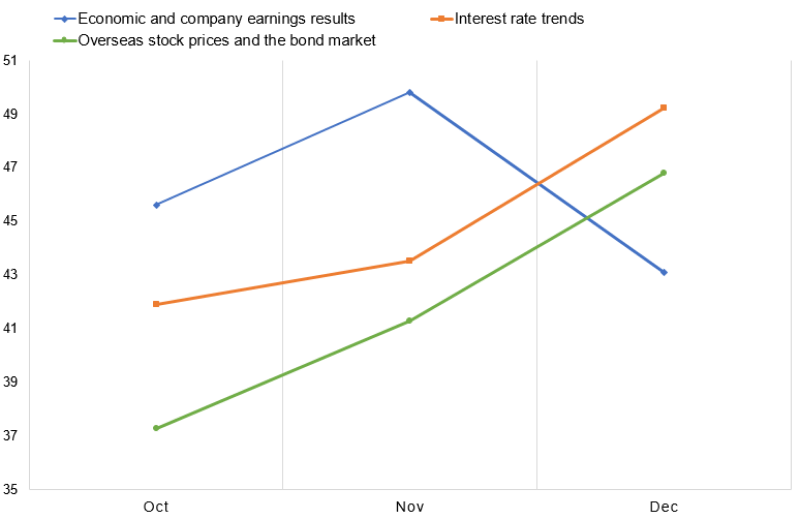

Instead, there is a growing sentiment that concerns about a worsening economy are likely to hold back stock prices. According to the QUICK Monthly Survey (Equity) in December, as a factor for the stock price fluctuation, respondents focusing on “Economic and company earnings results” once again rose to 53%, up 5 points from the previous month. Noteworthy is the movement in the index, which shows the degree of impact. In the December survey, the index was 43.1, down 6.7 points from the previous month, with a slight increase in the number of respondents who view it as a declining factor.

* When there is the strongest concern for it being a factor for depreciation, the index would be 0. When there is the strongest expectation of it being a factor for appreciation, the index would be 100.

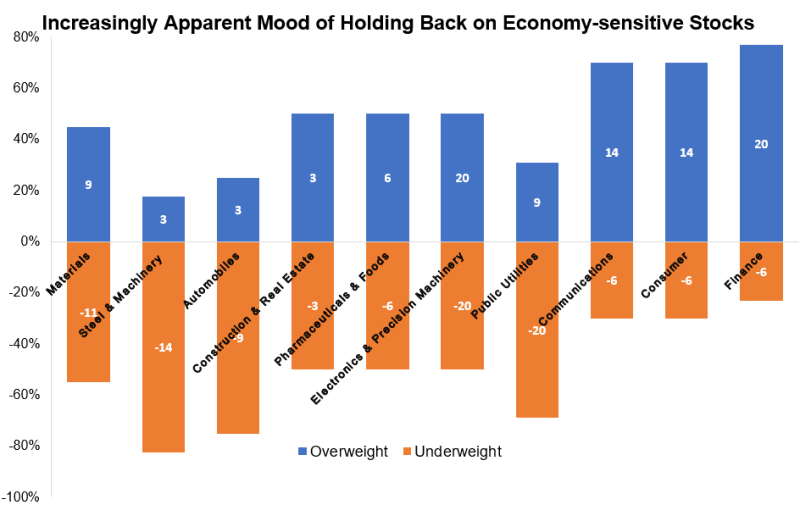

The investment stance by sector further reveals caution about the economy. Looking at the balance between the sectors survey participants intend to “overweight” and the sectors to “underweight” in their investment stance, the three sectors that posted positive results were “Communications,” “Consumer,” and “Finance.” Negative balance was seen in the three sectors, which are “Materials,” “Steel & Machinery,” “Automobiles,” and “Public Utilities,” while zero balance was identified in the three sectors, “Construction & Real Estate,” “Pharmaceuticals & Foods,” and “Electronics & Precision Machinery.”

The mood of holding back on stocks, especially economy-sensitive stocks, is increasingly apparent. These sectors are also vulnerable to soaring procurement prices and raw material prices driven by a weaker yen.

When asked about the timing of a FRB’s rate cut, the highest response rate was for the second half of 2023 at 50%, followed by the first half of 2024 at 38%, suggesting that the real economy is likely to continue deterioration in the near term in 2023.

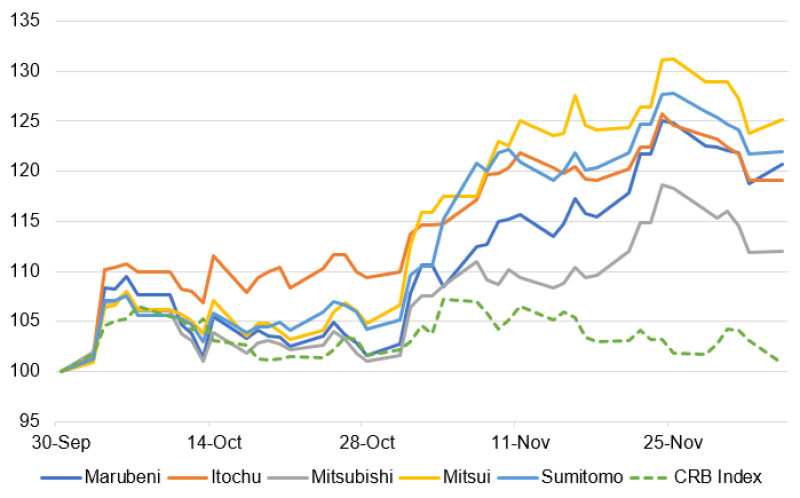

Under these circumstances, one sector of note is trading company stocks, which attracted attention when Warren Buffett increased his stock purchases of the five major trading companies. Although known for its high dividend yields, the sector had long been vulnerable to resource price fluctuations, which could cause earnings to swing sharply. However, this linkage has been fading, and the stock prices seem to be less affected by the sluggish commodity markets.

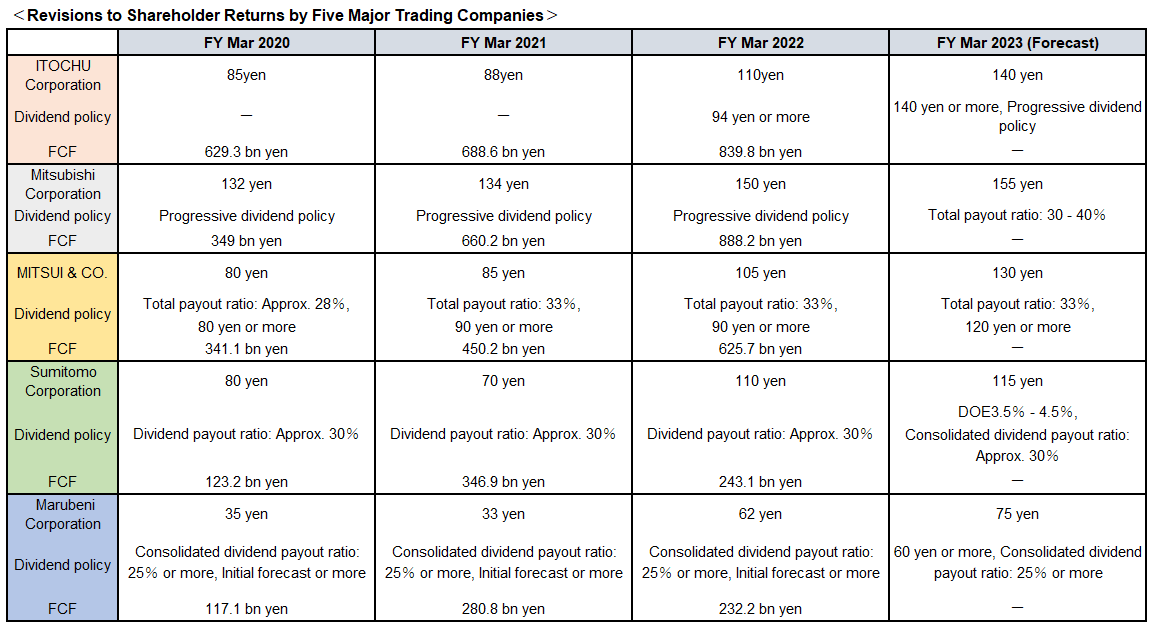

One of the reasons for this is their aggressive attitude toward returning profits to shareholders. According to a survey conducted by the Nikkei, 249 of the companies with fiscal year ending in March 2023 revised their dividend forecasts upward when they announced their April-September financial results. Among them, the largest sector was trading companies with 52 companies in total. Looking at the five largest trading companies by market capitalization, their free cash flow (FCF, net cash flow) has been positive across the board for the past three fiscal years. These companies have more leeway for shareholder returns than in the past, when they prioritized investment. In addition to this, the revision of dividend policy also makes them more attractive. For example, Sumitomo Corporation (8053) has introduced dividend on equity (DOE) as a criterion for its dividend policy from this fiscal year, in addition to the dividend payout ratio, which is linked to the net income level. As a result, the company now expects to pay a dividend of 115 yen per share for this fiscal year, a turnaround from the reduced dividend forecast at the beginning of the fiscal year.

* Upper rows show actual dividends, and for FY Mar 2023, the latest forecasts. Total payout ratios for Mitsui & CO. are the ratios of total payout to underlying operating cash flow. FCF = free cash flow (net cash flow)

Furthermore, ITOCHU Corporation (8001) has unveiled its policy of progressive dividend increases and has pledged a payout ratio of 30% by the fiscal year ending March 2024, the final year of its medium-term management plan. Mitsubishi Corporation (8058) has decided to adopt its total payout ratio along with the existing progressive dividend policy. The company intends to return the profit boost from higher resource prices to shareholders through share buybacks. While maintaining a progressive dividend that will not be reduced even in the event of a downturn in earnings, Mitsubishi Corporation intends to flexibly return profits to shareholders.

Trading companies’ stock prices are expected to turn away from their traditional pattern of being easily affected by resource prices. They are expected to enhance their self-sustainability by taking advantage of their stable dividend payments.

(Reported on December 8)

QUICK Monthly Survey on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data012/