Japan Markets ViewREIT Performance Estimation with Human Flow Data

Dec 01, 2022

The human flow data provided by KDDI (9433), a major Japanese telecommunications company, could be useful for various investment strategies, which include real estate investment trusts (REITs) that manage hotels. Mitsubishi UFJ Trust Investment Technology Institute Co., Ltd. (MTEC), a think tank specializing in financial engineering, examined the nowcast of hotel revenues using data on the guest population of properties owned by REITs.

The KDDI Location Data (location-specific movement data) is used for this study. It is from among the alternative data in the QUICK Data Factory, which is a data platform provided by QUICK, a financial information provider.

This data from KDDI is based on GPS location data and is composed of daily estimated population at each property of the major companies including 61 REITs.

Hotel Revenue Evaluated with Occupancy Rates and Average Daily Rates

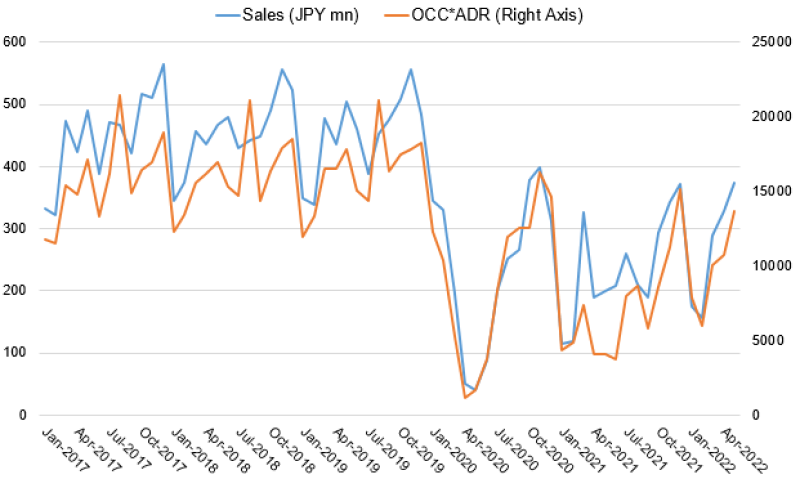

Generally, occupancy rates (OCC) and average daily rates (ADR) are used to evaluate the profitability of hotels. Since the primary source of revenue for hotels is room charges, these revenue indicators are generally linked to sales.

The chart below compares the monthly sales of Kobe Meriken Park Oriental Hotel, owned by Japan Hotel REIT Investment Corporation (8985, JHR), to revenue per available room (RevPAR, calculated as the product of OCC and ADR), which is a revenue indicator for hotels. The chart shows that sales and revenue indicators are linked.

Hotel sales depend on OCC. Some investment corporations publish revenue indicators such as sales and OCC on a monthly basis. They are disclosed publicly at the end of the following month. If the number of hotel guests, which can be checked on a daily basis, could be used as substitute data for OCC, it could predict hotel revenues to some extent before the announcement by the investment corporations.

1. Substituting OCC with Human Flow Data

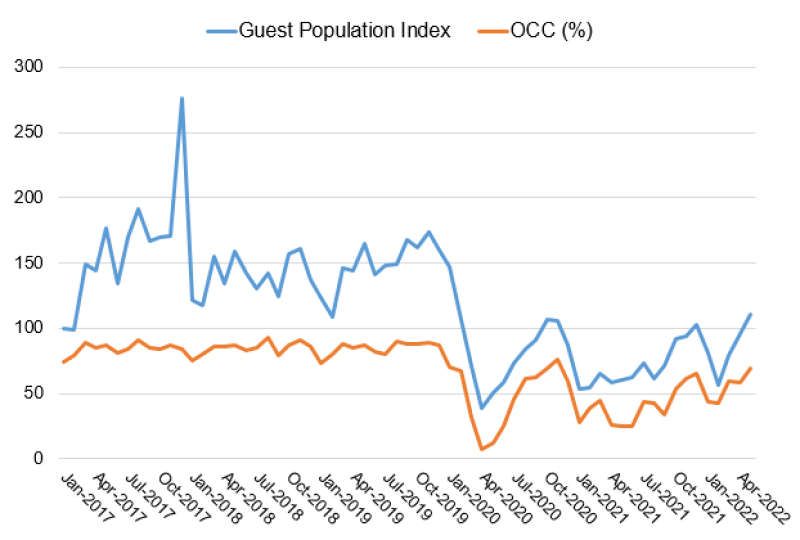

KDDI provides data on daily estimates of the number of people staying at each property. This data is aggregated on a monthly basis and standardized as January 2017 = 100 (hereafter, “guest population index”).

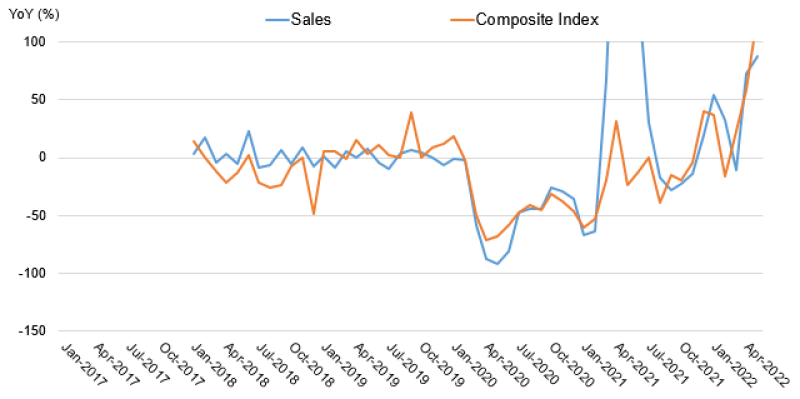

The charts below compare OCC published by the companies to the guest population index. The left chart compares actual values, while the right chart compares year-on-year values. As a result, the months of rise and fall in both charts are consistent. This suggests that the guest population index could be used as an alternative indicator to OCC.

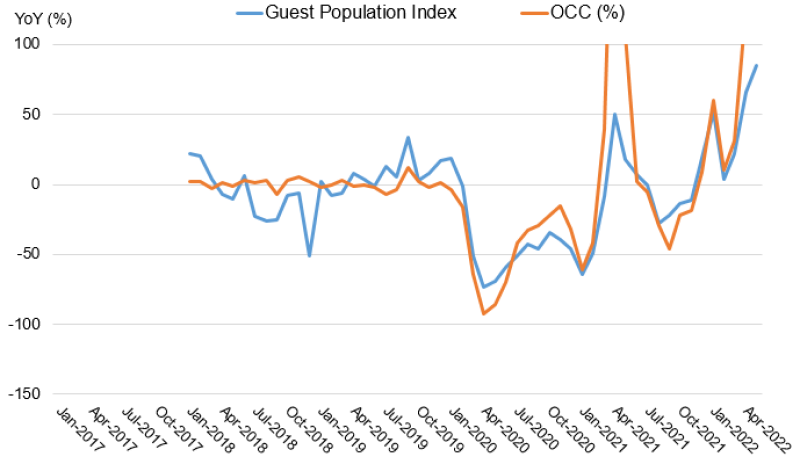

2. Nowcasting Revenue with the Guest Population Index

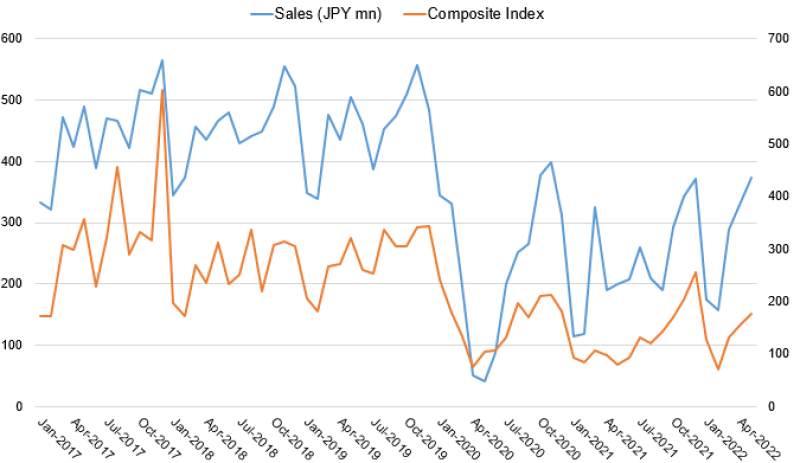

Then a composite index (= guest population index * (12 months lagged ADR) /10,000) is defined as a proxy for RevPAR (= OCC*ADR) up to scale and compared to sales. As shown below, the left chart compares actual values, while the right chart compares year-on-year values. Both charts show generally consistent directions.

This suggests that the composite index based on KDDI’s daily human flow data could be useful for real-time estimation of hotel revenues, which are announced approximately one month later.

Various Forecasts Available Taking Advantage of Promptness

The empirical study so far has shown the potential of KDDI-provided human flow data as a substitute for OCC. Using highly preliminary human flow data is likely to lead to diversification of revenue forecasts, such as projecting sales performance of individual properties before official announcements.

REITs usually close their accounts twice a year. Not all investment corporations publish monthly data. Therefore, there are few opportunities to obtain fresh information. However, using KDDI Location Data will enable us to obtain data on a daily basis. If daily property trends could be confirmed, it would be very useful information for predicting the operating performance of REITs.

QUICK provides the information through its data platform “QUICK Data Factory.” In addition to the 61 REITs used in this study, we provide human flow data of each property owned by the 393 companies comprising TOPIX that have a large number of production bases in Japan.

Mitsubishi UFJ Trust Investment Technology Institute Co., Ltd. (MTEC) is a subsidiary of Mitsubishi UFJ Trust and Banking Corporation, a member of MUFG. Through research into the latest technologies and data analysis in asset management and risk management, MTEC provides services to solve issues and sophisticate business for clients inside and outside the group. It has also been working in the area of alternative data and machine learning.

https://www.mtec-institute.co.jp/en/

KDDI Location Data on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data038/