Japan Markets ViewQUICK Forecast: Look Ahead to Earnings Recovery after COVID-19

Jun 25, 2021

Following COVID-19 vaccination to the elderly and healthcare professionals, vaccination at offices and universities began on June 21. Vaccination under the age of 64 began at large-scale venues, and the resumption of economic activities is likely to accelerate. Corporate earnings are expected to recover gradually.

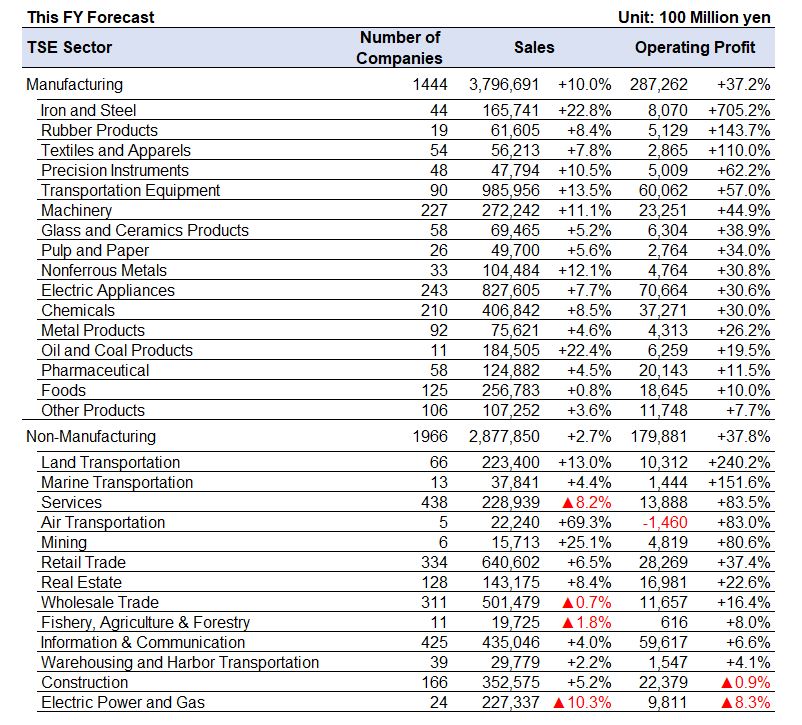

We calculate QUICK Forecast, an original earnings estimate, using financial data. According to the analysis of QUICK Forecast by sector, consolidated operating profit for all industries (based on 3410 companies)* except “Financials” is expected to recover sharply to +37.4% YoY as of June 15. Many sectors are expected to be more than double, such as a 705.2% increase in “Iron and Steel,” a 151.6% increase in “Marine Transportation,” and a 143.7% increase in “Rubber Products.”

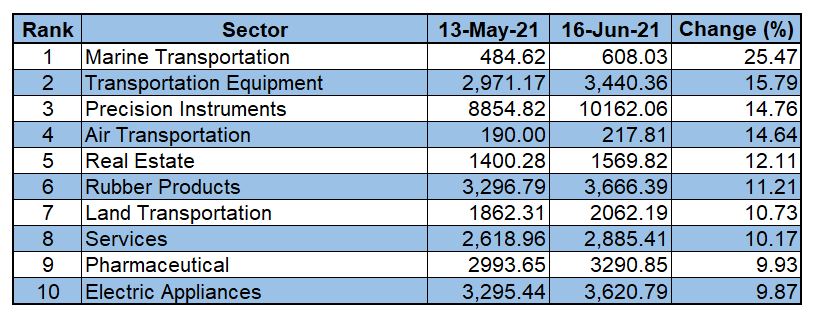

How much does the stock market factor in the recovery of business performance from abnormal situations such as repeated “COVID-19 State of Emergency” and a sharp decrease in the number of people who go out? In view of the leading role of the market return phase after May 13, when priority vaccination accelerated, “Marine Transportation” was at the top, followed by “Transportation Equipment” and “Precision Instruments.” Although the operating profit growth rate for this fiscal year is certainly high, the profit growth rate for “Transportation Equipment” remains at 10th place overall, and “Precision Instruments” also remains at 9th place. It is notable that “Iron and Steel,” which is at the top of the profit growth rate, has the lowest performance with a 9.4% down.

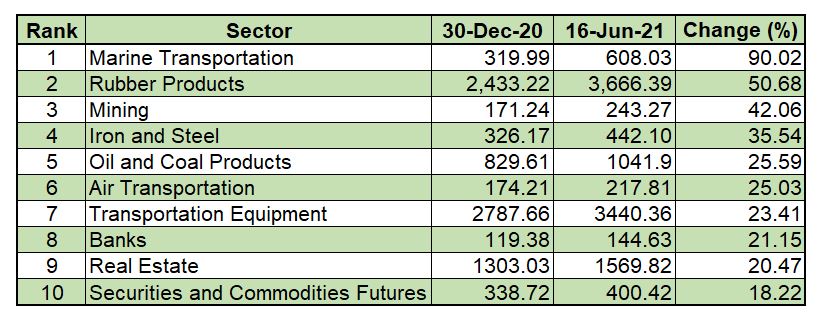

On the other hand, looking at the trend of stock prices from the beginning of the year, although “Marine Transportation” did not change at the top, the 2nd place was “Rubber Products,” which ranked 2nd of the operating profit growth rate, and the 4th place was “Iron and Steel.” Stocks with a relatively high growth rate in non-manufacturing industries such as “Mining” and “Air Transportation” also ranked high. This indicates that the stock price has factored in the earnings recovery after COVID-19 from the beginning of the year. “Iron and Steel” related stocks rose by the appreciation of the announcement of a massive restructuring program. Since the earnings recovery was already reflected in the stock price, the current weakness in the stock price is likely to be a decline due to profit-taking.

Updates from the latest forecast also seem to have affected stock price trends. Although there is no change in the significant increase in operating profit in “Iron and Steel,” the growth rate decreased 2.5 points from the previous forecast as of May 18. On the other hand, the profit growth rate for “Precision Instruments” increased by 2.3 points, and that for “Transportation Equipment” also increased by 3.5 points from the previous forecast. The stock market already reflects the direction of the rapid earnings recovery after COVID-19 vaccination, it may be reaching a phase to see how well the resilience will increase.

* It is calculated using the tool “QUICK Forecast” that calculates the earnings forecast of listed companies up to the fifth fiscal year ahead. Aggregation as of June 15 for this fiscal year (The next fiscal year for which results have already been announced, the fiscal year ended March 2022, etc.) and next fiscal year (The year after the results have already been announced, the fiscal year ended March 2023, etc.).

What is “QUICK Forecast”?

QUICK Forecast is the earnings estimate for the fifth fiscal year of all listed Japanese companies (FY1 – FY5). Forecasts are calculated by statistically analyzing data such as financial ratios and macro indicators based on company forecasts. This data is updated on a weekly basis.

QUICK Forecast on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data037/