Japan Markets ViewNikkei 225 forecast for 2021 is between 25,000 and 29,500. Rising U.S. interest rates are being closely watched. — QUICK Monthly Survey (Equity) in January 2021

Jan 13, 2021

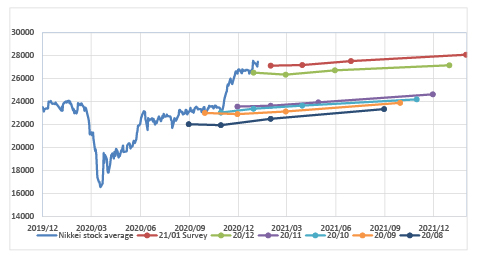

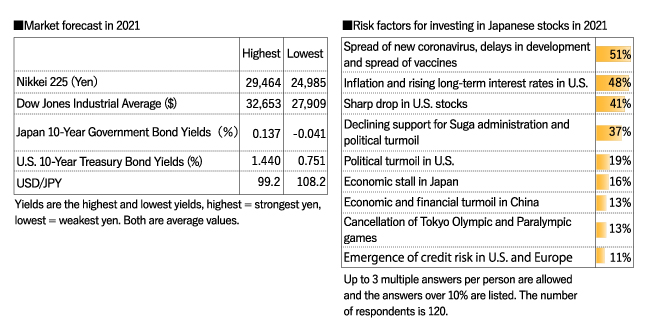

Market participants forecast that Nikkei 225 will fluctuate between 25,000 and 29,500 in 2021, according to the QUICK Monthly Survey (Equity) conducted at the beginning of 2021. Although the spread of the new coronavirus and concerns about inflation in the U.S. are risk factors, corporate earnings in Japan are expected to rise. When asked to forecast the Nikkei 225’s highest and lowest prices in 2021, the average was 29,464 and 24,985, respectively. 44% of the respondents answered that the highest price would be in December, while the lowest price was in March (19%) and the lowest in February and December (14%).

As for risk factors for investing in Japanese stocks in 2021, half of the respondents chose “The reemergence of new coronavirus infections and delays in the development and spread of vaccines”. Concerns about “Inflation and rising long-term interest rates in the U.S.” and “Sharp drop in U.S. stocks” also attracted a high level of attention. The top risk factor in Japan was “Declining support for the Suga administration and political turmoil”. On the other hand, domestic corporate earnings of all listed companies are expected to recover, with 42% of respondents expecting “10-30% increase in RP (recurring profit)” and 41% expecting “30-50% increase in RP” for FY2021.

The forecast for the closing price at the end of January, which is asked every month in the survey, is 27,131 on average, which is the sixth consecutive month of increase. With the yield on 10-year U.S. Treasury bonds hovering above 1%, the number of respondents who cited interest rate trends as a factor in stock price fluctuations increased sharply. For example, a securities firm said, “I’ll be watching to see how much the Nasdaq falls as U.S. interest rates rise.” indicating that they are watching how rising interest rates will affect stock prices. The survey was conducted among 214 people, including managers of domestic institutional investors, and the number of respondents is 120. The survey was conducted between 5th and 7th January 2021.

QUICK Data Factory(QUICK Monthly Survey)

https://corporate.quick.co.jp/data-factory/en/product/data012/