Japan Markets ViewJapan’s “Growth Market” Undergoing Severe Winter

Apr 30, 2024

[QUICK Market Eyes] A spring storm is hitting the market. In particular, on April 19, the Tokyo Stock Exchange (TSE) Growth Market 250 Index for start-up companies fell to its lowest level in six months since October 2023. The market is undergoing a severe winter, not a springtime. Some have pointed out that the emerging-market indices are structurally challenged to rise amid the headwind of rising interest rates.

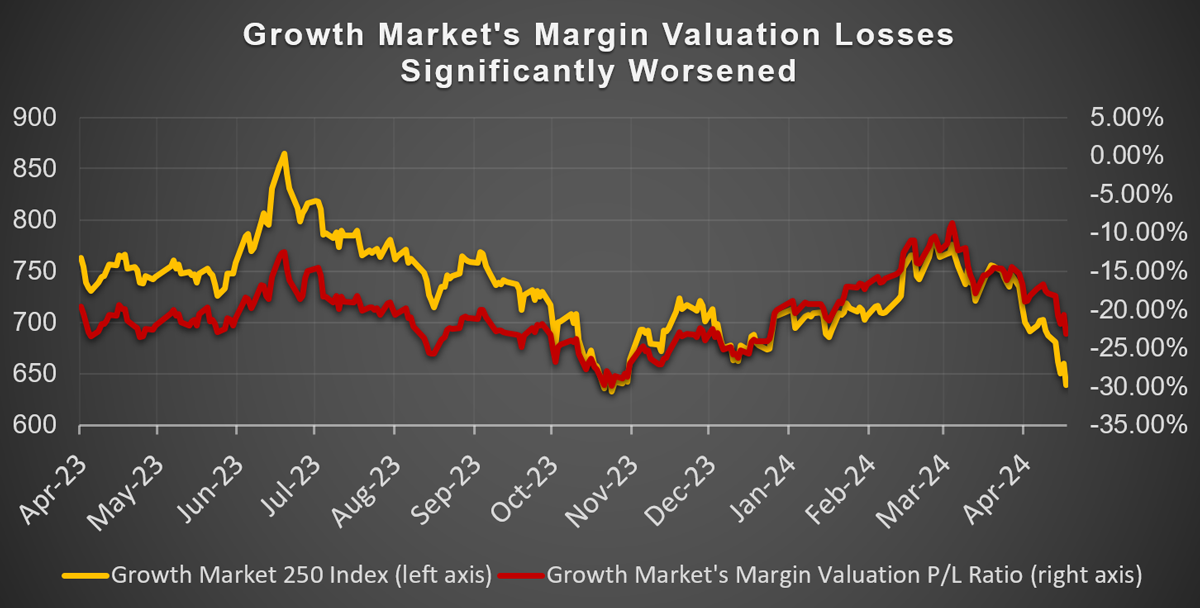

■ Worsening Margin Valuation P/L Ratio and Concerns of Cost Increases Due to Rising Interest Rates

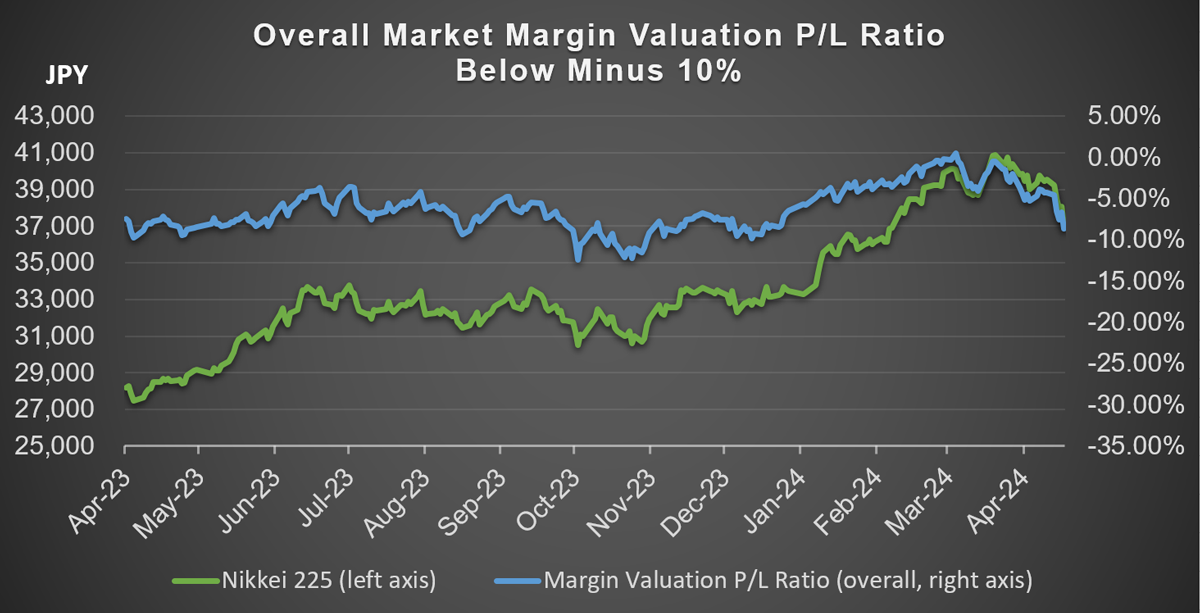

The financial situation of individual investors is worsening in the emerging market. According to Matsui Securities, the margin valuation profit/loss ratio, which indicates the degree of unrealized gains/losses on margin trading, stood at -23.15% on a TSE Growth Market issue basis as of April 19. This ratio went below -20%, which is the benchmark for requiring a margin call, and is the lowest level since December 2023. The securities’ overall margin valuation profit/loss ratio, including the Prime Market, was -8.68%. Although it is far from the level requiring a margin call, investors mainly trading in the emerging market are seeing their investment capability deteriorate.

Source: Matsui Securities

Source: Matsui Securities

Tomoichiro Kubota, senior market analyst at Matsui Securities, pointed out, “Rising interest rates in Japan may increase costs for individual investors, and we need to watch out for the potential decrease in the emerging market trading volume.” The Bank of Japan (BOJ) decided to lift negative interest rates in March, and many in the market anticipate additional interest rate hikes before the end of the year. However, since interest rates constitute a cost in margin trading, the normalization of the BOJ’s monetary policy would increase the cost of margin trading itself.

■ Growth Market’s Structural Problem

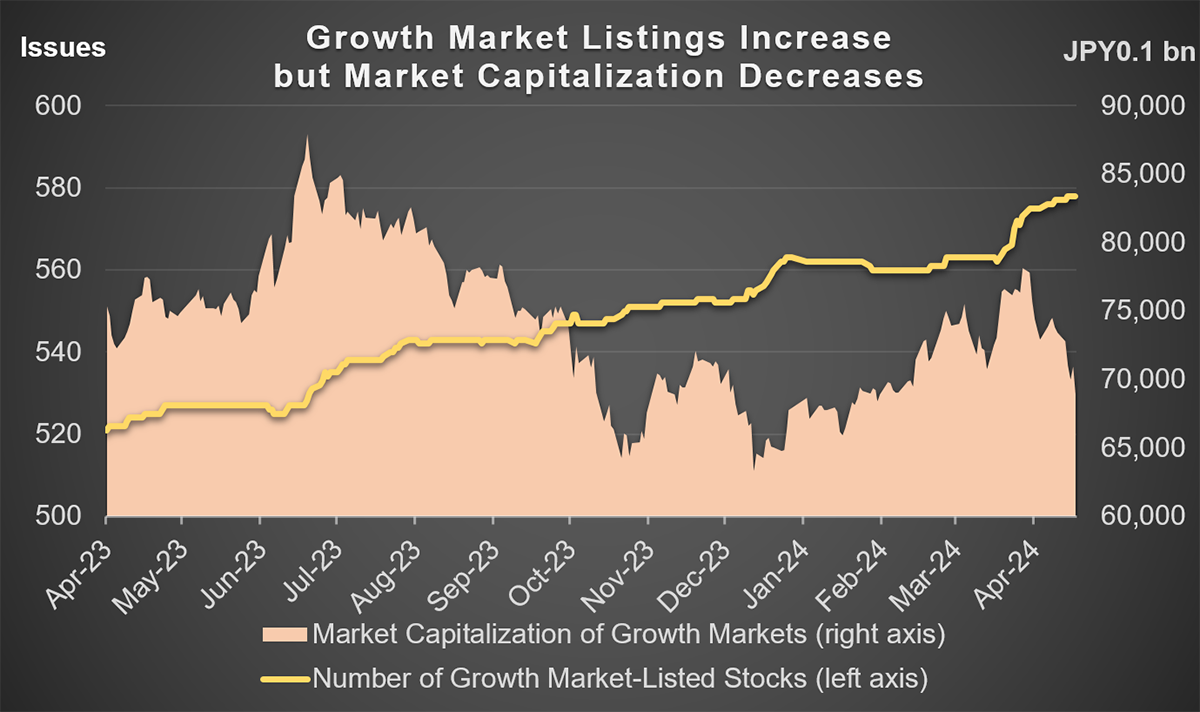

A dealer of a local securities company commented, “Companies that have grown in the Growth Market tend to move to other markets, such as the Prime Market. On the other hand, more and more immature companies go public through initial public offerings (IPOs), dispersing funds throughout the market. This results in a structural problem that prevents the emerging market indices from rising.” The Growth Market has seen an increase in the number of listed stocks, while market capitalization has been declining.

The TSE’s Follow-up Council Regarding the Market Restructuring also discussed the functionality of the Growth Market. At the March 22 meeting, the participants exchanged various opinions on the criteria for maintaining the listing of the Growth Market companies. An official from the Ministry of Economy, Trade and Industry, who participated in the follow-up council as an observer, noted, “Recently, we often hear that ‘growth stops after listing,’” indicating his view that the listing system needs to be changed.

One individual investor commented, “I would like to see the Growth Market become a place attracting high-growth companies by adding growth potential of about five years to the listing criteria.” The TSE has been requesting the Prime and Standard market-listed companies to take “Action to Implement Management that is Conscious of Cost of Capital and Stock Price,” and such efforts are beginning to have an effect. Therefore, it is worth watching if changes in the listing criteria and the boosting measures will be presented in the Growth Market.

(Reported on April 23)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/