Japan Markets ViewMarket Focuses on Mid-term Plans of Companies Announcing Earnings Results

May 14, 2024

[Nikkei QUICK News] The market has been paying close attention to companies releasing new mid-term management plans in conjunction with their earnings announcements. The Tokyo Stock Exchange (TSE) has been encouraging companies to improve capital efficiency. As a result, the market began to take a close look at mid-term management plans. This has triggered a trend toward higher stock prices for companies with targets that exceed market expectations in terms of shareholder returns, return on equity (ROE), etc. It is worth noting whether proactive plan disclosures will boost Japanese stocks, which have been in a correction phase since the start of FY 2024.

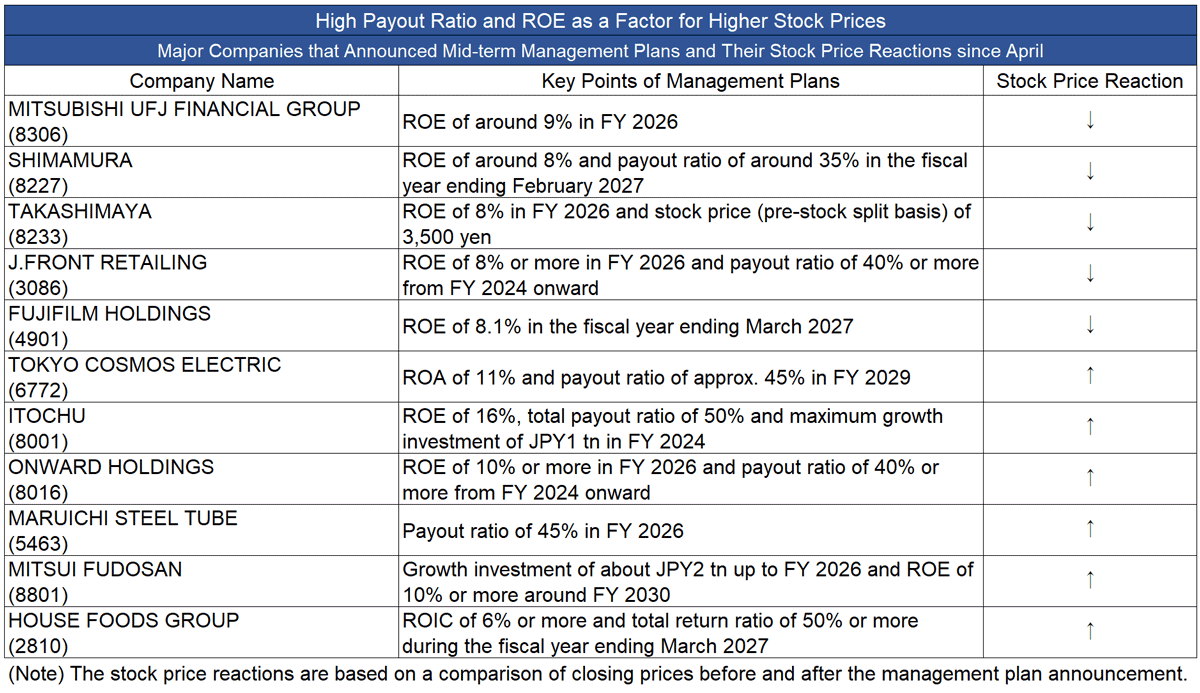

We have listed the major companies that have announced new mid-term or long-term management plans or revised their targets since the beginning of April, and summarized their stock price trends following the announcements.

■ Companies Proactive in Shareholder Returns Indicate Higher Stock Prices

Notable stock price gains can be seen in companies that are proactive in returning profits to shareholders. On April 3, at 1 p.m., ITOCHU (8001) unveiled its management policy of targeting a 50% total payout ratio for FY 2024. This boosted the company’s stock price, which closed 6.36% higher on the same day. Onward Holdings (8016) released its mid-to-long-term management vision (revised version) to increase its dividend payout ratio to 40% or more from FY 2024 onward in conjunction with its earnings announcement on April 4. On April 5, the company’s stock price rose 15.58% to close at a high of 660 yen.

Efforts to improve capital efficiency have also been well received. On April 11, Mitsui Fudosan (8801) announced its long-term management policy, which includes the target of achieving ROE of 10% or more around FY 2030. On April 12, the following day, its stock price temporarily rose by more than 8%. Other real estate stocks also rose, boosting the overall Tokyo Stock Price Index (TOPIX).

The TSE’s request for companies to improve capital efficiency is one of the reasons behind companies’ aggressive shareholder return policies and other measures in their mid-term management plans. According to a calculation by Masahiro Nakamura, chief researcher at Daiwa Institute of Research (DIR), the largest number of companies in the past five years, 229 companies, changed their dividend policies in FY 2023, when the TSE made the request for capital efficiency enhancement. Fumio Matsumoto, chief strategist at Okasan Securities, said, “Companies are aiming to appeal to the market by actively presenting their dividend payout ratios and other shareholder return policies in their mid-term management plans.”

■ “More Mid-Term Management Plan Announcements in 2024 than in Past Years”

Many companies are updating the mid-term management plans due to 2024 being the final year of their plans. This resulted in more announcements of mid-term management plans than in previous years. Mr. Nakamura said, “The external environment has changed dramatically since the pandemic-era three years ago, when the original plans were created. For example, inflation is higher than assumed at the time. Under such circumstances, many companies are revising their mid- to long-term management policies. This has prompted an increase in the number of announcements of new mid-term management plans and plan updates.”

In May, many companies with fiscal years ending in March are scheduled to announce their earnings results. Investors are likely to continue to pay close attention to the specifics of the mid-term management plans, which will be released at the same time. It is interesting to see whether the mid-term management plans, which are “appealing” to shareholders, will be a factor in boosting the overall Japanese stock market, not just individual companies.

(Reported on May 2)

NQN News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data017/