Japan Markets ViewFocus on PARK24 with Strong Performance amid Reopening and a Weaker Yen

Oct 21, 2022

[QUICK Market Eyes] Amid the weak market conditions, selective buying has been taking place for small- and mid-cap stocks with strong performance.

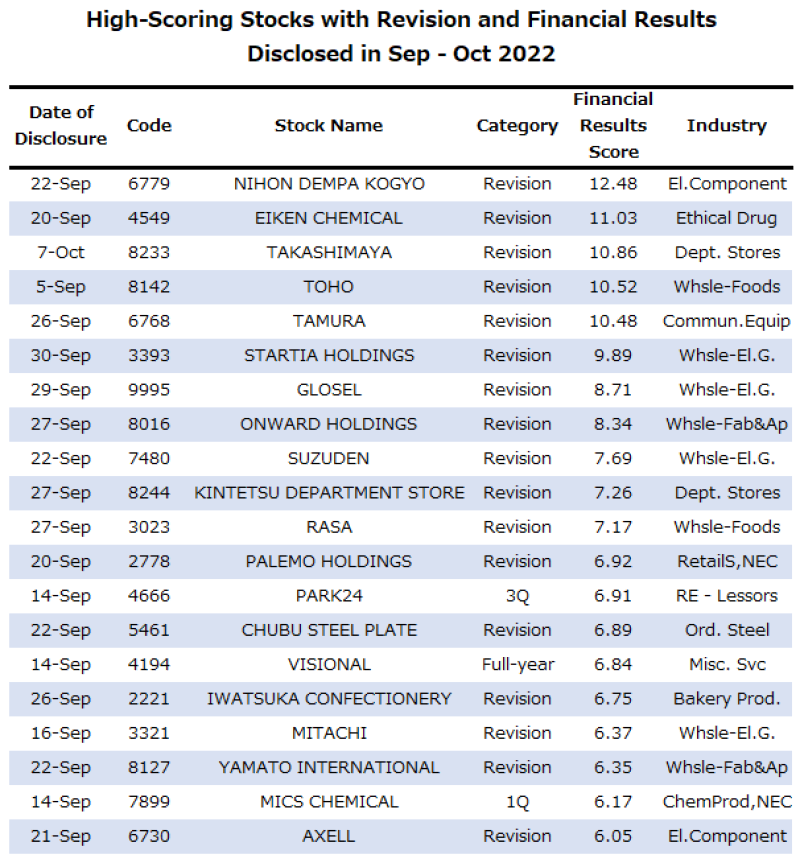

Comparing the Financial Results Scores of stocks for the companies that disclosed financial results or revisions of results forecasts from September to the latest, the top scoring stocks were small- and mid-cap stocks of department stores, electronic components, etc.

The Financial Results Score is a reference index which QUICK statistically calculates using artificial intelligence (AI) the degree of impact that financial results and revisions of results forecasts disclosed by companies have on stock prices.

Results Score takes major revenue items such as sales, classifies them based on comparisons with (1) the results of the previous term, (2) the latest company forecasts, and (3) market forecasts (QUICK Consensus), and aggregates and calculates how similar patterns impacted past and subsequent stock prices. Results forecasts and quarterly results are scored separately, with the higher score used for the same stock.

Movement of people and goods is recovering due to the easing of travel restrictions from abroad, reopening economy after the COVID-19 pandemic has slowed down, and improvements in supply chains. The companies that have benefited from these developments are performing strongly.

From among the ranked stocks, we would like to focus on PARK24 (4666) due to its strong performance amid reopening and a weaker yen.

PARK24 ranked 13th with a score of 6.91 for the period from November 2021 through July 2022 (Q3 cumulative total), which was disclosed on September 28, 2022.

During the above period, sales increased by 15% YoY to JPY211.0 bn and operating income was a profit of JPY11.9 bn (compared to a loss of JPY9.9 bn in the same period last year). For the parking service business, overseas operations posted an operating loss. On the other hand, the domestic parking service and the mobility service business exceeded the results for October 2019 showing a steady recovery to the pre-COVID-19 levels.

Monthly sales in Japan also has been on a recovery track after bottoming out in February 2022 when the company was affected by the behavioral restrictions. In the overseas markets, such as Australia and the U.K., performances have been on an upward trend after bottoming out in January 2022.

In the mobility service business of car rental and car sharing, Times Car membership for the third quarter from May to July saw a record growth of 95,000 to 1.94 million members.

This growth is attributed to the resurgence of travel demand after the COVID-19 has become under control, as well as to various measures such as the strengthening of corporate sales and the expansion of rental stations. In addition, efforts to reduce opportunity losses were made through “quick-ride enrollment,” which allows users to enroll immediately, and an app-based unlocking function that enables users to smoothly complete procedures when they want to ride.

Based on strong Q3 results, PARK24 has upwardly revised its full-year consolidated forecasts for the fiscal year ending October 31, 2022. For this period, the company expects sales to increase by 15% YoY to JPY288 bn and operating income to be positive at JPY18 bn (compared to a loss of JPY8 bn in the previous year). The revised forecasts are JPY5.0 bn and JPY4.5 bn higher than the previous forecasts, respectively.

In the report dated October 5, SMBC Nikko Securities maintained the target price at 2,300 yen and raised the investment rating from “2” in the middle to “1” at the highest level. The report stated that the company’s performance will continue to recover, benefiting from the acceleration of economy reopening and the strengthening of cost structure in the wake of COVID-19. Despite growing concerns about the global economy slowing down, PARK24 is expected to experience only a limited impact given the strong lifestyle-related business element of the company.

The stock price climbed to 2,198 yen on September 15 following the upward revision of the full-year results forecast. However, the stock was subsequently sold off afterwards, showing some signs of a late start for recovery. Despite that, the recent easing of travel restrictions and the economy reopening have brought the stock back above the 5-day and 25-day moving average lines. Expectations are high for another crossing of the September highs.

(Reported on October 12)

Data Provision via API

QUICK provides the Financial Results Score and the Monthly Sales & Business Activity Data introduced in this article via API. The Monthly Sales & Business Activity Data is scraped from the websites of approximately 400 listed companies and includes net sales as well as numbers of subscribers. These data allow for analysis of corporate performance and forecasting of stock price fluctuations.

Financial Results Score on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data025/

Monthly Sales & Business Activity Data on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data010/