As COVID-19 appears to have peaked out, stocks related to “theme parks and tourist facilities” have begun to rise in the stock market. Among them, the stock price of Oriental Land (OLC, 4661), the operator of Tokyo Disney Resort, is rising. COVID-19’s peak out is not the only the reason for the rise. In addition to expectations for a recovery in earnings, favorable financial results are also a factor pushing up the stock price.

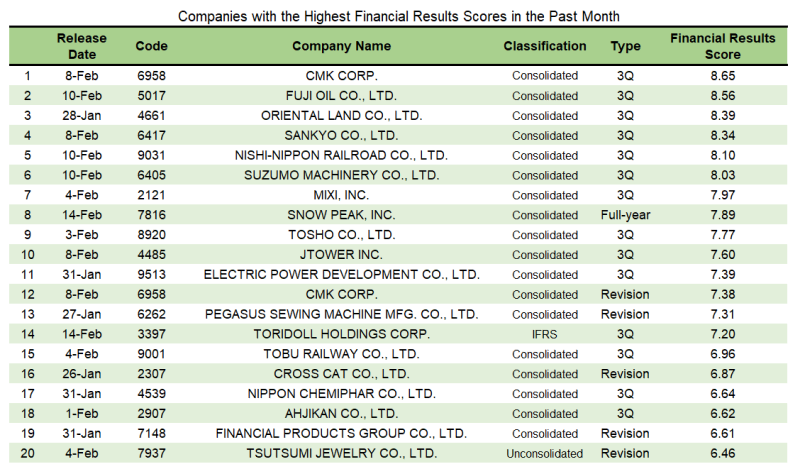

In comparing stocks that announced their financial results and were calculated Financial Results Scores in the past month, OLC’s score for the October-December period of 2021 (Q3) on January 28 ranked third at 8.39, supporting the stock price.

Financial Results Score

The Financial Results Score is a reference index calculated statistically using AI by QUICK to determine how much impact the financial results and revisions to its earnings forecasts, disclosed by a company, have on its stock price. The Financial Results Score takes major revenue items such as sales, classifies them based on comparisons with (1) the results of the previous period, (2) the latest company forecasts, and (3) market forecasts (QUICK Consensus), and calculates how similar patterns impacted past and subsequent stock prices. Earnings forecasts and quarterly results were scored separately, and the higher score was used for the same stock.

Target Price Raised

In the October-December 2021 period, OLC’s sales increased 19% YoY to JPY92.7bn and operating income quadrupled to JPY17.7bn, a significant increase in both sales and income. The company returned to profitability from an operating loss in the April-September 2021 period (the first half). In addition to the increase in the number of park visitors due to the temporary closure of the park in the same period of the previous year, sales per guest increased due to the earlier-than-expected increase in the maximum number of park visitors.

Ticket revenue was up due to price hikes for time-specified passports and an increase in the composition ratio of high-priced tickets. In merchandise sales revenue, sales of products related to the popular character Duffy as well as Tokyo DisneySea’s 20th anniversary event “Time to Shine!” were strong. Food and beverage sales revenue saw growth in revenue related to food souvenirs, which are specially produced goods for restaurants. Due in part to the upturn in the third quarter, the company has revised upward its full-year earnings forecast for the fiscal year ending March 31, 2022. For the fiscal year ending March 2022, the company expects sales to increase 54% YoY to JPY261.9bn and an operating loss of JPY7.6bn (JPY45.9bn loss in the same period last year). This is an increase of JPY22.9bn and JPY16.6bn from the previous forecast, respectively.

J.P. Morgan Securities raised its target price from JPY20,500 to JPY25,000 in a report dated February 18, and reiterated its “overweight” rating on the stock. The report indicated that the company is more resistant to price hikes and inflationary environment by the introduction of variable pricing system. While the company expects park capacity to remain under control for the foreseeable future, it also believes that the tight supply-demand balance will provide support and increase the upside for park ticket prices.

Financial Results Score on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data025/