With the restructuring of the market segments to be implemented by the Tokyo Stock Exchange (TSE) in April this year, the number of companies which will be listed on the Prime Market, the top-tier market, is 1,841. There are 296 of these companies that cannot achieve the transition criteria, such as a tradable shares market capitalization of JPY10bn, but were allowed to transition by submitting an improvement plan. The number of current TSE 1st Section companies that chose the Standard Market is 343.

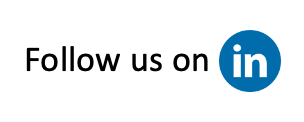

When QUICK asked how they would evaluate the market restructuring in its Monthly Survey (Equity) released on February 7, more than 50% of the respondents answered that “From an investor’s point of view, nothing substantive has changed.” This was followed by “Companies that do not meet the criteria will be listed on the Prime Market, making it more difficult to understand.” at 23%. Only 20% of the respondents gave positive evaluations, such as “It will make it easier to invest.” and “It will contribute to the internationalization of the TSE.”

Among the comments received, those that were harsh were notable, such as “My impression is that it has become even worse” (securities company) and “My impression is that it has become half-hearted” (other). Some of the respondents expressed hope for the future, saying, “The market restructuring has only just begun, and we need to wait for further reforms to enhance the reputation of the market among domestic and foreign investors.” (asset management)

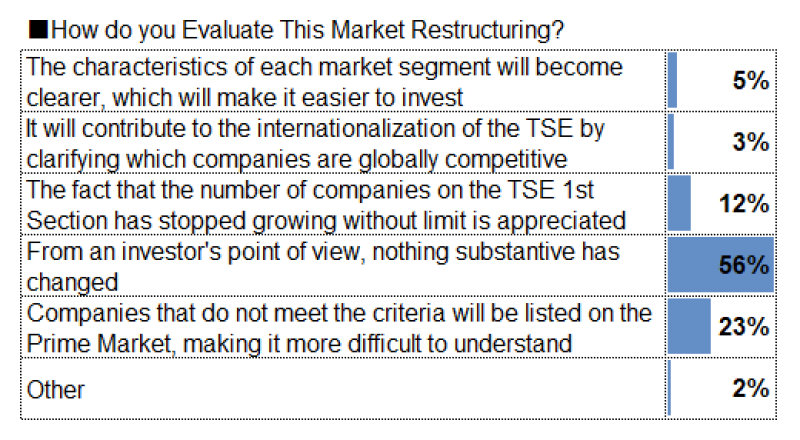

When asked how many companies would be appropriate to list on the Prime Market, the most common answer, at 50%, was “About 500 companies (total market capitalization of all shares: JPY200bn or more).” 21% of the respondents answered that they thought “About 300 companies (JPY400bn or more)” would be appropriate. TSE has set a criteria of JPY10bn in terms of tradable shares market capitalization, but it is expected to further narrow down the list of companies that can be listed on the top-tier market.

*The contents of () indicate total market capitalization of all shares.

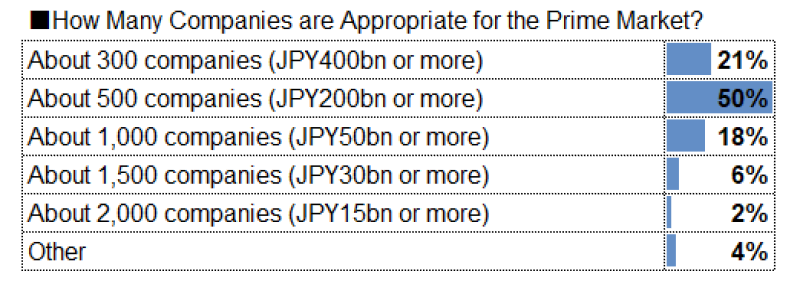

Regarding the impact of market restructuring on stock prices, the most common response was “Neutral” at 66%.

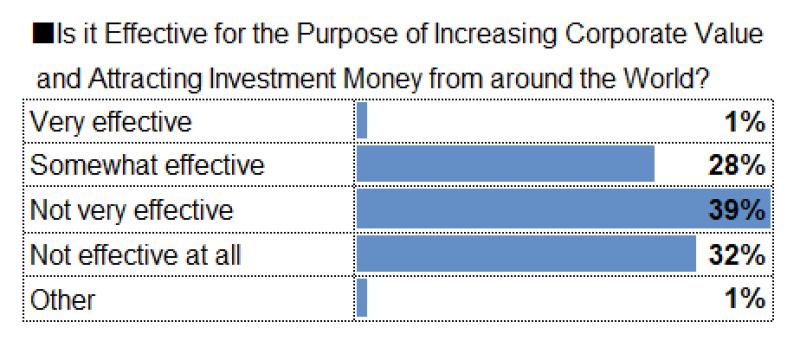

The purpose of this market restructuring is to “improve the medium- to long-term corporate value of Japanese companies” and to “attract investment money from around the world.” When asked if it was effective in achieving the goals, about 70% of the respondents gave negative evaluations: “Not very effective” (39%) and “Not effective at all” (32%). Only 28% said “Somewhat effective” and 1% said “Very effective.”

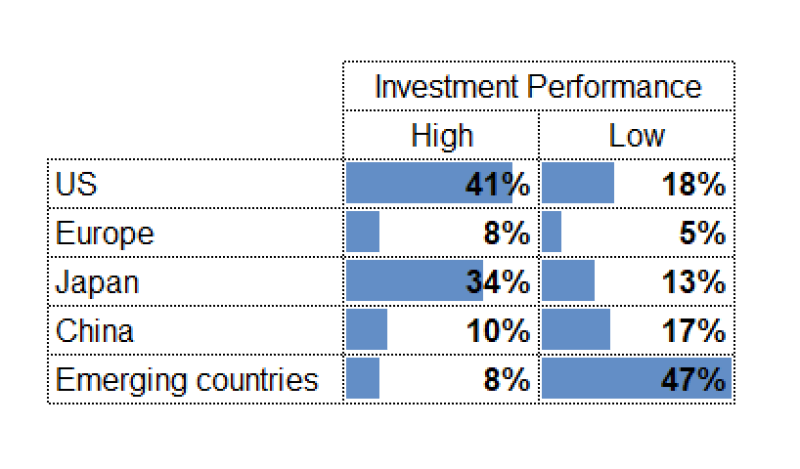

In the survey, we also asked about the future of the global stock market in 2022. “US” and “Japan” were the markets that respondents saw as having the best investment performance at 41% and 34%, respectively. On the contrary, nearly half of the respondents, 47%, saw “Emerging countries” as having low investment performance.

The survey was conducted among 211 people including investment managers of Japanese institutional investors. 123 people responded. The survey period was February 1-3, 2022.

QUICK Monthly Survey on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data012/