Japan Markets View[ESG Investment Survey 2022] (2) “Climate Change” the Essential Theme of Engagement

Feb 10, 2023

![[ESG Investment Survey 2022] (2) “Climate Change” the Essential Theme of Engagement](/wp-content/uploads/230210.png)

The ESG Research Center of the Enterprise Services Dept. at QUICK Corp. released the results of the “ESG Investment Survey 2022” on January 19. Following the first issue that highlighted ESG investment methodologies and promotional structures, this second issue covers the themes of “engagement,” which is the most common ESG investment methodology, and the decision to approve or disapprove shareholder proposals related to climate change.

[Notable Points]

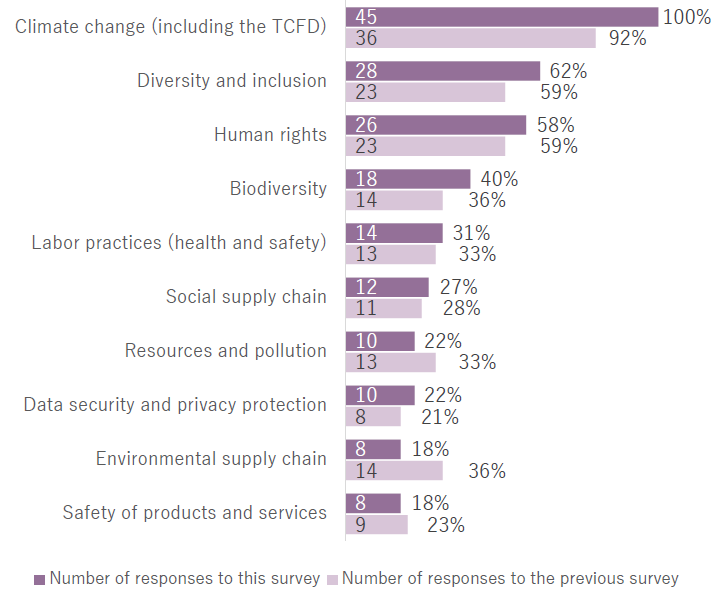

- “Climate change” was the most common among the engagement themes focused on in the 2022 fiscal year (100% of valid responses; percentage figures indicate the valid response rate for each question). It was followed by “Diversity and inclusion” (62%) and “Human rights” (58%).

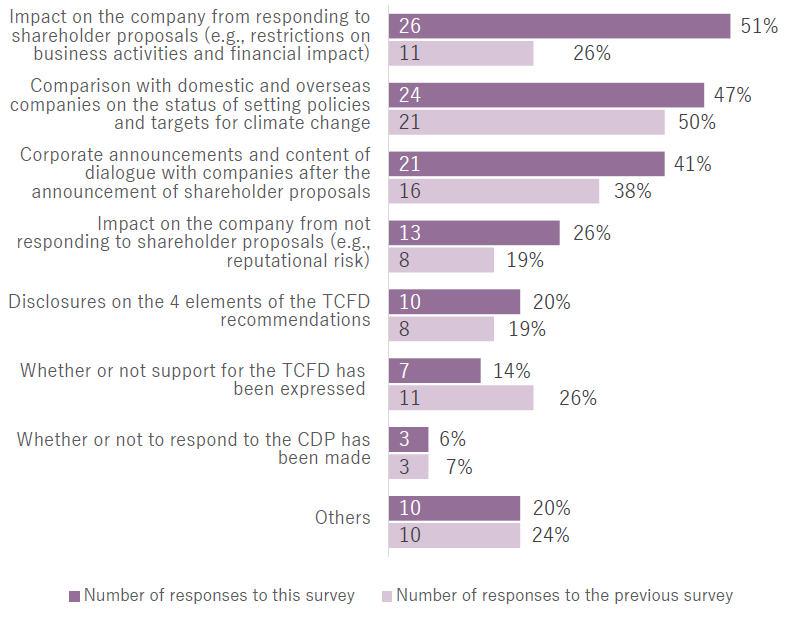

- Examining matters considered when deciding to approve or disapprove shareholder proposals related to climate change, the most common response was “Impact on the company from responding to shareholder proposals” (51%). This was followed by “Comparison with domestic and overseas companies on the status of setting policies and targets for climate change” (47%).

[TOP 10 Themes]

Figure 1: Major Engagement Themes

What engagement themes are you emphasizing in the 2022 fiscal year? (Multiple answers are allowed.)

* Excerpt from the “ESG Investment Survey 2022”

As noted earlier, “Climate change” was the engagement theme emphasized most in the 2022 fiscal year. All responding organizations selected this answer, making it an essential theme. The Corporate Governance Code, which is a guideline for corporate governance, requires companies listed on the TSE’s top-tier Prime Market to disclose information based on the Task Force on Climate-related Financial Disclosures (TCFD) Recommendations or their equivalent. Responding to climate change has become essential for companies.

“Diversity and inclusion” came in second, indicating a strong interest among institutional investors in “human capital” and “training and securing human resources and diversity.” “Human rights” ranked third. The government has formulated “Guidelines on Respecting Human Rights in Responsible Supply Chains.” This requires companies to demonstrate the results of their “human rights due diligence,” in which human rights risks related to their business are examined, and countermeasures are taken. Institutional investors are also working to encourage companies to act.

Figure 2: Decisions on Approval or Disapproval of Shareholder Proposals Related to Climate Change

This year and last year, shareholder proposals related to climate change were submitted to Japanese companies.

From what perspective did you decide on approval or disapproval? (Multiple answers allowed)

* Excerpt from the “ESG Investment Survey 2022”

Climate change, the top-ranked “Engagement” theme, has been a hot topic for shareholder proposals during shareholder meeting season for the past several years. When asked from what perspective a decision is made to approve or disapprove shareholder proposals related to climate change, the most common response was “Impact on the company from responding to shareholder proposals.” This indicates that many institutional investors are making decisions based on considerations such as restrictions on business operations and financial impact.

“Comparison with domestic and overseas companies on the status of setting policies and targets for climate change” came in second place. It was followed by “Corporate announcements and content of dialogue with companies after the announcement of shareholder proposals.” Companies’ responses and their information dissemination efforts are being tested. When companies disclose information, they need to be aware of comparability with other companies in the same industry.

Continue to (3) Only a Few Institutional Investors “Changed Policy” due to the Ukraine Situation

[Outline of Survey]

QUICK ESG Investment Survey 2022

- 170 institutional investors based in Japan selected from the companies that have declared acceptance of the “Japanese Stewardship Code” or are signatories to the Principles for Responsible Investment (PRI).

- Number of respondents: 61 organizations (of which 13 are asset owners and 48 are asset managers)

- Survey period: August 22 to October 4, 2022

(Reported on January 19)