Japan Markets ViewSignificant Effects of Share Buyback – Japan Post’s (6178) Share Buyback Accounts for 15% of Trading Volume

Jul 24, 2024

【QUICK Market Eyes】 Tightening supply-demand balance due to share buybacks has been gaining attention in the stock market. Since the beginning of July, net purchases by investors outside Japan have increased, leading to a rally in the Japanese stock market. In the background, share buybacks have also been pointed out as supporting the market and contributing to the rally.

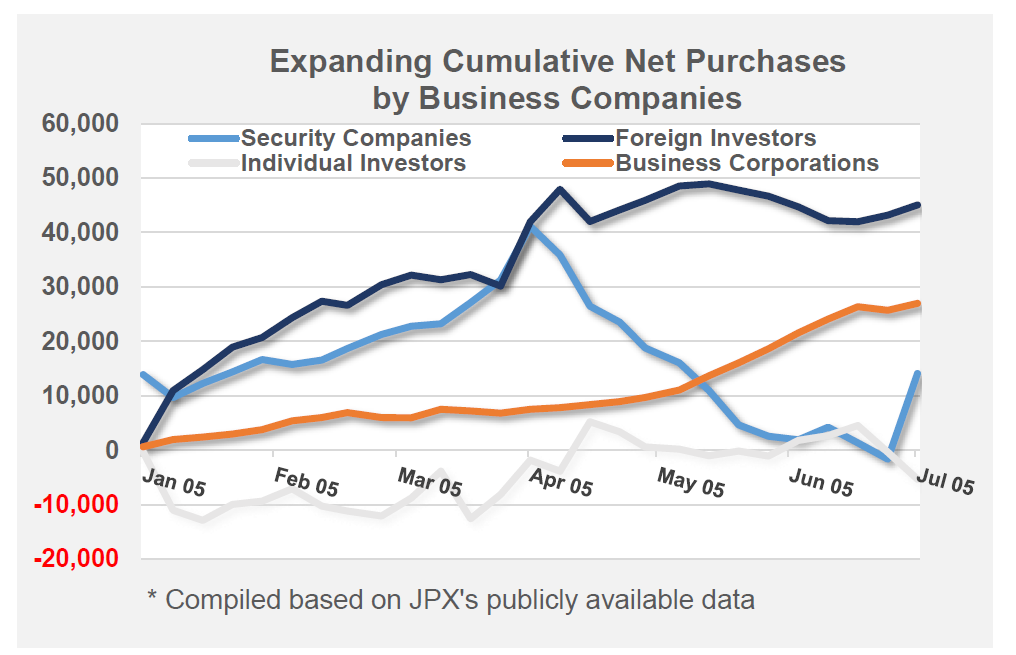

According to the trading trends by investor type for the first week of July (1-5) released by the Japan Exchange Group (JPX) on July 11, net purchases by foreign investors in cash and futures totaled JPY881 bn. This size is the second largest after JPY1.4439 tn in the week of January 8-12, indicating the recent surge in Japanese stock prices fueled by overseas investors’ short-term buying appetite. On the other hand, on a monthly basis, net selling by investors outside Japan amounted to JPY345.4 bn in June. Net purchases by business companies amounted to JPY708.9 bn, with share buybacks providing support on the supply-demand side.

The cumulative net purchases of cash equities by investor type since the beginning of 2024 were JPY4.5036 tn by overseas investors, followed by business companies at JPY2.6971 tn. While overseas investors’ buying of Japanese stocks helped the Nikkei 225 reach its record high, their net selling from the latter half of May to June was also noticeable. Fumio Matsumoto, chief strategist at Okasan Securities, views that “the fact that Japanese stock prices did not fall even when overseas investors were net sellers was largely due to the effects of sustained share buybacks.”

The cumulative net purchases by business companies have grown, especially since May. Share buyback resolutions increased simultaneously with the earnings announcement in May. In the background, many companies are making efforts to improve capital efficiency in response to the Tokyo Stock Exchange’s request to take “Action to Implement Management that is Conscious of Cost of Capital and Stock Price.” Share buybacks also function as a measure to redress the supply-demand imbalance caused by the elimination of cross-shareholdings.

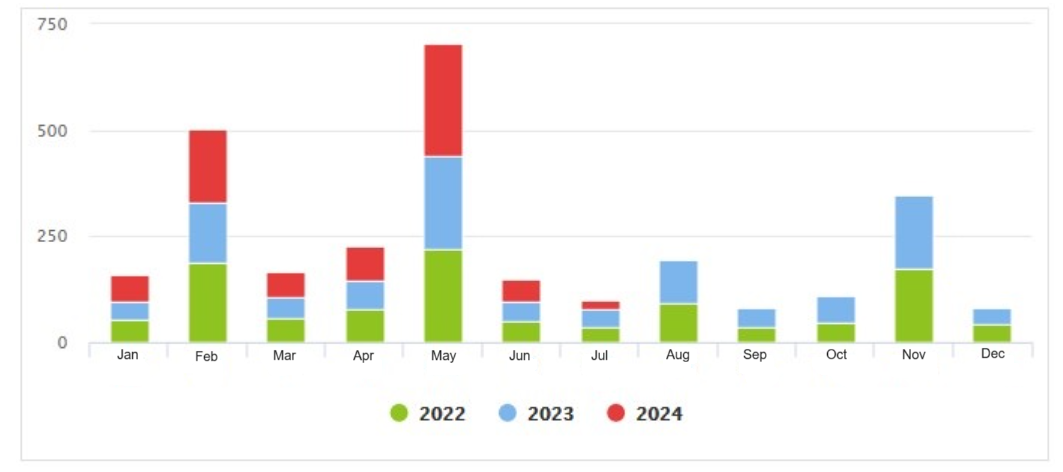

According to the Share Buybacks Data provided by QUICK, the number of share buyback resolutions increased at a faster pace in 2024 than in 2022 and 2023. The number of resolutions made in the first half of 2024 was 696, compared to 644 in 2022 and 564 in 2023. Expectations are high for the possibility of share buybacks to be announced at the same time as earnings announcements in the second half of the year as well.

* Compiled based on the Share Buybacks Data provided by QUICK

Stock Price of Japan Post, with Share Buyback Accounting for 15% of Trading Volume, Outperforms TOPIX

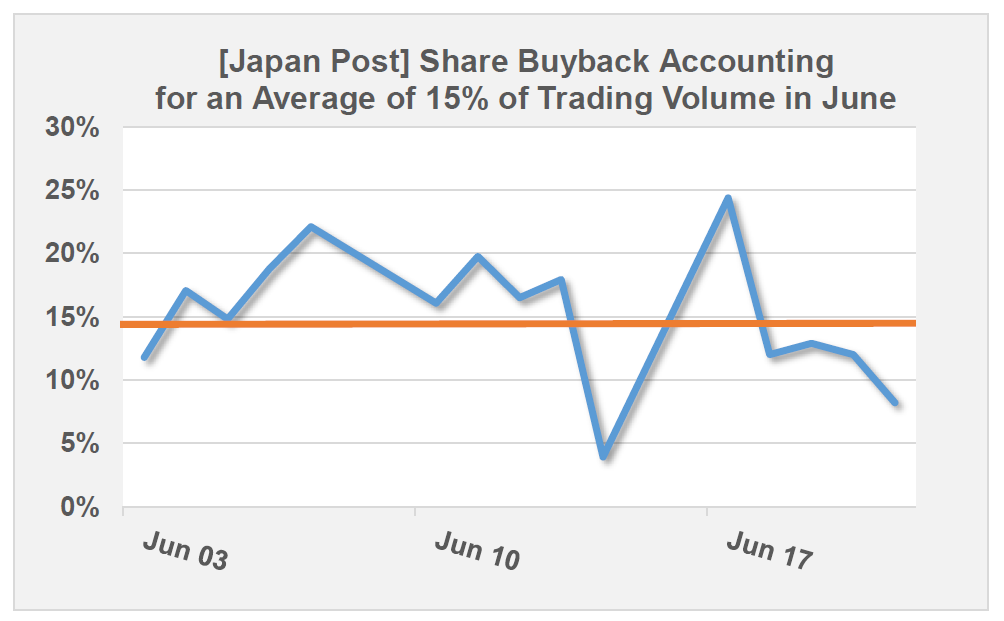

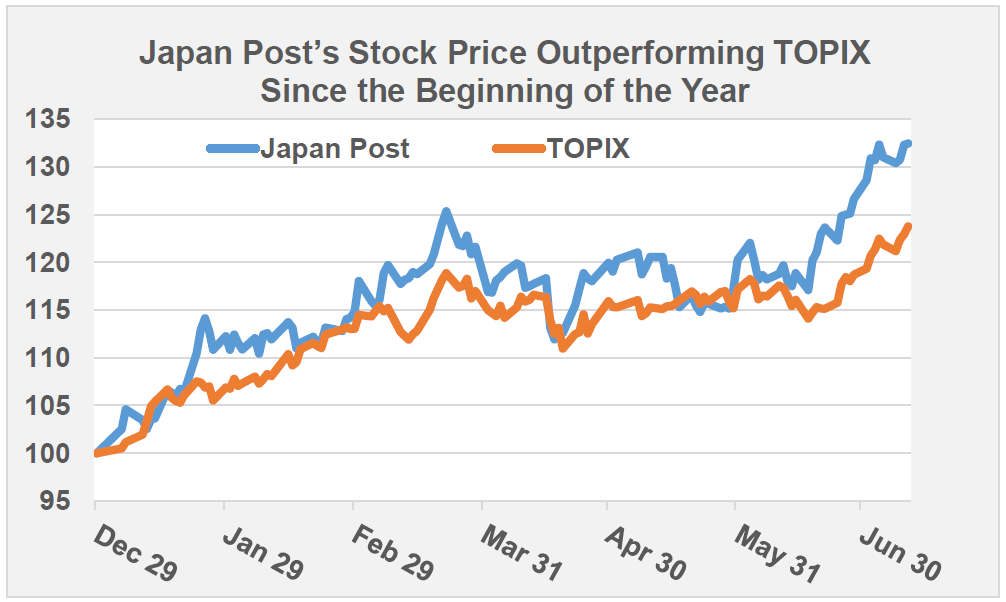

The impact of share buybacks on stock prices cannot be underestimated. In May, Japan Post announced plans to repurchase 320 million of the company’s own shares. This represents 10% of its outstanding shares (excluding treasury shares) and up to JPY350 bn in monetary terms. The company has been repurchasing more than 1 million shares on the market each business day. According to the Share Buyback Report submitted by Japan Post to the Kanto Local Finance Bureau on July 5, the company also repurchased its own shares in June, equivalent to an average of 15% of the daily trading volume.

Japan Post has set the deadline for share buybacks at the end of March 2025. Based on a backward calculation, it is highly probable that the company will continue to buy back its own shares at an average rate of 15% every business day. Since the beginning of the year, Japan Post’s stock price has been outperforming the Tokyo Stock Price Index (TOPIX). This suggests that the share buyback has given momentum to the stock price increase.

Investors outside Japan tend to trade Japanese stocks in an agile manner. According to one Japanese securities strategist, the recent booming stock market is the “result of a cherry-picking market, and we cannot rule out the possibility that investors outside Japan will sell off their shares if the opportunity arises.” The number of resolutions for share buybacks tends to increase in November as well, when the announcement of interim financial results for the fiscal year ending March 31 is concentrated. In terms of value, June saw more share buybacks resolved than the previous year. Share buybacks will continue to support the Japanese stock market, and their effects cannot be ignored and deserve further attention.

(Reported on July 18)

Share Buybacks Data on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data029/