Japan Markets ViewShare Buybacks Resolved in April Exceeds JPY3.5 Tn, Continuing to Support Supply-Demand Balance

May 14, 2025

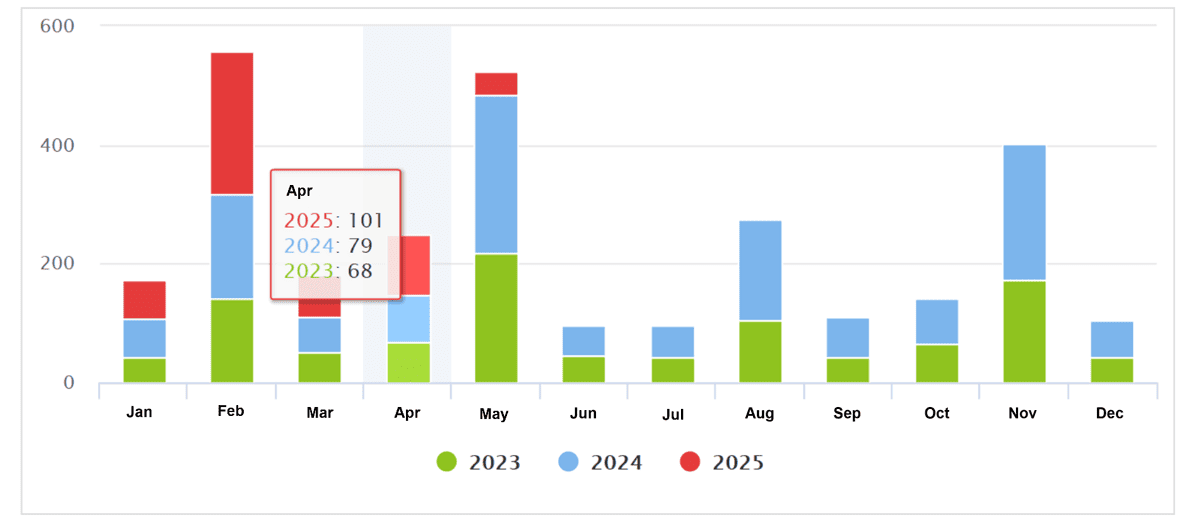

[Keiichi Nakayama, QUICK Market Eyes] The number of corporate share buyback resolutions in Japan has been on the rise. In April, share buybacks of more than JPY3.5 tn in monetary terms were resolved by the 28th, and April’s single-month record is expected to be renewed steadily. Share buybacks have been a major buyer of Japanese stocks. The same pattern is likely to continue for some time to come. Usually, many share buybacks are set up also in May. We should keep an eye on the trend of share buybacks.

*Compiled based on the Share Buybacks Data provided by QUICK

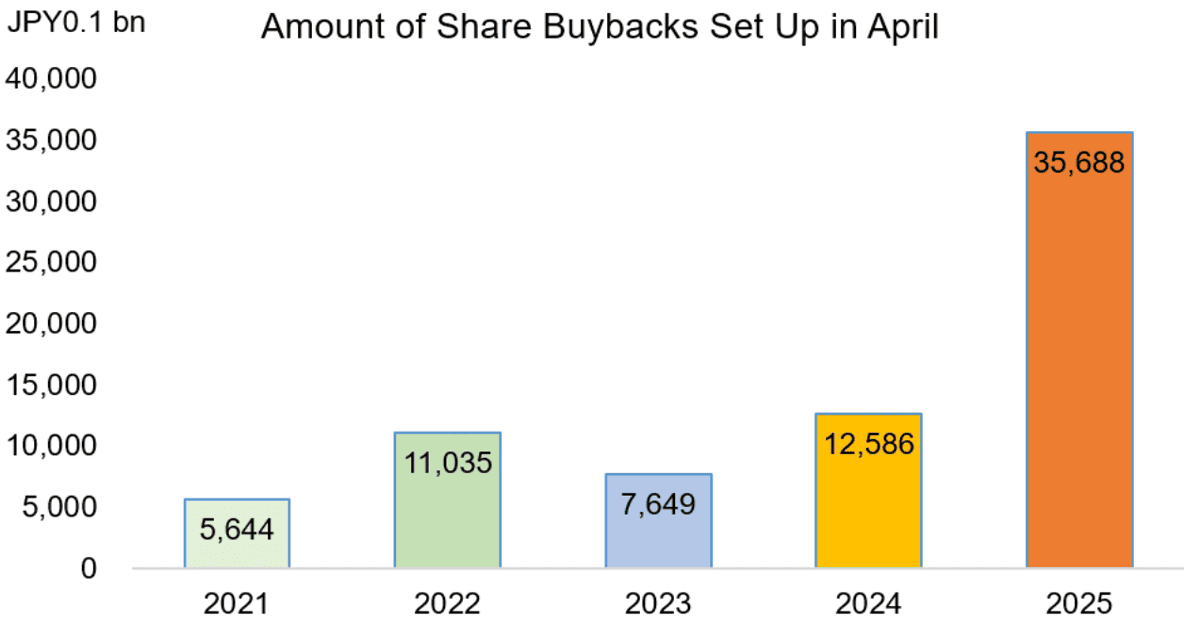

Regarding the large amount of share buybacks set up in April, Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Intelligence Laboratory, pointed out, “Companies may view their stock prices as undervalued. In addition, it shows that companies are committed to returning strong earnings to shareholders through the fiscal year ending March 31, 2025.” Mr. Suzuki said that in his discussions with investors, he heard a sense of caution that the U.S. tariff policy would reduce share buybacks in 2025. However, he also believes that the large amount of share buybacks set up in April dispels such investors’ concerns.

According to data compiled from the Share Buybacks Data provided by QUICK, the amount of share buybacks set up through April 28, 2025, exceeded JPY3.5 tn. This is a significant increase from the JPY1.2 tn or so in 2024, and will certainly set a new record for a single month in April. Shin-Etsu Chemical (4063) surprised the market by resolving to repurchase up to JPY500 bn of its own shares. Fanuc (6954) did not release its earnings forecast for the fiscal year ending March 31, 2026, due to the impact of the U.S. tariff policy. Meanwhile, some have praised the company for presenting returns to shareholders, such as its resolution to repurchase JPY50 bn of its own shares.

*Compiled based on the QUICK data.

Chizuru Morishita, a researcher at NLI Research Institute, said, “The Tokyo Stock Exchange’s request for Management Conscious of Cost of Capital and Stock Price may be having an effect.” In addition, Ms. Morishita noted, “With the future of U.S. tariff policy uncertain, the announcement effect of share buybacks is likely to be strongly at work.” An analysis of the stock price trends of companies that have resolved to repurchase their shares shows that the stock price trends are similar to those during the COVID-19 pandemic when there was a strong sense of uncertainty about the future.

*Source: NLI Research Institute

Companies that set up share buybacks between April and May of each fiscal year. For FY 2025, data as of April 18 is shown.

Calculated simple average of cumulative excess return over TOPIX with the share buyback set date as day 0.

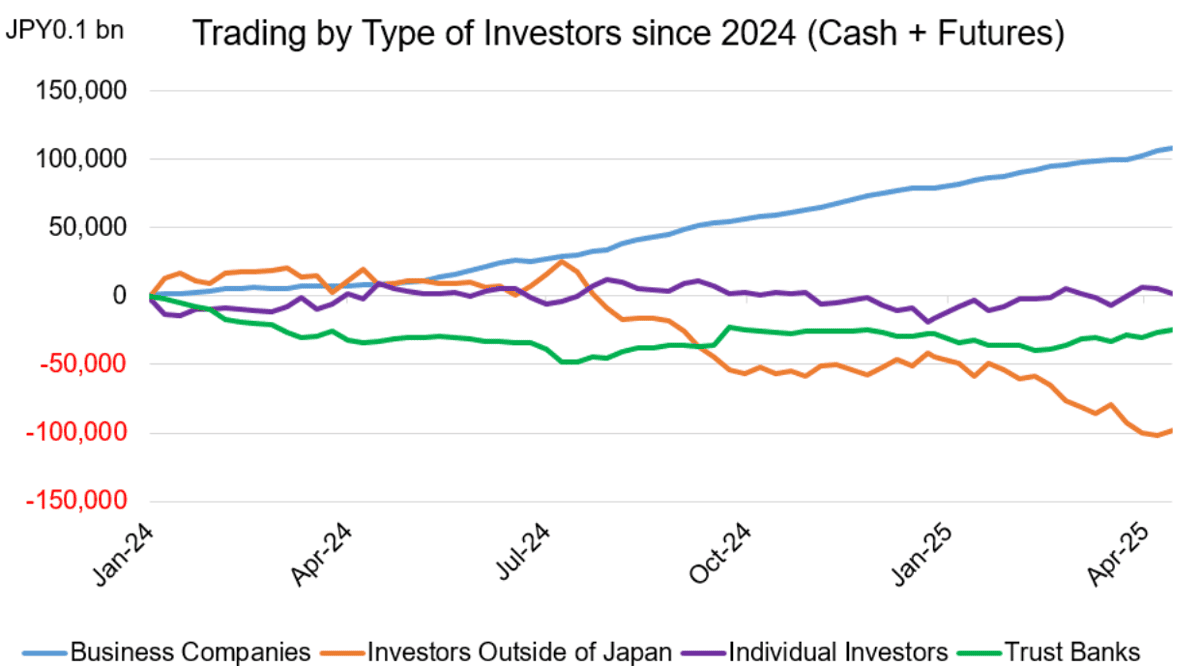

Share buybacks help improve the market’s supply-demand balance, at least statistically. Looking at the trading by type of investor since 2024, investors outside of Japan have been net sellers of Japanese stocks in cash and futures combined. On the other hand, the largest buyers have been business companies in Japan, which include buybacks of their own shares. The same pattern is likely to continue for some time to come.

*Compiled based on the QUICK data.

Nozomi Moriya, strategist at UBS Securities, sees corporate governance reforms by Japanese companies as a key to “Japan’s renewed growth scenario.” She positions shareholder returns, including share buybacks, as “the first step in the use of corporate cash.” If this is followed by the sale or consolidation of unproductive businesses and growth investment through industry restructuring, the scenario of renewed growth for Japanese companies and the market will be reached. While there are still many first steps to be taken, the key focus will be whether corporate transformation can be sustained over the long term.

(Reported on April 30)

Related dataset :

Share Buybacks Data

https://corporate.quick.co.jp/data-factory/en/product/data029/

If you are looking for datasets unique to the Japanese equity market, visit QUICK Data Factory:

https://corporate.quick.co.jp/data-factory/en/