Japan Markets ViewShare Buyback Resolution of Over JPY2 Trillion in November, Continuing to Support Supply-Demand Balance

Nov 29, 2024

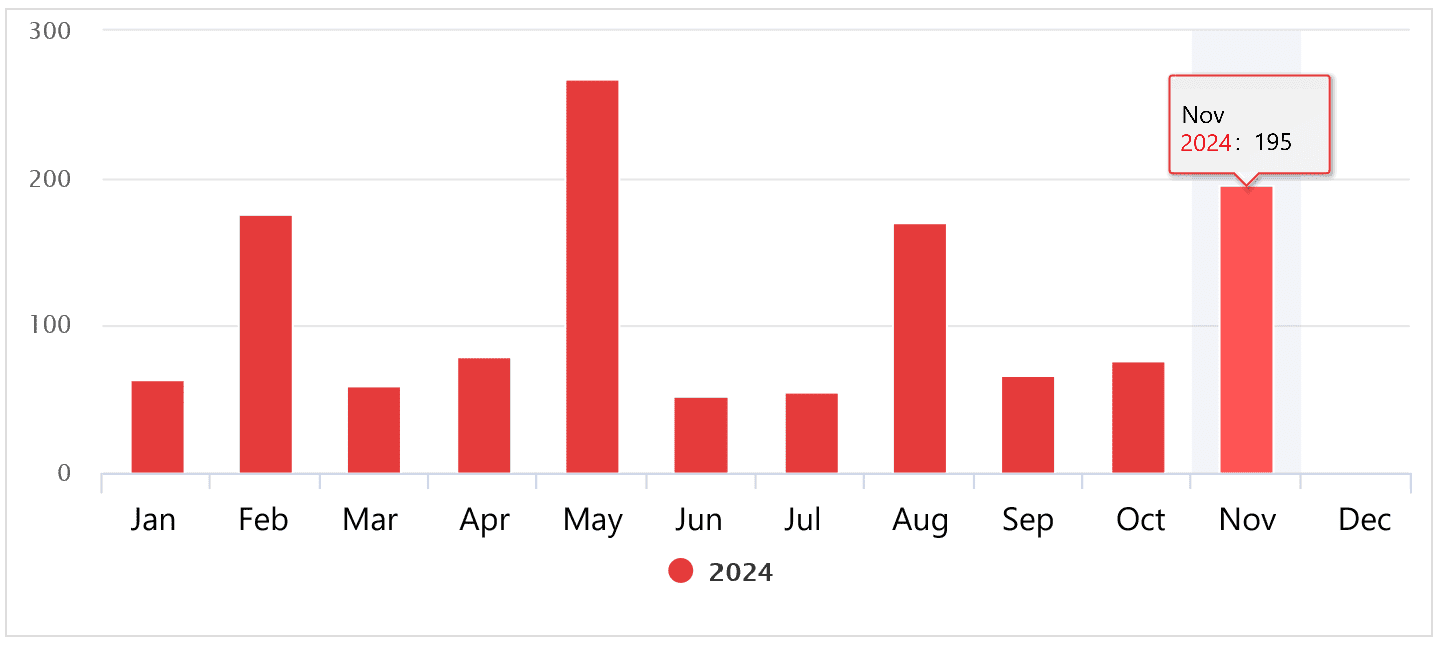

[Keiichi Nakayama, QUICK Market Eyes] The number of corporate share buyback resolutions has been on the rise. Many of them were announced at the same time as the April-September 2024 financial results were published. As of November 15, the number of share buyback resolutions exceeded 190. As of the middle of this month, the total amount of buybacks resolved exceeded JPY2 tn, reaching a record high for a single month in November. Share buybacks are expected to increase and are likely to continue to support the market in terms of supply-demand balance.

Overall, many Japanese companies reported lackluster results for the April-September period of 2024. However, there were comments focusing on companies’ efforts to strengthen shareholder returns, such as share buybacks and dividend increases. Some of the comments included: “Several companies surprised us with large-scale share buybacks in conjunction with revisions to their management plans,” and “Many companies decided to repurchase their own shares after a long time or for the first time.”

According to Share Buybacks Data provided by QUICK, as of November 18, a total of 195 companies resolved share buybacks in November. This number has already surpassed last year’s 173 companies and the average over the past five years of 143 companies. According to Tokai Tokyo Intelligence Laboratory, share buyback quotas through November 15, totaled JPY 2.1442 tn in value terms. This is higher than the record high of JPY2.151 tn in 2021, which was the highest ever for November.

* Compiled based on the QUICK’s Share Buybacks Data.

Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Intelligence Laboratory, pointed out, “Compared to May and August, the growth in the amount of share buybacks is not large enough year-on-year. However, share buybacks are supporting supply-demand balance, preventing the overall decline in Japanese stock prices.” The increase in November was somewhat sluggish considering May and August, when the amount of buybacks was nearly double that of the same month a year earlier, according to Mr. Suzuki.

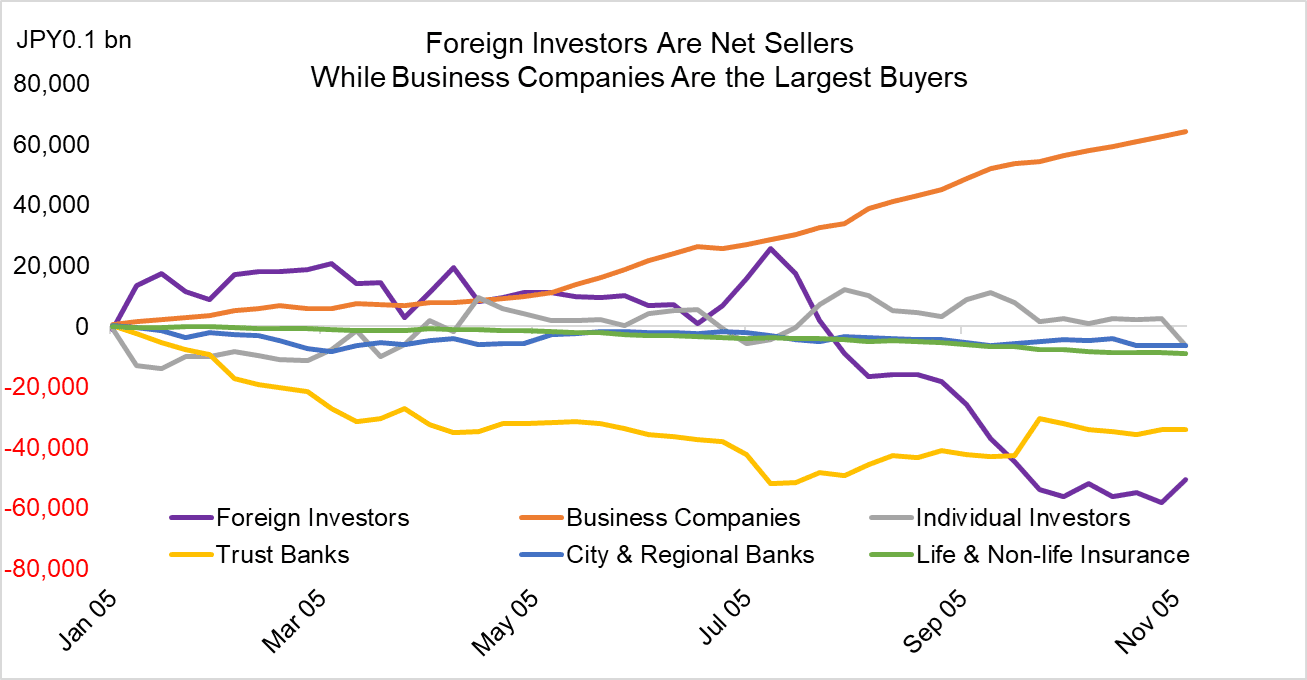

At least, share buybacks are statistically the leading buyers of Japanese stocks. According to the Trading by Type of Investors released by the Japan Exchange Group (JPX), net purchases by business companies continued for 19 weeks through the first week of November (5th to 8th). The cumulative net purchases by business companies since the beginning of the year amounted to JPY6.4435 tn, making them the largest buyers of Japanese stocks. The cumulative net selling by investors outside Japan, who account for the largest trading share, amounted to JPY5.068 tn, much of which went into futures. With the recent increase in share buybacks, the ongoing repurchases by business companies will continue to “support the bottom line in terms of supply and demand,” according to Mr. Suzuki.

*Compiled based on data from JPX and QUICK showing trends of major investor types (total of cash and futures)

In a report dated November 18, Kazunori Tatebe, Japanese equity strategist at Goldman Sachs, noted, “There are two patterns underlying the increase in share buybacks. The first is direct repurchases to eliminate cross-shareholdings, and the second is to strengthen shareholder returns using funds obtained from unwinding cross-shareholdings.” Due to Japanese companies’ high level of cash holdings, Mr. Tatebe expects that share buybacks will increase as the unwinding of cross-shareholdings progresses. He also expressed his view that eventually “investors outside Japan may see the unwinding of cross-holdings as a sign of change in Japanese companies and buy more Japanese stocks.

Due in part to the Tokyo Stock Exchange’s request for companies to take “Action to Implement Management That Is Conscious of Cost of Capital and Stock Price,” some companies are gradually revising their medium-term management plans and announcing plans to raise their price-to-book ratios (P/B ratios). Japanese companies have accumulated a large amount of capital in an effort to enhance their financial soundness. For the time being, companies are likely to continue to review their appropriate capital cost and decide to repurchase their own chares, amid the trend toward eliminating cross-shareholdings, which is unique to Japan. However, it is also important to keep in mind that, ultimately, the direction of investment in growth areas and measures for growth will be important, taking into account the significance of a company’s listing on a stock exchange.

(Reported on November 20)

Related dataset

Share Buybacks Data on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data029/