Japan Markets ViewSeason of Rising Share Buybacks Tests Corporate Stance

Oct 24, 2025

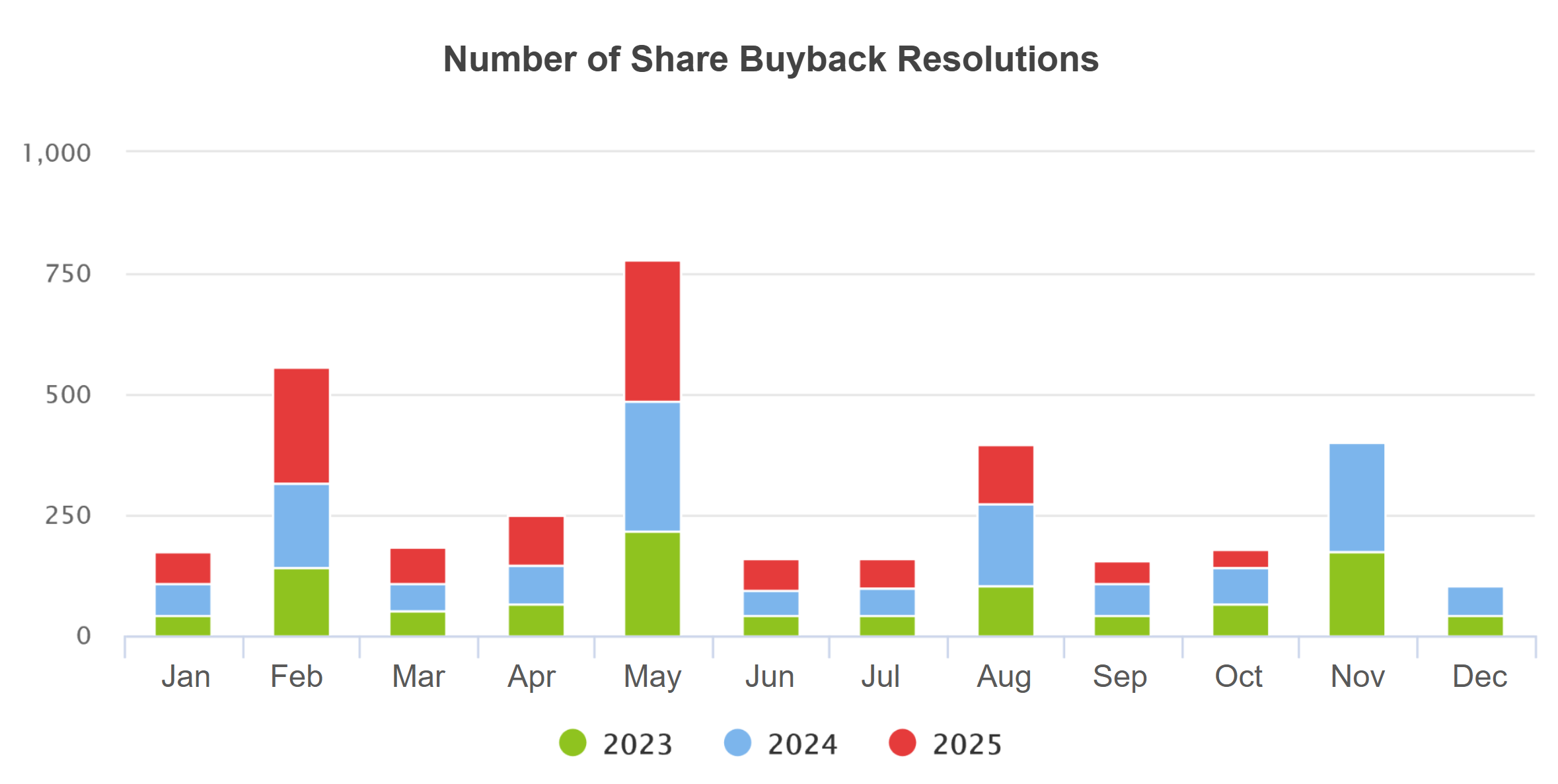

[Keiichi Nakayama, QUICK Market Eyes] Companies are beginning to announce their financial results for the April–September 2025 period. Historically, many companies tend to resolve share buybacks during October and November. Share buybacks help tighten the supply-demand balance for stocks and are the largest buyer in 2025. However, the overall rise in Japanese stock prices has raised the hurdle for new share buybacks. They are likely to become a litmus test for corporate attitudes toward the market.

* Compiled from Share Buybacks Data provided by QUICK

Looking back at 2024, share buyback resolutions amounted to approximately JPY1.0 tn in October, JPY2.7 tn in November, and JPY1.5 tn in December, totaling JPY5.2 tn.

Companies such as DENSO (6902), Mitsubishi UFJ Financial Group (8306), and Honda Motor (7267) resolved large-scale share buybacks. Many companies decide to repurchase their shares concurrently with their April–September earnings announcements, making this a period with a high number of share buyback resolutions and their value.

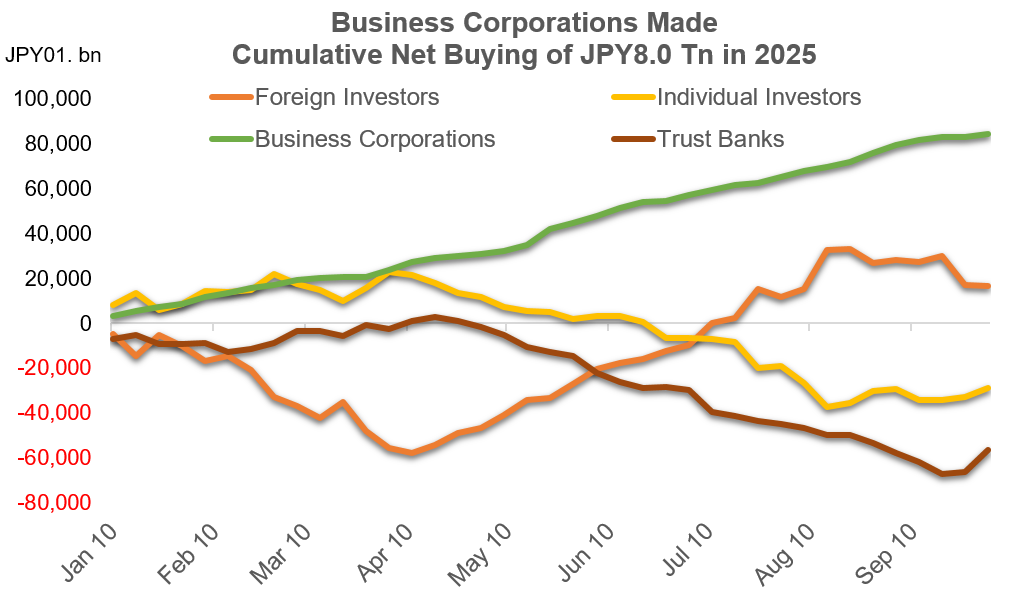

From a supply-demand perspective, share buybacks are the largest buyer of Japanese stocks.

According to the Trading by Type of Investors published by Japan Exchange Group (JPX), business corporations made cumulative net buying of JPY8.4371 tn in 2025 by the first week of October (September 29-October 3). Overseas investors, who have a high trading share and act flexibly, have been a driving force behind the stock market rally with JPY1.6822 tn in net purchases. However, the supply-demand tightening effect from share buybacks remains significant.

*Compiled from JPX and QUICK data.

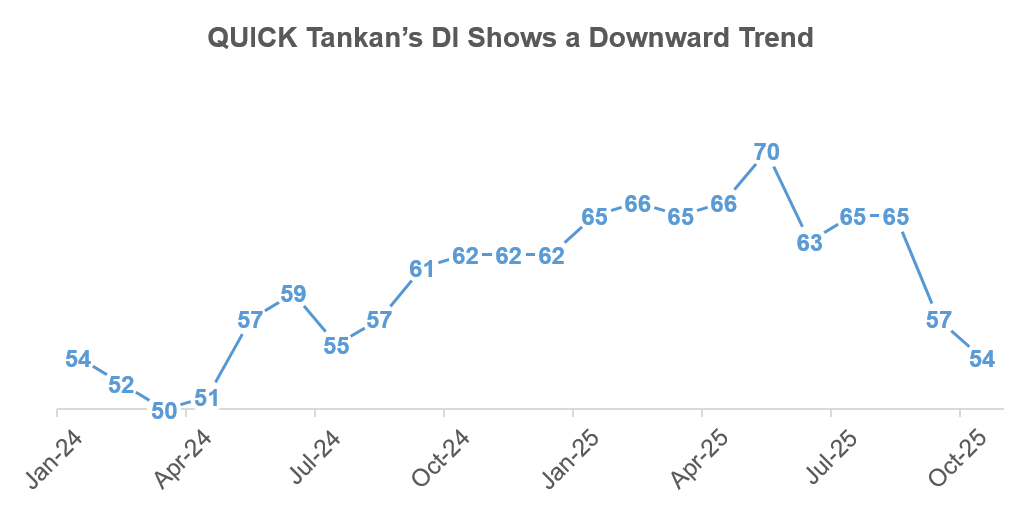

The rise in Japan’s stock market and price levels has somewhat raised the psychological hurdle for companies to initiate share buybacks. According to the QUICK Tankan (QUICK Short-term Economic Survey) published monthly by QUICK, the diffusion index (DI) for all industries (including finance) was +55 in October, declining 3 points from the previous month. The DI is calculated by subtracting the number of responses for “overvalued” from that for “undervalued.” The DI has continued to fall from +70 in May, indicating that the sense of stocks being undervalued is weakening among companies.

*Compiled from the “QUICK Tankan” data

Makoto Sengoku, Senior Equity Market Analyst at Tokai Tokyo Intelligence Laboratory, points out, “Corporate share buybacks from October onward are important in two respects.” The first is their impact on supply and demand. According to Mr. Sengoku’s estimates as of August, daily share buybacks based on existing resolutions are projected to average around JPY60 bn per business day in August–September, decrease to around JPY55 bn in October, and fall to around JPY40 bn from November onward. He believes that market stability will decline as the momentum from this “silent buyer” fades.

The second is the corporate attitude toward the market amid growing pressure on retained earnings. In June 2025, the Financial Services Agency (FSA) published the “Action Programme for Corporate Governance Reform 2025.” The Action Programme addresses the “cash hoarding” issue, where companies accumulate excessive cash. It indicates that companies will be expected to be accountable for their allocation of management resources, including their policies on holding cash.

Investors outside of Japan are also turning their attention to the cash Japanese companies have accumulated. Sho Nakazawa, Equity Strategist at Morgan Stanley MUFG Securities, visited investors in Hong Kong and Singapore from October 6 to 10. He stated that the FSA’s proposed revisions to the Corporate Governance Code based on the Action Programme “garnered significant interest.” He added, “We should pay attention to the possibility that cash-rich stocks may come into the spotlight.”

Japanese companies have accumulated massive amounts of cash and deposits under the banner of strengthening financial soundness. Pressure is mounting year by year for them to either enhance shareholder returns through share buybacks and dividend increases or allocate funds toward growth investment. This is a time when intense focus is being directed not only at corporate earnings, which serve as companies’ report cards, but also at their corporate actions.

(Reported on October 17)

Share Buybacks Data:

Provides share buyback progress rate, purchase method, announcement date, etc.

Interested in the data in this article?

Contact us: https://corporate.quick.co.jp/en/contact/form_service_en/

Disclaimer

https://corporate.quick.co.jp/en/terms/#disclaimer