Japan Markets ViewSanrio Earns Globally (8136) – Market Eyes Shifting Beyond “Kitty’s 50th Anniversary”

Mar 03, 2025

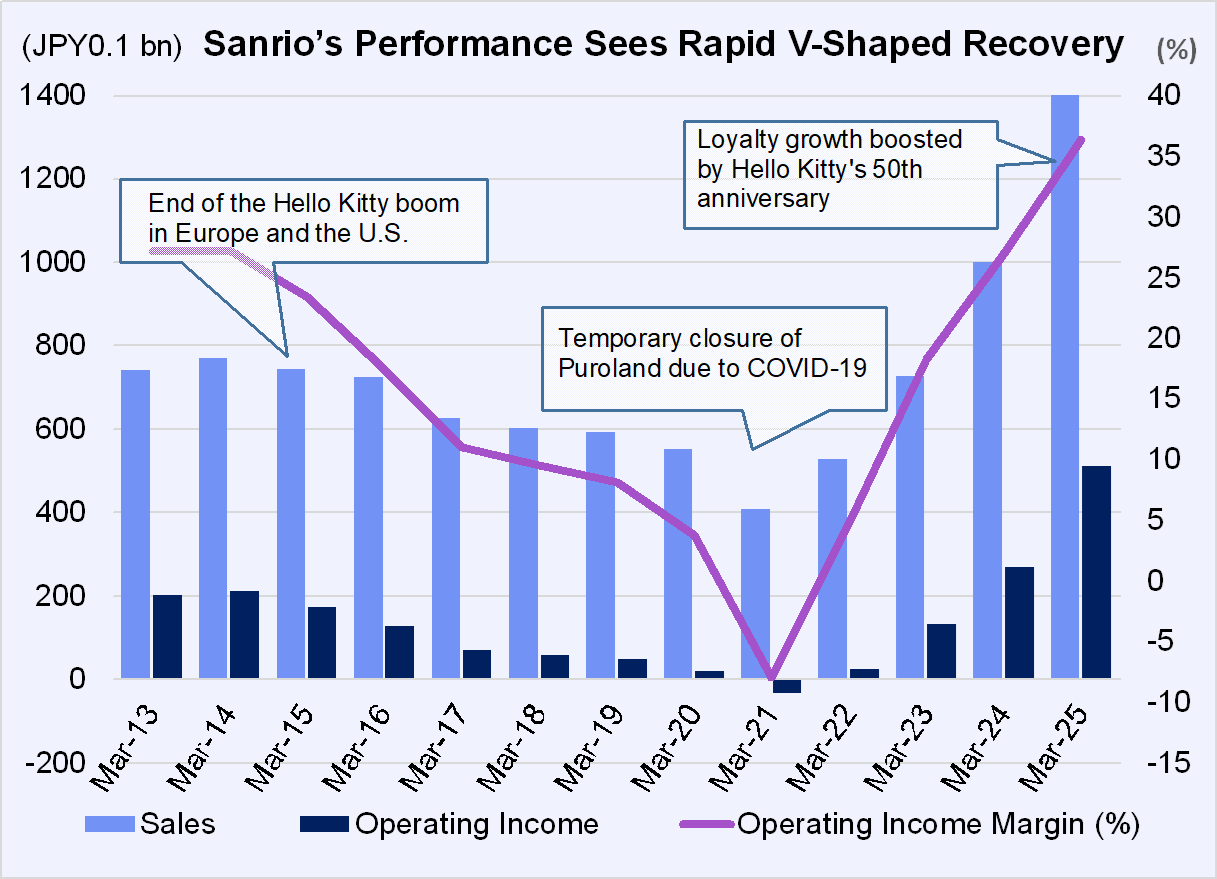

[Kanako Nagashima, QUICK Market Eyes] Sanrio’s performance has seen a V-shaped recovery driven by its growing popularity outside Japan. In the past, Sanrio lost ground to the popularity of other companies’ characters, especially in the United States. However, the company has built up a fan base by making full use of cute Japanese-style characters and digital marketing. How will the company continue to grow after the tailwind of the 50th anniversary of its signature character “Hello Kitty” stops? Market attention may gradually shift to the company’s long-term strategy.

Successful Digital Marketing Revives Popularity in the U.S.

According to Sanrio’s April-December 2024 financial results announced on February 14, 2025, sales increased 45% YoY to JPY 104.7 bn, and operating income rose 92% YoY to JPY 41 bn. The 50th anniversary of Hello Kitty also helped other characters increase their popularity, resulting in stronger-than-expected royalty sales in North America and China. Operating income reached a record high on a quarterly basis. The company also upwardly revised its forecast for the fiscal year ending March 31, 2025, for the third time. Yasuki Yoshioka and Eiji Maeda, analysts at SMBC Nikko Securities, gave Sanrio a thumbs up in a report dated February 14, calling the “strong financial results a positive surprise.”

Looking back, Sanrio had a bitter experience about a decade ago when its performance deteriorated due to the sudden emergence of a rival. The Disney movie “Frozen (Princess Anna and The Snow Queen),” which was released in 2014 in Japan, was a huge hit. As a result, in the U.S., sales of Sanrio products at mass retailers, such as Wal-Mart (WMT), gradually declined. Sanrio suffered a prolonged hardship, and the COVID-19 pandemic plunged the company into an operating deficit.

In recent years, Sanrio has been focusing on digital initiatives: its “Hello Kitty and Friends” channel on YouTube has over 3 million subscribers. The company has also expanded into the U.S. Roblox (RBLX), which is popular among young people in the U.S. and Europe, raising character recognition and branding. Seiichiro Matsumoto, Managing Executive Officer, explained at the February 14 financial results briefing, “Nowadays, we can create popularity through social networking service (SNS).” He expressed confidence in the company’s ability to disseminate content, saying, “This is a definite difference from a decade ago.” Sanrio has increased its sales at specialty stores for young people by improving the recognition of its characters. The company also greatly increased its sales at mass retailers, with Kitty’s 50th anniversary being one of the catalysts.

Can Sanrio Grow over the “Next Decade”?

The company’s operating income margin for the fiscal year ending March 31, 2025, is expected to increase to 36% due to the growth of its licensing business and its operations in Europe and the United States. In a February 17 report, Tomoaki Kawasaki, senior analyst at Iwai Cosmo Securities, noted, “The company’s earnings power, which generates revenue from multiple characters around the world, has risen to a higher level, and this should boost the company’s stock rating.” He reiterated his top investment rating of “A” and significantly raised his target price to 7,500 yen from 5,000 yen.

The year 2025 marks the 50th anniversary of “My Melody” and the 20th anniversary of “KUROMI,” which is gaining popularity mainly in China. Both characters are as popular as Hello Kitty in character polls conducted by fans in Japan and abroad. Managing Executive Officer Matsumoto expressed confidence in the company’s performance in the coming fiscal year, saying, “We do not expect the trend (of character popularity) to decline.”

Sanrio has become one of Japan’s leading intellectual property (IP) companies, with its unique characters (IPs) attracting fans around the world. The challenges for Sanrio are large fluctuations in business performance and securing human resources. In May, Sanrio will unveil an update to its mid-term management plan, which will be the company’s first “10-year plan.” The company will likely present its strategies and initiatives over a longer time frame than the mid-term plan period.

Sanrio’s performance has been highly dependent on the popularity of a handful of its characters, and its earnings have been highly volatile. The market is calling for more stable earnings from a medium- to long-term perspective. Managing Executive Officer Matsumoto stated, “Employees continue to be quite busy.” The rapid recovery in sales has led to an urgent need to increase the number of employees. Although there is still some time before Sanrio discloses its strategy for the “next 10 years,” the company may increase its fan shareholder base even further if it is well-received in the marketplace.

(Reported on February 21)

Related dataset

Interested in Japanese companies’ earnings forecast data?

QUICK Forecast – 5FY earnings forecast for all listed companies in Japan daily calculated by QUICK

If you are looking for datasets unique to the Japanese equity market, visit QUICK Data Factory:

https://corporate.quick.co.jp/data-factory/en/