Japan Markets View[QUICK’s Alternative Dataset] QUICK Probability of Default

Nov 19, 2021

![[QUICK’s Alternative Dataset] QUICK Probability of Default](/wp-content/uploads/1119-2.png)

■ What is QUICK Probability of Default?

QUICK Probability of Default is the estimated probability, expressed as in percentage (%) terms, that a company will default on its loans within a certain period. QUICK calculates the estimated probability of default (PD) by itself as credit risk data for individual companies.

■ Credit risk model using stock prices

The fundamental way to understand the debt repayment capacity of an individual company is to refer to its financial data. This data is updated when full-year and quarterly financial results are announced. Therefore, the probability of default (PD) of credit risk estimation models that use financial data such as Altman’s Z-score is updated once every three months at a minimum.

Stock prices change in a timely manner, and such price fluctuations can be considered by incorporating information on corporate value and debt repayment capacity held by market participants. Therefore, a credit risk estimation model using stock prices is expected to provide timelier estimated probability of default (PD).

■ Estimated probability of default (PD) by stock price

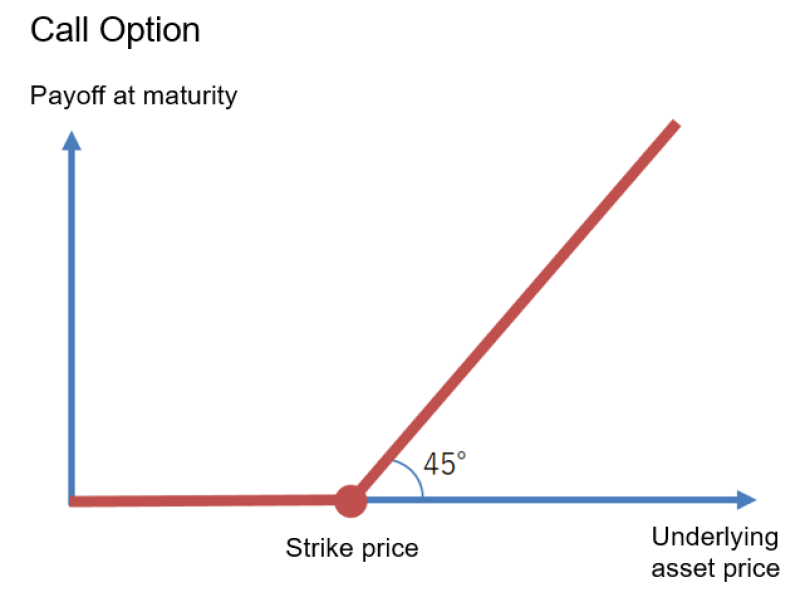

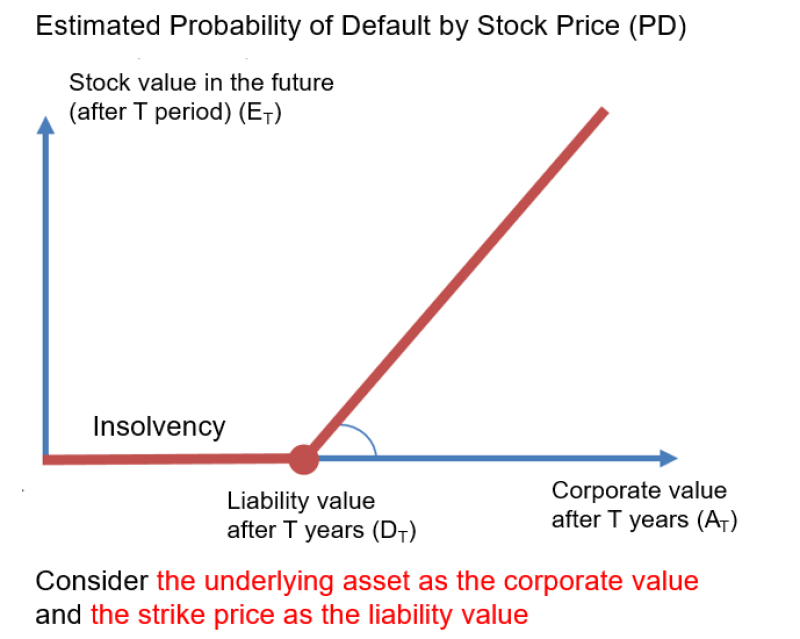

The credit risk estimation model using stock prices uses the Black-Scholes equation, which is familiar from its use with options. Specifically, the model considers that “stock value = the value of a call option whose underlying asset is a corporate asset.” A call option is a “right to buy a commodity at a predetermined strike price.” An investor buys the right fee (premium) of a call option. To profit from the exercise of the right, the underlying asset (stock value) must exceed the strike price (liability value). If the stock price rises significantly, the investor’s profit will increase. Conversely, if the underlying asset (stock value) falls below the strike price (liability value), the investor will not exercise the right (i.e., they will not purchase the underlying stock). In such a case, the loss is limited to the right fee (premium) of the call option. Based on this concept, the probability of the stock value becoming negative (i.e., the probability of becoming insolvent) is estimated as the estimated probability of default (PD).

■ Backtesting

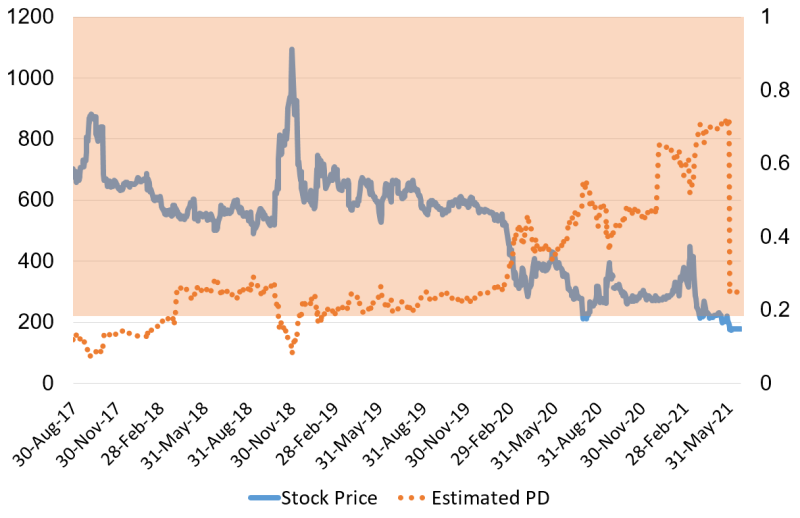

As an example, we evaluated Watabe Wedding (4696), which was delisted from the First Section of the Tokyo Stock Exchange on June 28, 2021. In the figure below, the solid blue line is the stock price and the dashed orange line is the estimated PD. The estimated PD is generally considered to be critical when it exceeds 0.2. Watabe Wedding’s stock price started to fall at the beginning of 2020. If you look at the estimated PD, you can see that it had been high since well before 2020. In addition, on May 31, 2021, Watabe Wedding issued new shares to a third party. From June 1, 2021, the company’s equity capital increased significantly, causing the estimated PD to decrease from 0.7 to 0.2.

QUICK Probability of Default on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data039/