Japan Markets ViewQUICK Monthly Survey: LDP’s Landslide Victory Boosts Growth Hopes, but Fiscal Concerns Linger

Feb 19, 2026

[Yosuke Oyake, QUICK Market Eyes] In the QUICK Monthly Survey (Equity), released by QUICK on February 9, market participants predicted the Nikkei 225 in one month to be 54,087, a significant increase from 51,526 in the previous survey. Investor sentiment leaned heavily toward a bullish outlook prior to the House of Representatives election on February 8. This was driven by earlier predictions that the Liberal Democratic Party (LDP), led by President Sanae Takaichi, would emerge victorious.The actual election results showed a historic landslide victory for the LDP. The party secured 316 seats, surpassing the two-thirds threshold of 310 seats. Investor expectations for higher stock prices have strengthened further. This stems from the view that the foundation is now set to execute growth strategies based on the “responsible and proactive public finances” promoted by the Takaichi administration. On the other hand, concerns about fiscal deterioration continue to linger.

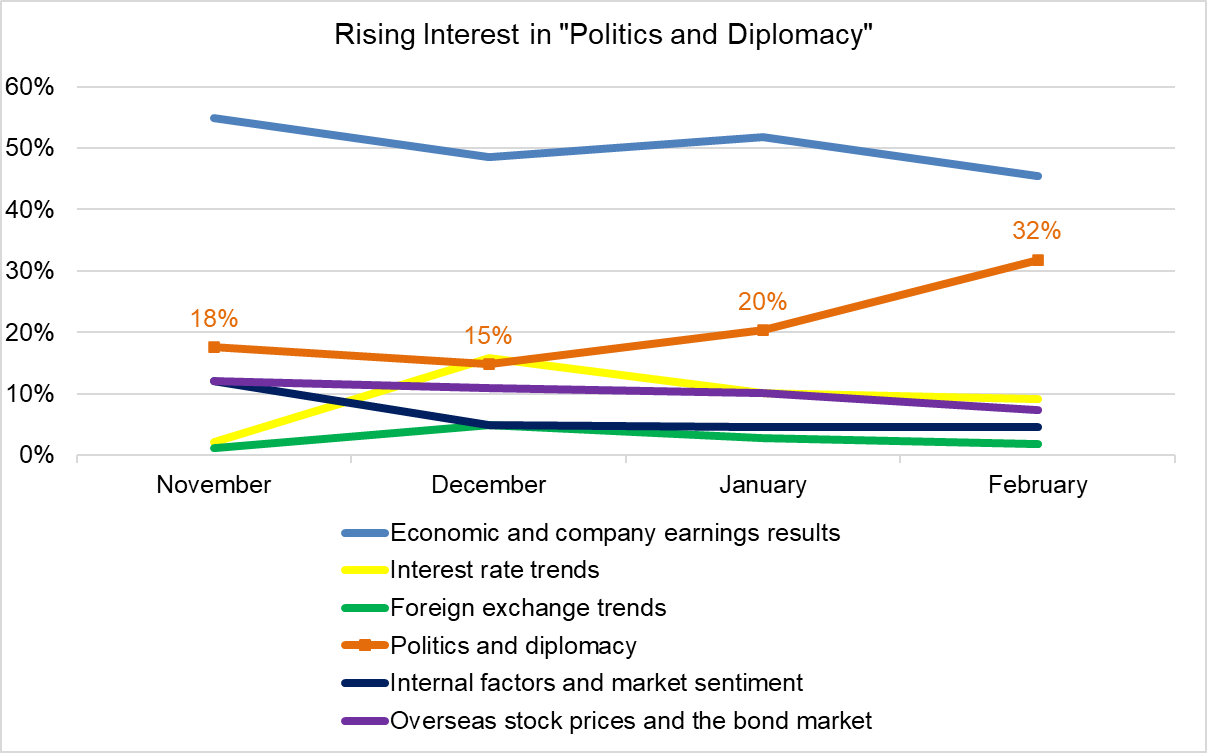

The survey was conducted between February 3 and 5, prior to the House of Representatives election. Responses were obtained from a total of 119 individuals, including those from securities firms and investment trust management companies. In a question regarding the most closely watched stock price volatility factors for the next six months, “Politics and diplomacy” rose 12 points from the previous survey (20%) to 32%, reaching its highest level in seven months since July 2025. “Economic and company earnings results” fell 7 points from the previous 52% to 45%. However, the “Economic and corporate earnings” index, which indicates the strength of impact on the stock market, reached 68.2, the highest level since July 2021 (68.8). On this scale of 0 to 100, 0 represents the strongest concern as a downward factor, while 100 represents the strongest expectation as an upward factor. These results suggest that market interest was expected to shift toward the details of policy implementation and the resulting trends in corporate earnings once the major event of the House of Representatives election concluded.

*Compiled from the QUICK Monthly Survey (Equity) in February.

In a question about the Nikkei 225’s one-year outlook, market participants showed a persistent expectation of higher prices, likely pricing in the LDP’s victory. The most frequent response rose by 5,000 from the January survey to reach 60,000 for the first time in history. One background factor for this bullish outlook is the market anomaly that “elections are a time to buy.” In the past, stock prices surged by approximately 20% to 30% in the three months following major LDP victories, such as the 2005 “Postal Election” and the 2012 general election that brought the second Abe administration to power.

The LDP’s acquisition of two-thirds of the seats has significantly increased the stability of the administration’s governance. In fact, in a question about the allocation of Japanese stocks in investment funds, the response “significantly overweight” jumped from 0% in the previous survey to 17%, the highest level since February 2013 (18%). At that time, stock prices were rising during the “Abenomics” market following the inauguration of the second Abe administration at the end of 2012.

In a question regarding policies the ruling party should focus on after the general election, 66% of respondents selected “growth strategy.” This suggests strong expectations for priority investment in the 17 areas of the growth strategy promoted by the Takaichi administration. On the other hand, only 9% of respondents chose “consumption tax reduction” as a policy to be promoted, despite it being a campaign pledge of many ruling and opposition parties. This was lower than “diplomacy and security strategy” (33%) and “social security system reform” (32%). There appear to be concerns about yen depreciation and rising interest rates due to continued proactive fiscal policy. A special question asked about the impact on the stock market if the upward trend in long-term interest rates continues (assuming the 10-year government bond yield exceeds 2.5%). Two responses indicating a negative impact on stock prices accounted for more than half of the total. Specifically, 9% said it would be a “factor for a significant decline in stock prices (pushing prices down by 10% or more),” and 45% said it would be a “factor for a decline in stock prices (pushing prices down by approximately 0% to 10%).” One respondent from a securities firm expressed concern about the impact of interest rate trends. They stated, “economic and company earnings are trending steadily. Thus, we are not overly concerned about them. However, we are closely monitoring interest rate trends. The worst-case scenario would be a situation where rising interest rates lead to credit anxiety regarding financial institutions.”

However, 43% of respondents said the impact of rising interest rates on stock prices would be “limited.” Furthermore, the market showed a calm reaction on February 9. The yield on the newly issued 10-year Japanese Government Bonds (JGB) in the Japanese bond market remained at 2.290%, representing only a slight increase from the previous weekend. Additionally, the exchange rate moved toward a stronger yen. This seems to be because the LDP victory had already been priced in. There is also a certain level of trust that the Takaichi administration “will not resort to unchecked fiscal expansion,” according to a market participant.

On the other hand, there are many critical voices. A respondent from an investment trust management company noted, “Maintaining fiscal expansion and monetary easing may be a tailwind for the wealthy. However, for ordinary citizens, it could further accelerate inflation and lead to financial hardship.” Another respondent in the “Other” category commented, “I feel that Prime Minister Takaichi played the ‘House of Representatives dissolution card’ too early.” There is a risk that Japanese stocks will face limited upside toward the second half of the year if the administration’s approval rating begins to decline. This could occur due to concerns over its ability to execute policies. The key will be how the administration can balance growth strategies with fiscal management that maintains market confidence to avoid excessive yen depreciation and rising interest rates. The phase of scrutinizing the policy capabilities of the Takaichi administration is likely to continue.

(Reported on February 13, 2026)

QUICK Monthly Survey:

https://corporate.quick.co.jp/data-factory/en/product/data012/

Discover datasets unique to the Japanese equity market

Visit QUICK Data Factory: https://corporate.quick.co.jp/data-factory/en/

Disclaimer:

https://corporate.quick.co.jp/en/terms/#disclaimer