Japan Markets ViewOutlook for Each Industry Polarized due to High Resource Prices

May 19, 2022

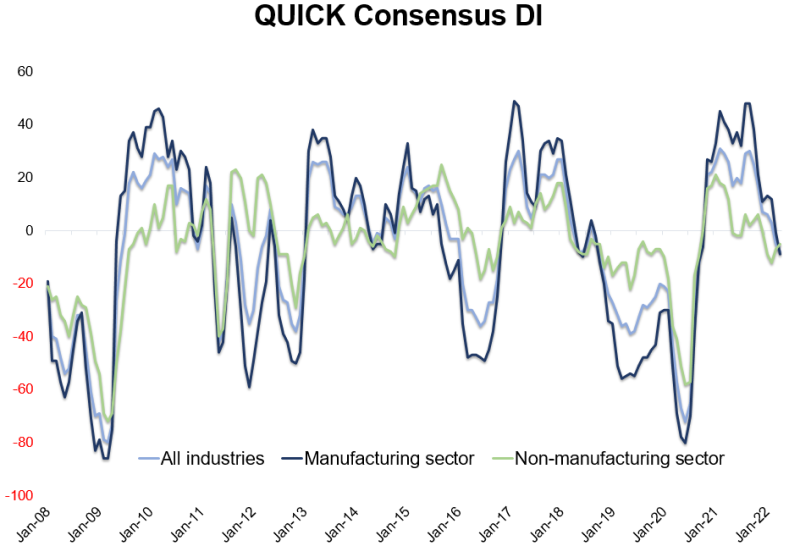

The QUICK Consensus DI, which indicates changes in earnings forecast for major companies, was -8 across industries including the finance sector (as of the end of April), which is a further fall by 3 points from the previous month, where the figure turned negative for the first time in one year and four months. This is the second consecutive month of deterioration.

Amidst continued uncertainty over rising prices of resources and other raw materials, as well as the situation in Russia and Ukraine, some companies conservatively revise their earnings forecasts.

The DI for the manufacturing sector worsened by 8 points from the previous month to -9. The external environment has caused polarization among industries, and the DI for the iron and steel and nonferrous metals industries, which are benefiting from rising resource prices, improved, while that for the food and beverages, pharmaceuticals, and transportation equipment industries, which are facing higher costs, worsened.

The DI for the non-manufacturing sector improved for the second consecutive month, improving 2 points to -5. Wholesale improved significantly by 25 points due to higher resource prices. Retail, on the other hand, deteriorated by 20 points. Among 16 targeted industries for calculation, 5 were positive, 10 were negative, and 1 remained unchanged.

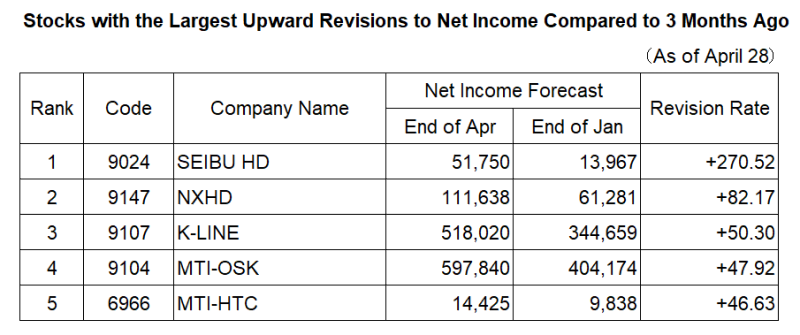

Upward Expectation by Easing Restrictions The company whose upward revisions to net income was the largest among individual stocks compared to 3 months ago was Seibu Holdings (9024), the same as the previous month. The easing of admission restrictions at amusement and theme parks in Japan is expected to boost earnings, and the company’s improved financial condition is also being evaluated. Shipping giants Kawasaki Kisen Kaisha (9107) and Mitsui O.S.K. Lines (9104), which expect shipping markets to remain high as economic activity resumes and resource prices rise, and Mitsui High-tec (6966), which will benefit from the electrification of automobiles and rising semiconductor demand, ranked high.

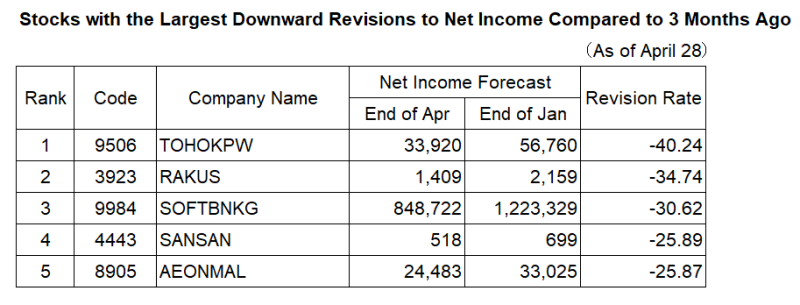

Concerned About Increased Costs

The company with the largest downward revision was Tohoku Electric Power (9506). The depreciation of the yen and rising fuel prices are expected to weigh on costs, as well as the cost of restoring power plants due to the earthquake that struck off the coast of Fukushima in March. SoftBank Group (9984) has seen its profit/loss situation deteriorate as growth stocks in which it invests are weak across the board. However, some analysts expect a review and buyback due to the declining stock price and the recent share buyback.

QUICK Consensus DI

The QUICK Consensus DI classifies stocks as “Bullish” in the case of analysts revise their consolidated net income forecasts upward by 3% or more compared three months ago, while as “Bearish” in the case of downward. The DI calculates by subtracting the ratio of “Bearish” from “Bullish” to total stocks. A negative DI means that the number of downward revision stocks exceeds upward revisions. The stocks are for the forecasts of at least five analysts and the DI indicates whether the market-wide expectations for the performance of major companies are upward or downward.

QUICK Consensus DI on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data031/