Japan Markets ViewNearly 90% of New NISA Users See Gains: Success Stories Drive Shift from Savings to Investment in Japan

Jan 26, 2026

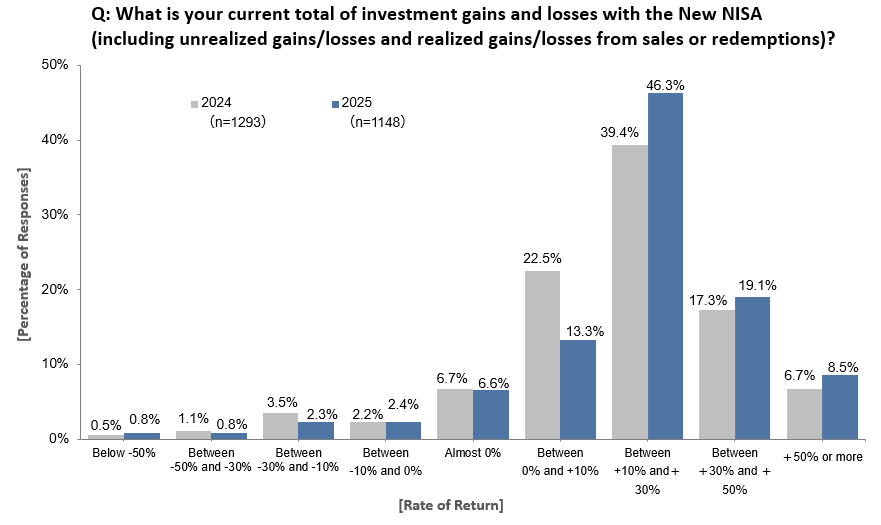

QUICK Asset Management Research Center has compiled the results of the 10th “Survey on Individual Asset Formation,” which was conducted in October 2025. The survey targeted 5,075 individuals across Japan aged 18 to 74. According to the results, 87.2% of users of the New NISA (Nippon Individual Savings Account), which was drastically expanded in 2024, saw positive investment returns. Strong “success stories” fueled by favorable market conditions are leading the investment behavior of Japanese individuals toward an irreversible turning point. For many years, these individuals had focused heavily on cash and savings.

* Target: New NISA users. Comparison of the 2025 survey and the 2024 survey. Single response format. Investment gains/losses include unrealized gains/losses and realized gains/losses from sales/redemptions.

Totals exclude “”Don’t know”” (19.8% in 2025) and “”No response / Don’t know”” (17.7% in 2024). Totals may not add up to 100% due to rounding.

Over 70% of Users Achieve Investment Gains of “10% or More”

According to the survey results, the investment performance of the New NISA users is extremely solid. The proportion of users achieving investment gains of 10% or more rose by over 10 percentage points to 73.9%, from 63.4% in the previous survey. Against this backdrop of positive outcomes, 74.4% of users responded that “using the system was worthwhile,” and satisfaction levels have also improved.

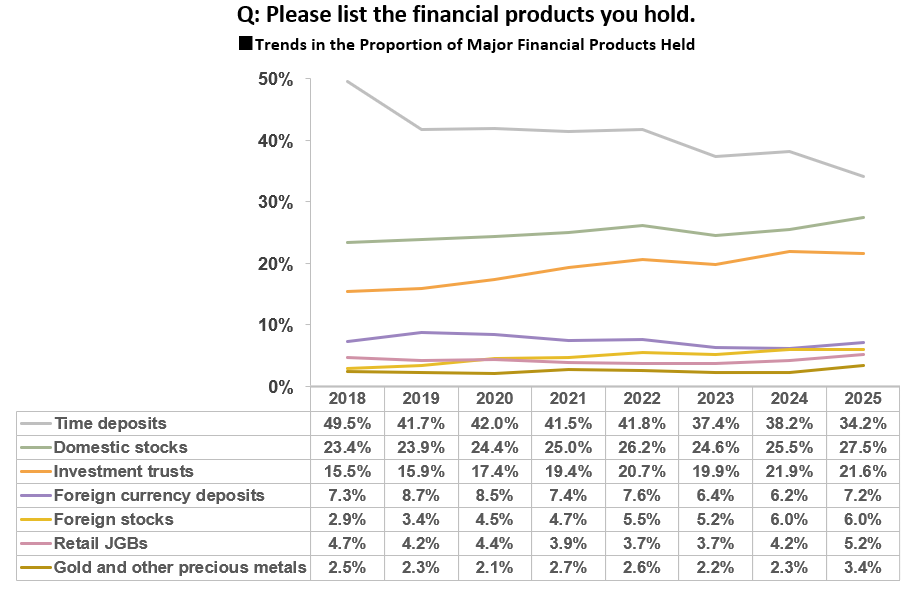

Changes are also visible regarding investment targets. In the “Growth investment quota” category of the New NISA, individual Japanese stocks (56.0%) are the most preferred. Meanwhile, in the “Tsumitate (Installment) investment quota” category, all-country equity index funds (45.1%) are the mainstream. Looking at the overall financial assets held by individuals, the proportion of Japanese stock holdings reached 27.5%. This marks the highest level since the survey began in 2018. Investments in precious metals such as gold (3.4%) also reached a record high. This is driven by an awareness of inflation hedging as Japan moves away from deflation.

* Target: New NISA users. Comparison of the 2025 survey and the 2024 survey. Single response. Investment gains/losses include unrealized gains/losses and realized gains/losses from sales/redemptions.

Totals exclude “Don’t know” (19.8% in 2025) and “No response/Don’t know” responses (17.7% in 2024). Totals may not add up to 100% due to rounding.

“Psychological Barriers” and “Intergenerational Gaps”

On the other hand, challenges specific to Japanese individual money have also come to light.

The image of asset management remains rooted in negative perceptions, such as “losing money (38.9%)” or “high risk (30.6%).” There is a large gap between these perceptions and the actual state of investment.

However, such perceptions are clearly polarized, depending on “whether or not one has investment experience.” Among the New NISA users and young adults aged 18 to 29, the proportion holding positive perceptions such as “future security (21.7%)” and “asset growth (25.0%)” significantly exceeds the overall average. The tendency to believe that one can support society and companies through investment (17.6%) is particularly prominent among the younger generation compared to other age groups.

Reflecting the aging society, seniors in their 60s and older have a high interest in the “asset inheritance of assets.” As a request for system improvement, 10.7% of seniors cited a “mechanism to pass on investment products directly to bereaved family members (spouses) upon death.” This figure exceeds the needs of the working-age generation.

Market Resilience Being Tested

In April 2025, when the market plummeted due to policy uncertainty from the U.S. administration, 56.5% of experienced veteran investors remained calm and “chose to do nothing.” Individual investors are gaining success stories and adopting a long-term investment stance. They are beginning to support the market as “resilient capital,” even during temporary adjustment phases.

The government has set a goal to achieve 34 million accounts by the end of 2027. Individual awareness is maturing from “savings” to “investment for growth.” Detailed system improvements that address the concerns of each generation will be the focus for further vitalizing Japan’s financial markets.

[Supplementary Information] The New NISA (Nippon Individual Savings Account) is a tax incentive system for individuals, which the Japanese government drastically expanded in January 2024 to accelerate the shift from savings to investment.

Want to know more about the New NISA?

Shift from Savings to Investment – New NISA to Start in January 2024

Article by QUICK Asset Management Research Center

MRF Balance Hovers at Record High JPY16 tn Level: QUICK Calculations

Discover datasets unique to the Japanese equity market

Visit QUICK Data Factory: https://corporate.quick.co.jp/data-factory/en/

Disclaimer:

https://corporate.quick.co.jp/en/terms/#disclaimer