Japan Markets ViewIs Corporate Reform Further Progressing in 2025? – ROE Improvement as Key

Jan 10, 2025

[Keiichi Nakayama, QUICK Market Eyes] Looking back on the year 2024, the seeds of corporate reform have gradually begun to grow. Unwinding cross-shareholdings, a uniquely Japanese practice, is increasing. Corporate awareness is also changing in response to the Tokyo Stock Exchange’s (TSE) request for “Management Conscious of Cost of Capital and Stock Price.” The oriental zodiac sign for 2025 is “Kinotomi,” meaning development through repeated regeneration and change. Attention will be focused on whether companies will further strengthen their reforms. The key will be the improvement of return on equity (ROE) in many companies.

Chisa Kobayashi, strategist at UBS SuMi TRUST Wealth Management, pointed out, “2025 is likely to be the most important year for Japanese stocks also in terms of the outlook for the next decade.” She considers that, although President-elect Trump’s tariff policy may pose a risk, the market will be underpinned by “expectations” of higher wages, an end to deflation, and growth in corporate earnings following the previous year. For the market to rally further, expectations for changes in corporate behavior need to be more “realized,” according to Ms. Kobayashi.

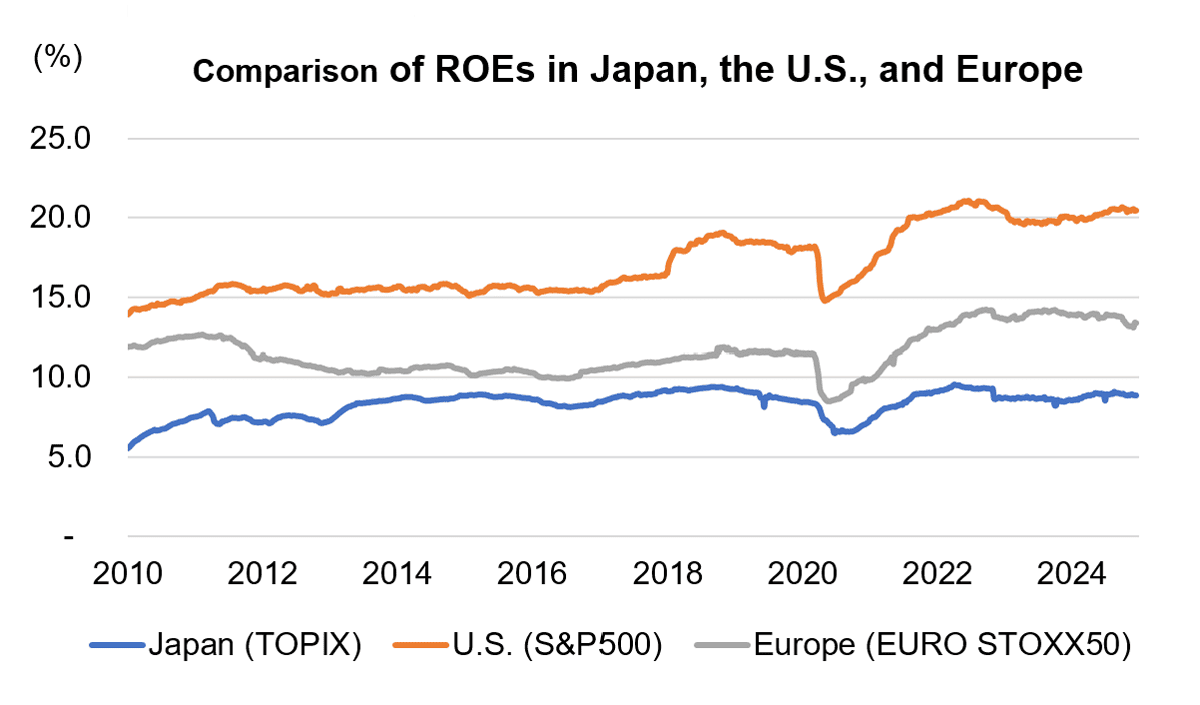

What changes are needed? Ms. Kobayashi noted that companies need to improve their ROEs in order to bring back investors outside of Japan with a particularly high share of trading in Japan. The ROEs of Japanese companies are still lower than those in Europe and the U.S. The year 2025 marks the first full cycle of the oriental zodiac since 2013, when Japan’s corporate governance reforms began. Nevertheless, ROEs in Japan have been lower than those in Europe and the U.S. to date.

Source: UBS SuMi TRUST Wealth Management

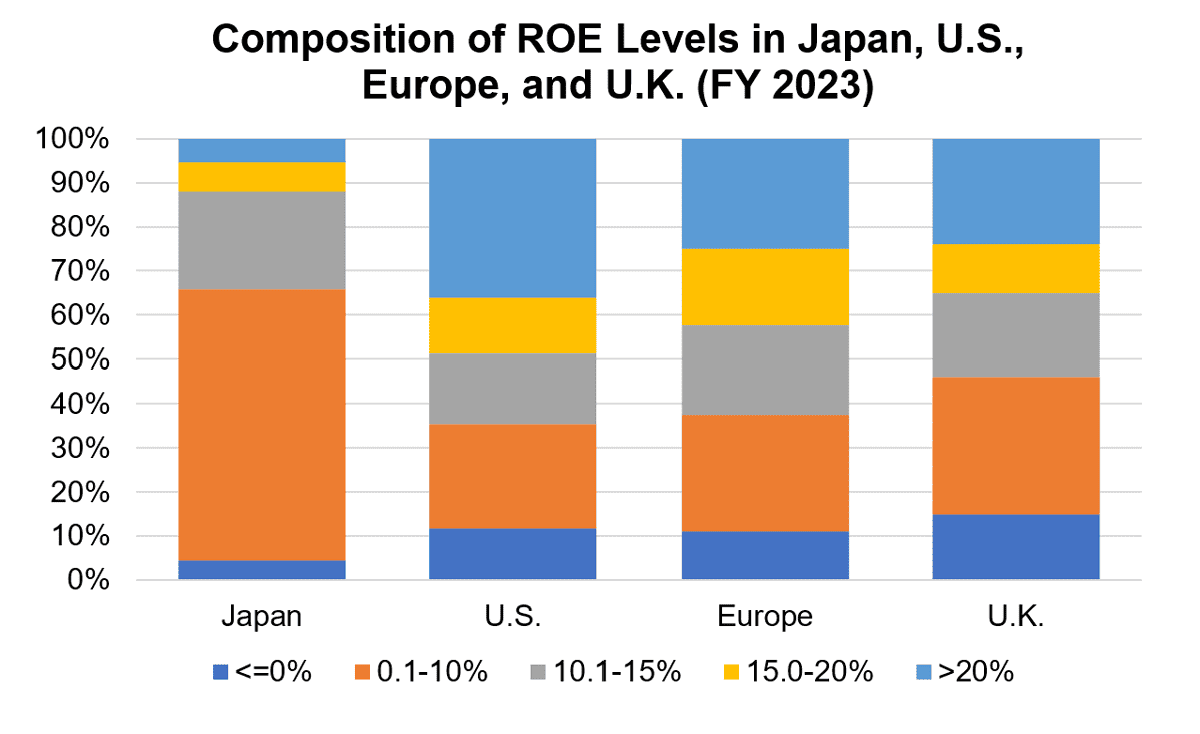

Looking at the composition of ROE levels, companies with ROE above 20% account for the largest proportion in the U.S. Meanwhile, more than 60% of companies in Japan have an ROE of 10% or less, which is noticeably low compared to Europe and the U.K. Recently, Japanese companies have been increasing their share buybacks, indicating a change in their attitude toward capital. However, Ms. Kobayashi noted, “Share buybacks alone will soon run out of steam.” She added, “ROE improvement in Japanese companies, which are undervalued compared to companies in other countries, will help boost valuations (investment scale).” The key is whether this change can be made steadily.

Source: UBS SuMi TRUST Wealth Management

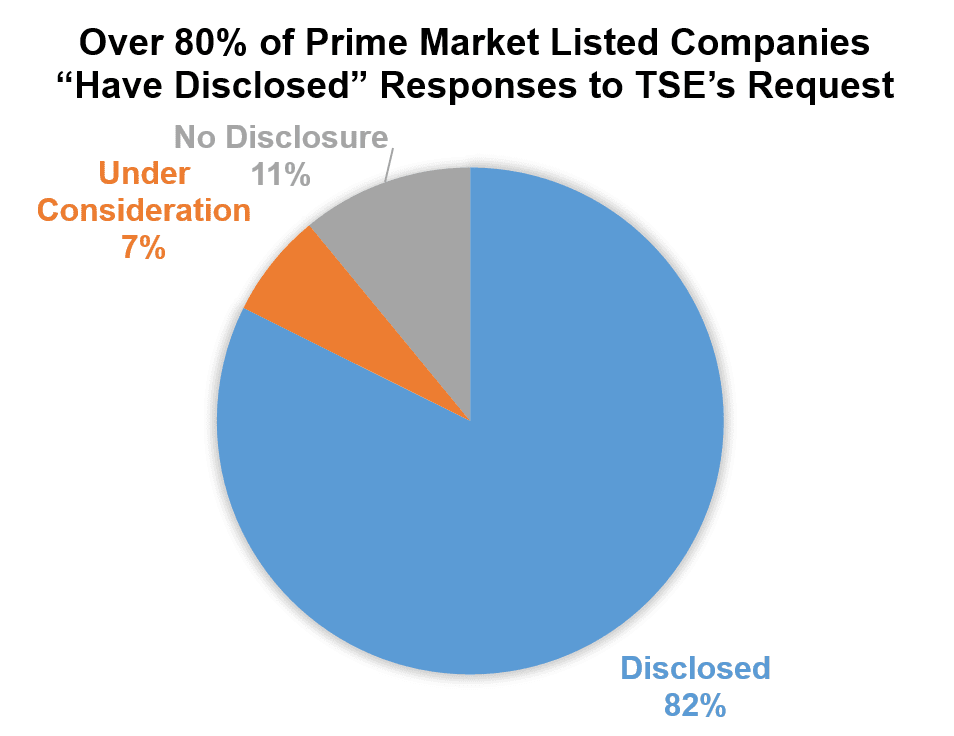

In March 2023, the TSE requested that listed companies take actions for “Management Conscious of Cost of Capital and Stock Price.” As of the end of November 2024, more than 80% of Prime Market listed companies (1,354 companies) “have disclosed” their response to the request, and 110 companies were “under consideration.” When the number of companies that have disclosed their response and those under consideration are combined, almost 90% of the companies have begun to take some action.

*Compiled based on the materials published by the TSE.

However, there is a view in the market that “many companies respond to the request for cost of capital only in a formal manner” (strategist). In November 2024, the TSE, based on discussions with investors, published case studies of companies’ responses to the request for “Management Conscious of Cost of Capital and Stock Price” not aligned with investors’ perspectives. The TSE compiled examples of “unfavorable disclosure” and urged companies to further promote reform.

At the ceremony held at the TSE on January 6, the first trading day of the year, Hiromi Yamaji, CEO of Japan Exchange Group (JPX), once again referred to the request for “Management Conscious of Cost of Capital and Stock Price” and stated, “Reform has only just begun.” He reemphasized that the goal is to create a market where listed companies’ efforts to improve their corporate value over the medium to long term are a matter of course.

Referring to Kinotomi, the oriental zodiac sign for 2025, also the year of snake, Mr. Yamaji mentioned, “A snake changes as it repeatedly sheds its skin. I hope that the market will shed its skin and become more mature.” Katsunobu Kato, Minister of Finance and Minister of State for Financial Services, who delivered an address following Mr. Yamaji, also touched on the oriental zodiac sign and expressed his expectations for change in Japan. Mr. Kato said, “Kinotomi is said to be a year of flexible development through repeated regeneration and change.” Expectations for Japanese companies are high. For many companies, this year will be a year in which they will be challenged to make further changes and realize their expectations.

(Reported on January 8)

Related dataset

Share Buybacks Data

https://corporate.quick.co.jp/data-factory/en/product/data029/

If you are interested in the Japanese equity market data, please contact us:

https://corporate.quick.co.jp/en/contact/form_service_en/