Japan Markets ViewInvestment Appetite for Auto Stocks Rebounds Sharply – QUICK Monthly Survey (Equity) in January 2022

Jan 25, 2022

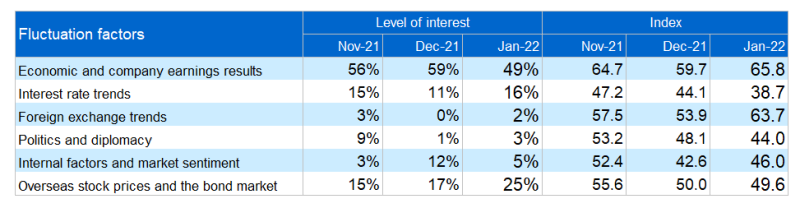

The QUICK Monthly Survey (Equity) in January shows investors bracing themselves for the changing tide of the market. While participants focusing on “economy and company earnings results” as a factor for the stock price fluctuation fell below 50% for the first time in three months, those focusing on “Overseas stock prices and the bond market” accounted for 25%, the highest level since March 2018.

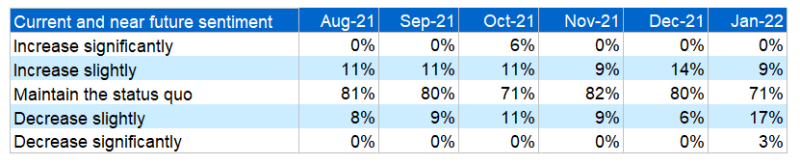

They are also clearly cautious about their investment stance. While only 9% of respondents answered that they would “Increase slightly” their investment stance on Japanese stocks in the future, the total of those who answered “Decrease slightly” and “Decrease significantly” reached 20%.

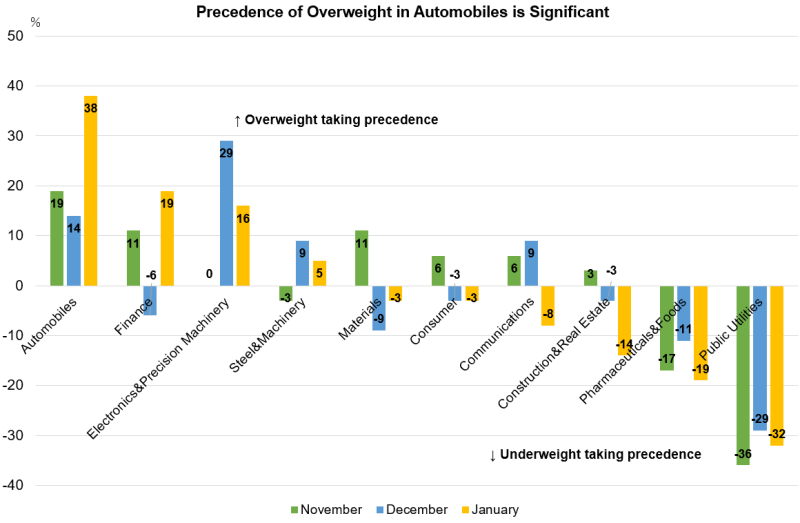

This answer confirms the adjustment of the Nikkei 225 since the beginning of the year. The target of the position adjustment seems to be the growth stocks, especially the high-priced high-tech stocks that have led the rally so far. In terms of investment stance by sector, “Electronics & Precision Machinery” dropped to +16% when “Underweight” is subtracted from “Overweight.” The “Communications” also shifted to the “Underweight” category at -8%. The rise in US interest rate seems to have caused a shift of funds from stocks with high valuations to value stocks.

*Subtract the “Underweight” from the “Overweight”.

On the other hand, “Automobiles” stood out for its bullish investment stance. The subtraction result was +38%, expanding the dominance of the “Overweight” category by 24 points from the previous month.

Although the stagnation of production due to parts shortages has made it difficult to be bullish on auto stocks during 2021, the acceleration of recovery production seems to have boosted the move to factor in improved earnings. The weakening of the yen, especially against the US dollar, as a result of rising US interest rate and the expectation of a widening interest rate gap, has also given momentum to a review of auto stocks, which are highly vulnerable to the impact of exchange rate fluctuations on profits. A one-yen decline against the dollar is expected to have a positive impact of about JPY40bn on operating income at Toyota Motor (7203).

Foreign securities firms have pointed out that increased production in response to the supply of parts has also led to improved profitability, including the suppression of incentives (sales incentives). Among them, Nissan Motor (7201) is expected to see a better-than-expected earnings recovery in its US business as it continues to curb price discounting, and Subaru (7270) is also likely to see a recovery in earnings as it normalizes production amid its abundant order backlog.

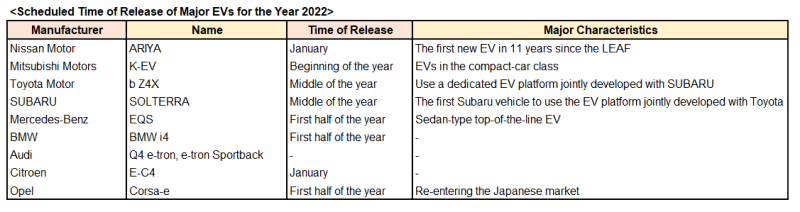

As for automobiles, Toyota and Subaru have introduced electric vehicles (EVs) in earnest. It seems that Japanese manufacturers will finally enter the first year of the EV era.

Japan Steel Works (5631) is a company that has been attracting attention since the end of last year for its automotive battery-related products, which are the heart of EVs. The company is involved in producing separator manufacturing equipment for lithium-ion batteries and is seen to have a 70% share of the global market. The separator is a plastic film that blocks the contact between the positive and negative electrodes, while allowing ions to pass through. The distribution of materials and oil is important in the production of films, and the high level of mixing technology is a competitive advantage. Although the rise of Chinese and Korean manufacturers is noticeable in the field of separators themselves, the company still maintains its superiority in manufacturing equipment, leading to a high market share.

Japan Steel Works is also attracting attention in the field of power semiconductors, which are used to drive the motors that are essential for EVs. It has developed a material for Gallium Nitride (GаN) single crystal substrates in collaboration with Mitsubishi Chemical Corporation, a subsidiary of Mitsubishi Chemical Holdings (4188). The company is now ready to mass-produce the product, with a view to supplying it from fiscal 2022. Compared to the conventional semiconductor material made of silicon, which is a single substance, the compound GaN material is expected to reduce power consumption and environmental impact. GaN has been said to be difficult to produce crystals because it is difficult to control impurities, but Japan Steel Works is supporting mass production with its advanced crystal manufacturing technology.

On the other hand, the negative impact of NSK (6471) is a concern among the automotive sector. In general, 100 to 150 bearings, the company’s main product, are used in one automobile today, but the shift to EVs is expected to reduce demand by 30% on a volume basis. While engine vehicles require the use of different gears when starting and depending on the road environment, EVs can be accelerated efficiently by controlling the motor’s speed without the need for a gearbox, thus reducing the number of situations where the bearings that support the rotating shaft come into play and making it difficult to add value.

The tectonic shifts in auto-related stocks are likely to be significant this year.

QUICK Monthly Survey on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data012/