Japan Markets ViewHuman Flow in Hotels Affects REIT Prices

Dec 13, 2021

It turns out that the flow of people into and out of a hotel greatly affects the earnings of the REIT (real estate investment trust) that owns the property. This is one of the factors that drive the prices of REIT units.

We conducted our analysis using “KDDI Location Data (location-specific movement data),” which QUICK has begun providing. This analysis aggregates the flow of people into and out of each major corporate location based on GPS location data provided by KDDI Corporation (9433). It can also be used to check the human flow around hotels.

■ Increase in Human Flow Leads to Increase in Profits

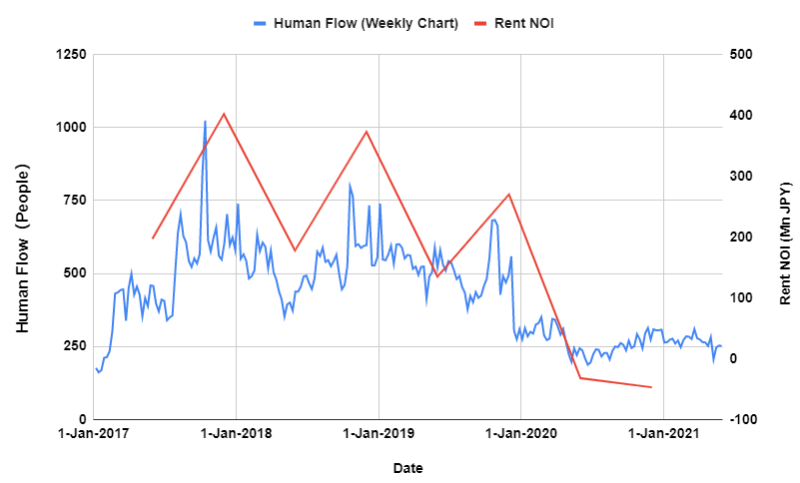

We compared the average weekly human flow at Mercure Okinawa Naha, owned by Japan Hotel REIT Investment Corporation (8985), with the NOI (net operating income that a REIT can earn from real estate leasing). The hotel uses a fully variable rent system, which means that the rent paid to the REIT is determined by the hotel’s revenue.

As a result, when the human flow increased, the NOI increased, and when the human flow decreased, the NOI also decreased. (See the graph below.) When the correlation between the human flow data and the NOI YoY for each fiscal period is determined, the correlation coefficient is 0.9824545545 and the coefficient of determination is 0.96521695, indicating a high correlation. The closer the coefficient of determination is to 1, the higher the relationship can be judged to be.

The data confirms that human flow is a factor that directly affects the profitability of a hotel. It is highly likely that the same trend will be seen in other REITs that include hotels with variable rents.

■ Hotel Revenues Become REIT Revenues

A REIT that invests in hotels is called a specialized hotel REIT. There are many types of hotels, such as business hotels, luxury hotels, inns, and resort facilities, which can be invested in for a wide range of purposes, customer segments, and locations. A high level of expertise is required in the management and operation of real estate, and the skill of the management affects the earnings. In general, hotels derive their income from room rates, food and beverage at restaurants, and bridal-related fees. Since the revenue depends on the number of users of the hotel, it is susceptible to economic fluctuations and refraining from going out due to the COVID-19 pandemic.

In addition to fixed rents, REITs receive variable rents from hotels, which are linked to the hotel’s sales and operating income. The type of rent varies by REIT issue and property, but in many cases, a variable rent system is adopted, making it easier for the earnings from the core business to be directly linked to the REIT’s earnings compared to other REITs such as offices and residential properties.

REITs usually close their accounts twice a year. Compared to stocks, which have quarterly results, there are fewer opportunities to obtain latest information. With KDDI Location Data, data can be obtained on a daily basis. If daily property trends can be confirmed, this information will be extremely useful in forecasting REIT earnings.

QUICK provides the information through its data platform, QUICK Data Factory. With the expansion of the coverage data, it is now possible to check the human flow data for each property held for 61 REITs.

KDDI Location Data on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data038/