Japan Markets ViewGrowing Presence of Share Buybacks – May Resolution Highest Ever Exceeding JPY5 Tn

Jun 05, 2024

[QUICK Market Eyes] Corporate share buybacks are becoming increasingly prominent in the stock market. In terms of cumulative net buying since the beginning of the year, the amount of business companies, including share buybacks, is the largest among investor types. In May, companies resolved to repurchase their own shares, the largest ever, exceeding JPY5 tn, providing a means for unwinding cross-shareholdings. The increase in share buybacks helps tighten the supply-demand balance. In addition, corporate excess capital elimination may enhance the valuation of Japanese stocks as a whole.

■ Surprisingly Large Net Buying – Who Are the Main Players?

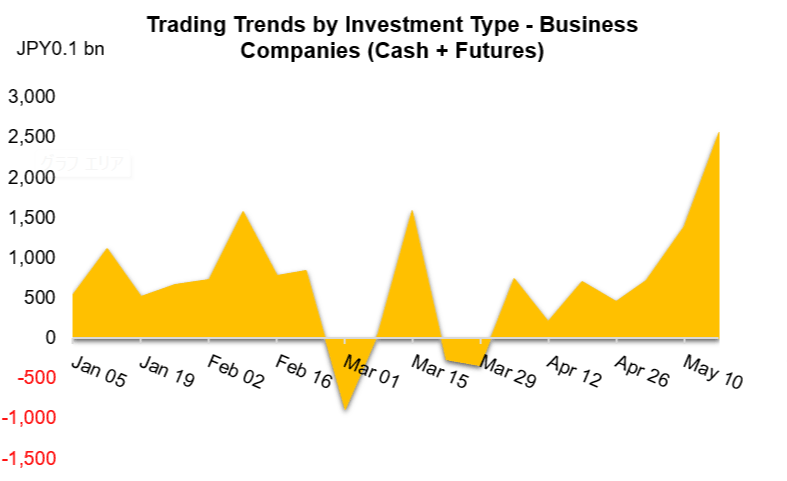

“Honestly, I was surprised at the scale of net buying,” said a trader at a Japanese securities firm while looking at the trading trends by investor type for the third week of May (May 13-17) released by the Japan Exchange Group (JPX) on May 23. The trend was not that of foreign investors, who account for a large market share of Japanese stocks, but that of business companies repurchasing their own shares. Their net buying amount during the week was JPY256.7 bn in cash and futures. In 2023, there were only three weeks in which business companies’ weekly net buying exceeded JPY200 bn, making this week’s amount outstanding.

* Compiled based on the JPX data

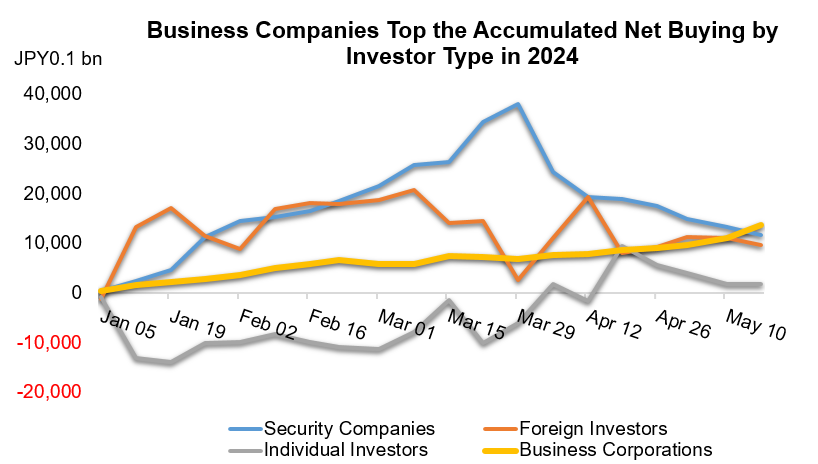

In the cumulative net buying by investor type since the beginning of 2024, business companies ranked first, with a cumulative net buying amount of JPY1.3763 tn. While mainly securities companies and foreign investors were net buyers from January to March, business companies have gradually increased their accumulated net buying. One market participant noted, “From a long-term perspective, we should consider that corporate share buybacks, rather than foreign investors who repeatedly buy and sell shares, help tighten the supply-demand balance.

* Compiled based on the JPX data

■ Share Buybacks Resolved in May Hit a Record High of Over JPY5.7 Tn

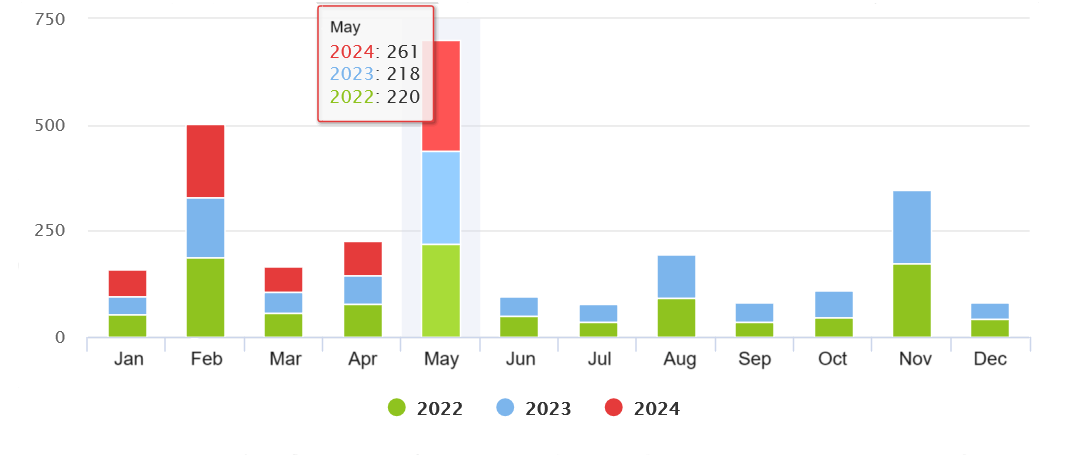

The number of new share buyback resolutions increased in May when many companies announced their financial results. According to the QUICK’s Share Buybacks Data, as of May 27, a total of 260 companies resolved share buybacks in May. This is much higher than those in May 2023 (218 companies) and May 2022 (220 companies). On a monetary basis, the amount of share buybacks totaled JPY5.7438 tn, far exceeding the amount in May 2023 (JPY3.2 tn). On a monthly basis, the amount of share buybacks resolved in May 2024 will undoubtedly set a new record.

* Compiled based on the QUICK Share Buybacks Data

On May 8, Toyota Motor (7203) resolved to repurchase its own shares up to JPY1 tn, exceeding the previous May’s maximum amount of JPY150 bn. When asked about the share buyback and the elimination of cross-shareholding at the May 8 earnings conference, Masahiro Yamamoto, Chief Officer of Accounting Group at Toyota Motor, explained, “Many companies are promoting the conversion of their shares into living assets.” He did not refer to specific stocks but added, “This is carried out while using treasury stock, as the impact on the market (from selling cross-shareholding stocks) is also significant. Mr. Yamamoto indicated a policy of using share buybacks as a means for unwinding cross-shareholdings.

■ “Japanese Stock ROE to Rise from 9% to 10%”

Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Intelligence Laboratory, pointed out, “Since major non-life insurers have recently unveiled their policy of aggressively unwinding cross-shareholdings, institutional investors tend to be wary of the supply-demand imbalance caused by cross-shareholding unwinding.” On the other hand, he noted, “The market has not yet factored in the expectation that selling stocks to unwind cross-shareholdings will end soon, as companies are increasingly setting up share buybacks as a means of unwinding their cross-shareholdings.”

Unwinding of cross-shareholdings and increased share buybacks could make Japanese stocks more attractive overall. In a report issued on May 22, Nozomi Moriya, strategist at UBS Securities, noted, “Many Japanese companies have low return on equity (ROE) due to excess capital accumulated during the deflationary period. The report estimated that “the ROE of Japanese stocks will rise from 9% to 10% as a result of excess capital elimination,” based on the simplified assumption that cross-shareholdings, which account for 12% of Japanese stocks, will be eliminated through mutual share buybacks and sell-backs.

Ms. Moriya predicts that changes in Japanese companies’ management attitudes toward enhancing corporate value could increase Japan’s ROE to about 12%. The share buybacks, set at record highs on a monthly basis, have yet to be implemented. We should keep a close eye on the progress, including the supply-demand balance and positive factors resulting from share buybacks, such as corporate excess capital elimination.

(Reported on May 29)

Share Buybacks Data on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data029/