Japan Markets ViewEmerging Corporate Changes Responding to TSE’s Request

Nov 16, 2023

[QUICK Market Eyes] In March, the Tokyo Stock Exchange (TSE) requested companies to take “action to implement management conscious of cost of capital and stock price.” Following this request, changes are emerging in Japan’s leading large companies. In January 2024, the TSE will disclose a list of companies that have disclosed information responding to the TSE’s request. Emerging changes in corporate governance momentum may further accelerate and lead to higher stock prices.

“Last week may be remembered as the week that showed that Japan’s large companies are taking seriously the TSE’s request for reform,” Bruce Kirk of Goldman Sachs wrote in a report dated November 4. Behind this is the changing attitude of Japan’s major corporations toward their cross-shareholdings.

When announcing, on November 1, its financial results for the April-September period of 2023, Toyota Motor (7203) indicated that it would continue to reduce its cross-shareholdings with other companies, review cross-shareholdings within the group, and make use of treasury stock and cash on hand as the core of its capital strategy. On the same day, Kyocera (6971) also stated that it would review its holdings in KDDI (9433), which accounts for about 30% of its total assets. Kyocera’s previous medium-term management plan included increased capital investment by borrowing around JPY500 bn using KDDI shares as collateral. However, the company unveiled its intention to reconsider the continued holding of KDDI shares and develop a new policy for the fiscal year ending March 2025.

Bruce Kirk of Goldman Sachs noted, “Concrete examples of fundamental change finally appear to be emerging, driven by a combination of top-down pressure from the TSE and bottom-up engagement from shareholders.” Including other corporate actions, “the momentum for reform is visibly improving,” he said.

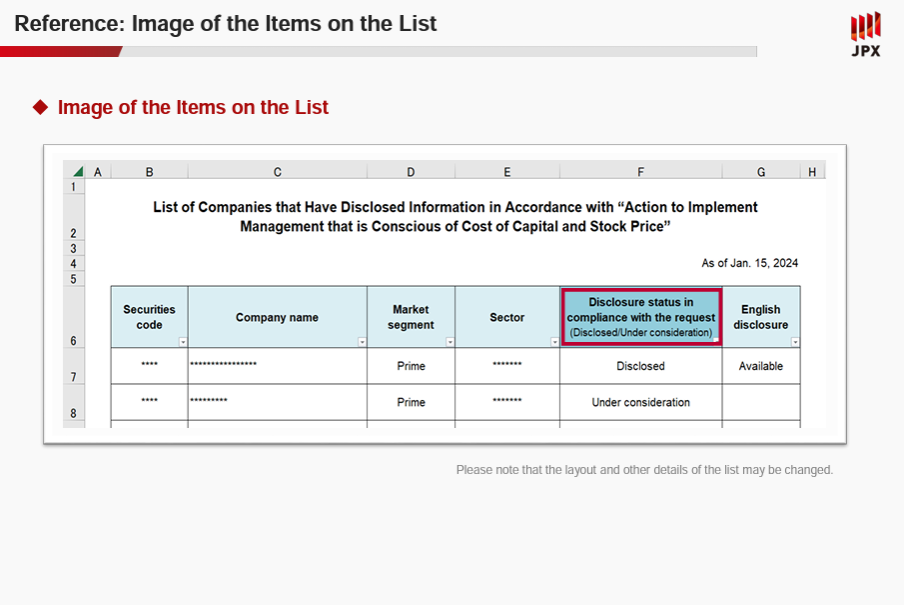

On October 26, the TSE unveiled its plan to publish, on January 15, 2024, a list of companies disclosing their actions to implement management conscious of cost of capital and stock price. The TSE intends to compile a list of companies proactive to the TSE’s request, hoping to encourage companies that have not taken action yet to take measures.

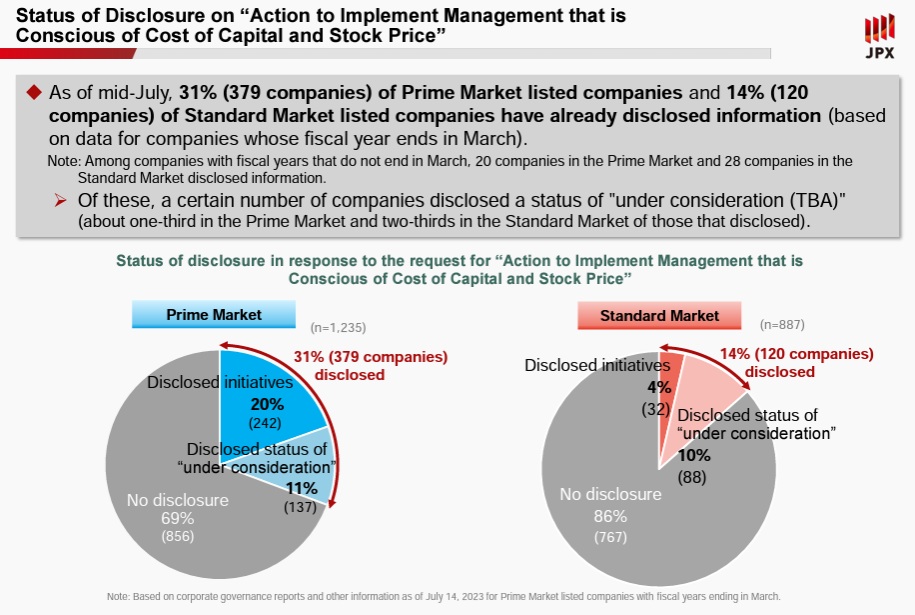

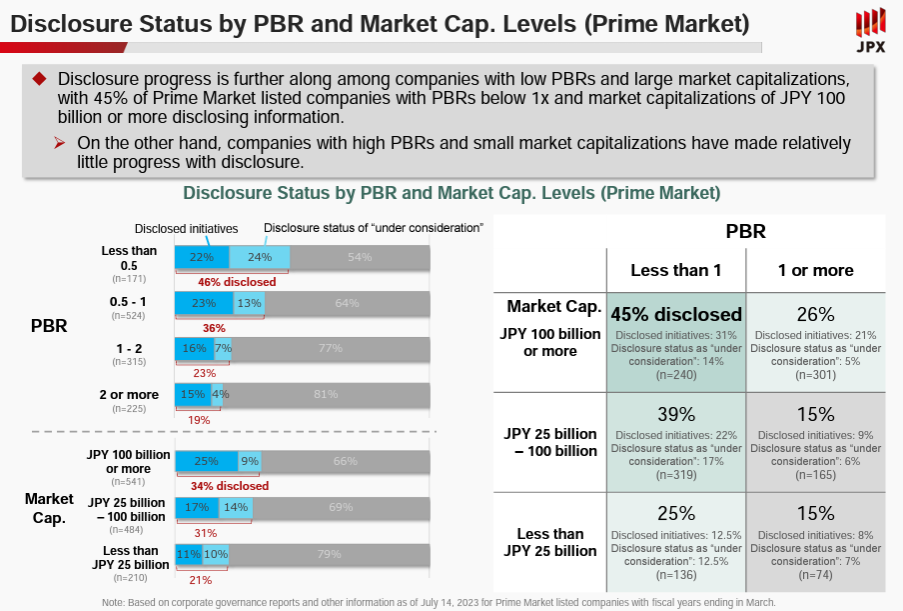

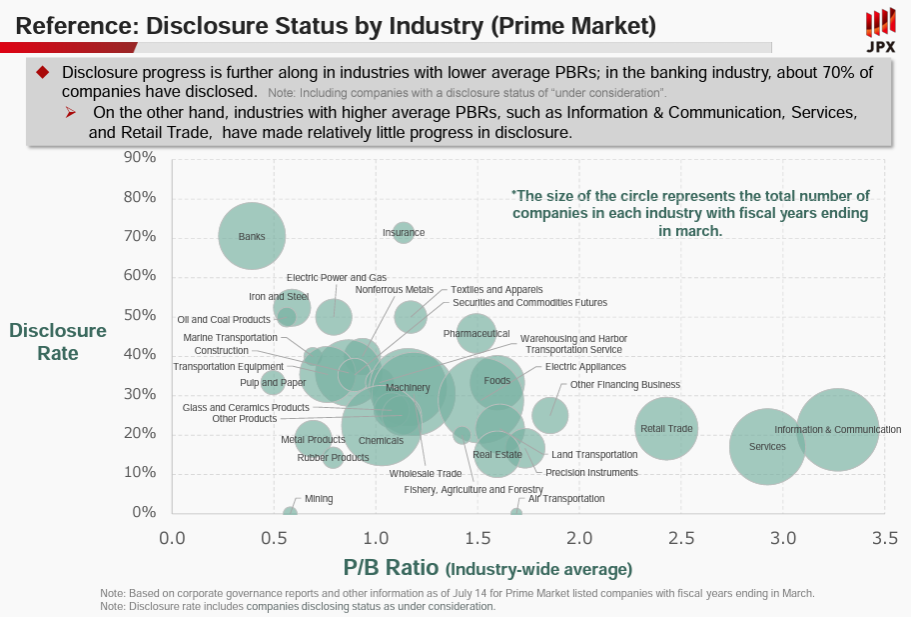

According to the TSE, as of July, 379 companies, or 31% of all companies listed on the Prime Market with a fiscal year ending March, disclosed information on their responses to the TSE’s request. 242 companies, or 20%, disclosed their initiatives; and 137 companies, or 11%, indicated a status of “under consideration” of taking actions responding to the request. The remaining 856 companies, 69% of the total, did not disclose their responses. Most of the companies that made disclosure were those with a market capitalization of JPY100 bn or more and a P/B ratio of less than one.

Source: Tokyo Stock Exchange, October 26, 2023

The TSE will compile the initial list based on the status of corporate governance reports as of the end of 2023, and publicize it at 3:00 p.m. or later on January 15, 2024. After that, the list will be compiled as of the end of each month and updated by the 15th of the following month. The list will come in Excel format, making the sorting by issue code, etc., possible.

Source: Tokyo Stock Exchange, October 26, 2023

[URL] https://www.jpx.co.jp/english/equities/improvements/follow-up/02.html

The TSE received voices from investors and companies that they would like the TSE to share the cases of excellent actions responding to the TSE’s request. To accommodate this, the TSE will release “good practices” in January 2024, depending on company size and circumstances. The TSE will compile key points of the actions taken based on investors’ viewpoints and examples that received high evaluations from investors.

Atsushi Kamio, Senior Researcher at Daiwa Institute of Research, expressed his expectation that the TSE’s list publication will “make it easier for companies to see which companies are taking actions, thereby further raising their awareness of their efforts.” Regarding the release of good practices, he explained, “Many companies are looking for excellent case studies, and thus, there is a need for this among institutional investors as well.”

According to a market participant, a hedge fund commented, “We initially thought that the TSE’s request would have no impact on stock prices. However, we are now carefully checking the status of the initiatives because they will be reflected in the stock price.” Amid the gradually growing market expectations for the TSE’s request, it is worth watching to see if the list of initiatives and good practices, which will be released in January 2024, will further spur corporate actions.

(Reported on November 7)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/