Japan Markets ViewCorporate Stance Indicated by Extended Share Buyback Periods

Jul 08, 2025

[Keiichi Nakayama, QUICK Market Eyes] Corporate share buybacks are playing a key supporting role in the supply-demand balance of Japanese equities. While these activities tend to pause during the last five business days of each quarter, companies have recently been setting longer acquisition periods. This trend, coupled with the growing overall volume of buybacks, suggests that companies may be prioritizing flexibility. They are likely to be a major support even during market downturns.

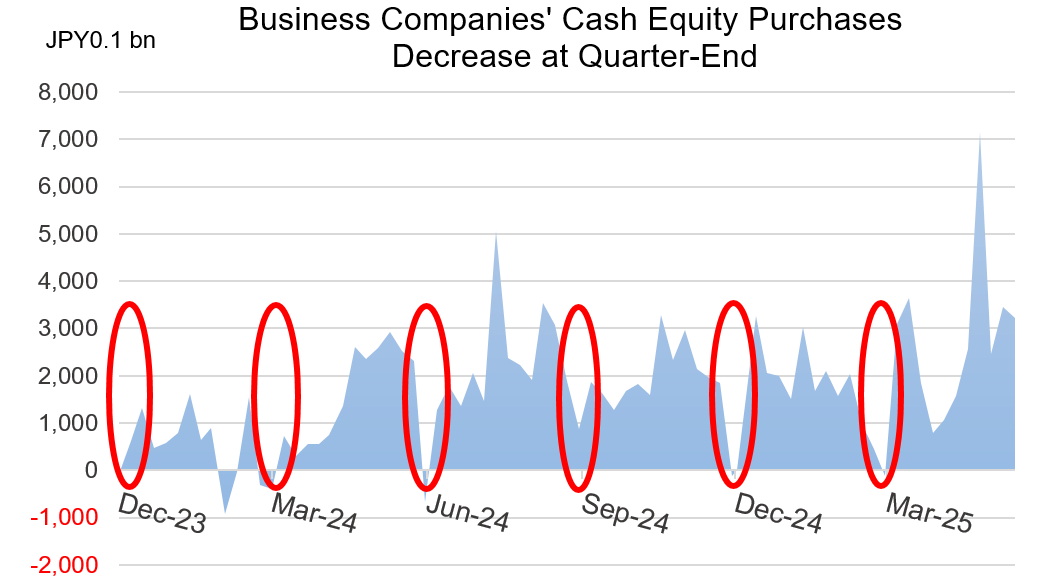

The end of June is a period when share buybacks tend to be curbed. The guidelines for share buybacks set forth by the Japan Exchange Group’s (JPX) self-regulatory organization guidelines include a section on “end-of-period purchases” as a monitored activity. The applicable period is the five business days preceding the end of the fiscal period. Although this is only an activity to be “monitored” as stipulated in the guidelines, companies tend to comply with it. The Trading by Type of Investors published by the JPX also shows a tendency for business companies to decrease their purchases of cash equities at the end of each quarter.

*Compiled based on data from JPX and QUICK

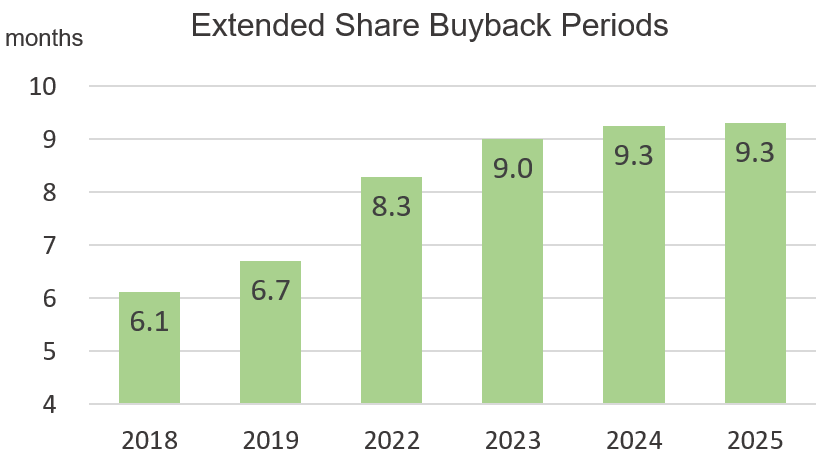

According to QUICK data, approximately JPY9 tn in share buyback resolutions were made in April (JPY3.8 tn) and May (JPY5.1 tn), periods when many companies with a March fiscal year-end announce their financial results. While share buybacks continue to support the supply-demand balance, there has been a notable trend in the setup period in recent years. The average acquisition setup period is now 9.3 months, which is longer than before the COVID-19 pandemic.

*Compiled based on data from NLI Research Institute and QUICK

Target: TOPIX constituents that set share buybacks in April-May of each year

Chizuru Morishita, a researcher at NLI Research Institute, points out, “Companies may be shifting to a more flexible stance toward share buybacks based on their assessment of stock price levels and the market environment.” The lengthening of the repurchase period is thought to be partly because the size of these buybacks is increasing. Meanwhile, Ms. Morishita also believes that “after the pandemic, companies may be prioritizing a flexible response due to the uncertain market outlook.”

While the actual progress rate of buybacks against the set amount has been somewhat slower compared to pre-pandemic levels, companies generally make steady progress. Therefore, Ms. Morishita believes that “even if the market were to decline significantly during the summer doldrums, adaptable share buybacks could provide major support.”

Typically, market participation tends to decrease in July and August, leading to lower trading volume and value. In 2025, the impact of U.S. tariffs on corporate earnings and uncertainty about the future are also dampening investor sentiment. If investors outside Japan, who are agile in trading Japanese stocks, increase their selling due to deteriorating investor sentiment, the market could face a downward adjustment. It remains to be seen whether buybacks will become the primary buying force to gradually absorb any potential shocks.

(Reported on June 27)

Share Buybacks Data:

Provides share buyback progress rate, purchase method, announcement date, etc.

Related case study:

Evaluating Predictability of Share Buybacks