Japan Markets ViewCompanies Continuously Viewing Their Stock Prices as Undervalued

Aug 20, 2024

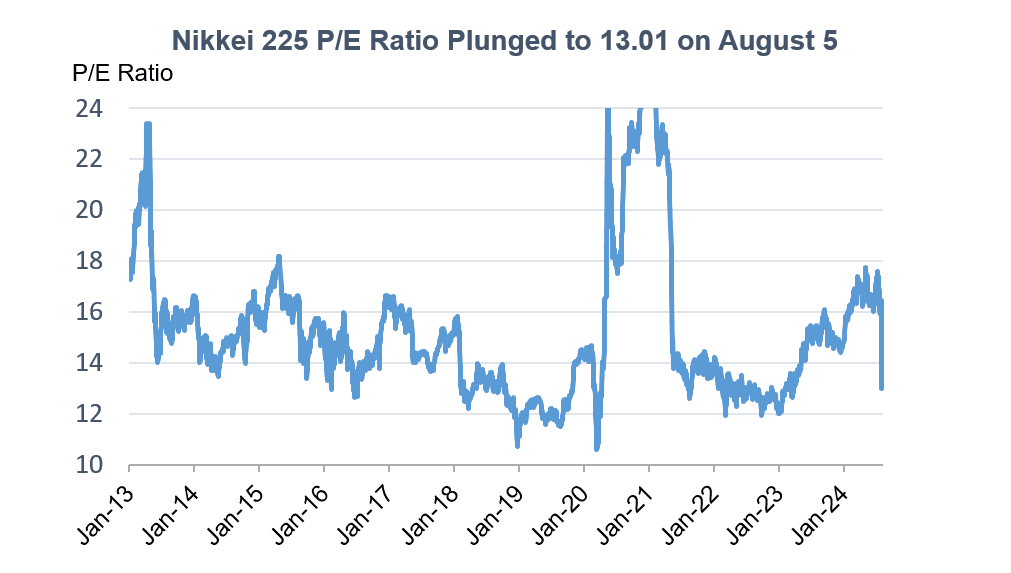

Japanese stock prices continue to be volatile. After recording their largest-ever decline on August 5, they are now returning, albeit with continued large price swings. Many have pointed out that the August 5 level was undervalued in terms of expected price-to-earnings (P/E) ratio. Meanwhile, it is also worth noting that some entities have continued to view their stock prices as “undervalued” even before the market began to fluctuate.

Regarding the stock market plunge on August 5, Tomohiro Okawa, chief strategist at PS Oskar Group, known for his cautious market outlook, commented, “Even with any pessimistic situation factored in, the market was undervalued.” Mr. Okawa described the market decline on August 5 as being at the same level as during the COVID-19 pandemic. He also noted that the TOPIX’s expected P/E ratio was undervalued because it was below the average, excluding the COVID-19 Shock, and below 12, the approximate lower limit for 2013 and beyond. The Nikkei 225’s expected P/E ratio was 13.01 on August 5, the highest level since March 28, 2023, and also below 14.25, the average since 2022.

*Compiled based on the QUICK data

Mr. Okawa views the market’s subsequent recovery as somewhat eliminating the sense of undervaluation. Nevertheless, he recommends switching holdings from foreign-demand stocks to domestic-demand stocks as a precaution, given the sluggish growth of corporate earnings due to the slowdown in yen’s depreciation. The market is increasingly seeing many investors shifting their holdings to domestic-demand stocks, which have been relatively slow to recover.

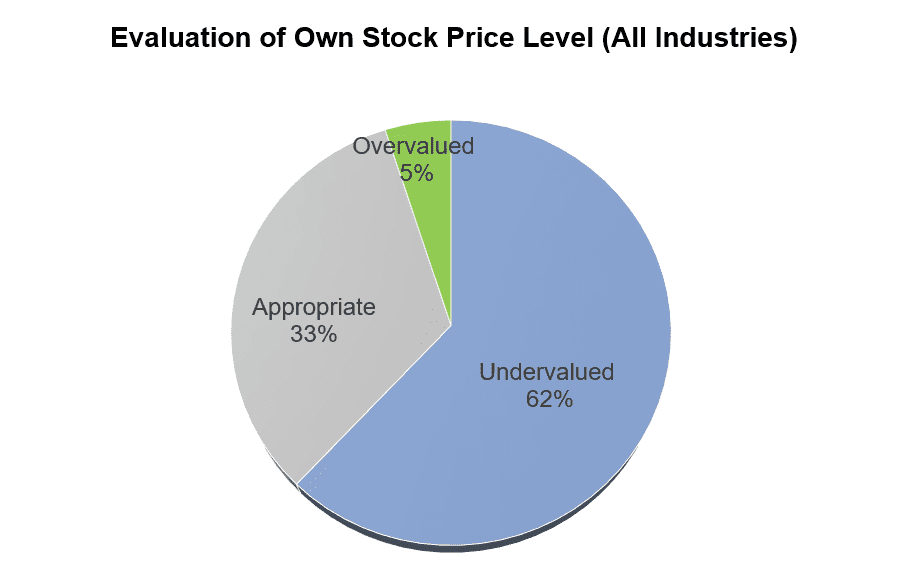

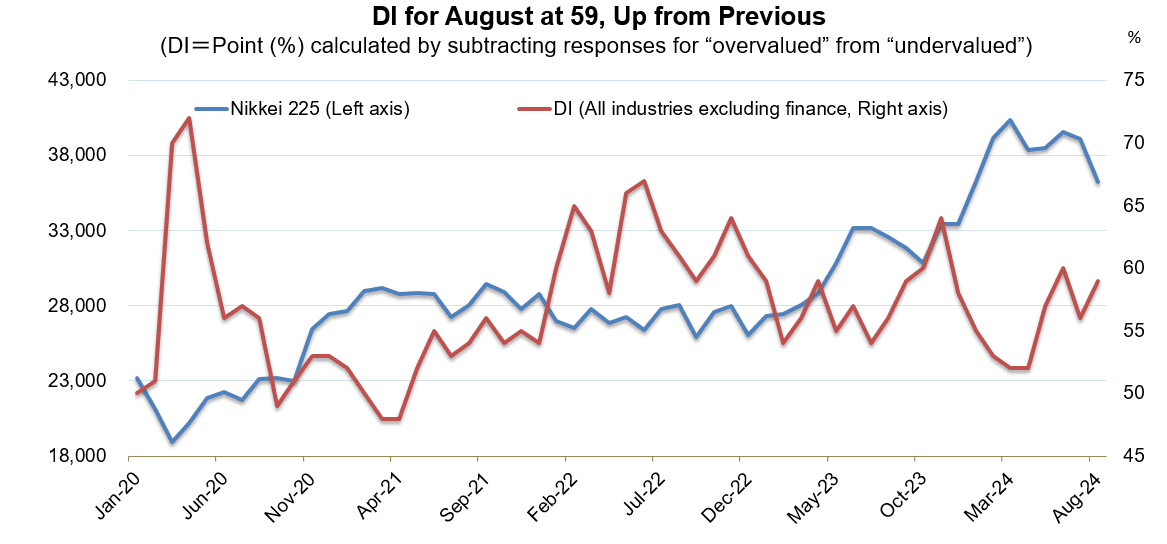

Some entities regard their stock prices as “undervalued” regardless of the current market level. According to the QUICK Short-Term Economic Survey (QUICK Tankan) for August, released by QUICK on August 13, 62% of all respondents answered that their companies’ stock price levels were “undervalued.” The “undervalued” response continued to account for about 60% of the total responses in 2024. In August, the diffusion index (DI) for all industries (excluding finance) was +59, up 3 points from the previous month. The DI is calculated by subtracting the number of responses for “overvalued” from that for “undervalued,”

*Extracted from the QUICK Tankan for August (No.213)

*Created based on the historical data from the QUICK Tankan

Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Intelligence Laboratory, pointed out, “An increasing number of corporate managers are thinking that their stock prices are undervalued from a different perspective from that of investors.” In March 2023, the Tokyo Stock Exchange (TSE) made a request for companies to take action to implement “Management Conscious of Cost of Capital and Stock Price.” According to Mr. Suzuki, this has raised awareness of price-to-book (P/B) ratio, prompting more companies to repurchase their shares.

According to the data compiled by Tokai Tokyo Intelligence Laboratory, the amount of share buybacks resolved in August through August 9 totaled JPY1.67 tn (including additional acquisition limits to share buybacks). This is already more than double the amount in August of last year (JPY821.3 bn). The amount of share buybacks resolved has exceeded that of the same month of the previous year for 12 consecutive months, including August. Mr. Suzuki stated, “This demonstrates that many companies consider their stock price levels to be undervalued.”

Even in the market, a trader at a non-Japanese securities firm said, “We are surprised that more companies than expected announced share buybacks even at the end of their earnings announcement season for the April-June period.” The market is prone to fluctuations primarily due to the agile movements of investors outside Japan. On the other hand, share buybacks will help to continuously tighten the supply-demand balance through corporates’ continued purchases of their own shares in the market. In the near term, the market is still expected to be somewhat volatile, making it difficult to get a sense of its direction. In the medium to long term, the actions of companies that view their stock prices as “undervalued” may underpin the market.

(Reported on August 15)

Share Buybacks Data on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data029/