Concerns about power shortages are growing in China and India. The demand for electricity is increasing as economic activities are resuming after the stagnation in the COVID-19 pandemic. In addition, the price of coal, the raw material for electricity, has skyrocketed and the coal is in short supply. China and India rely on coal for about 70% of their energy needs, but coal production is declining due to safety inspections at major coal mines as a result of coal mine accidents, and environmental policies are also having a strong impact. As a result, coal demand is expected to continue to expand for some time, and coal-related Mitsui Matsushima Holdings (1518) is worth watching.

■ Coal prices soar as relations between China and Australia deteriorate

Behind the rise in coal prices is the deteriorating relationship between China and Australia. In response to Australia’s demand for an independent international investigation into the origin of COVID-19, China retaliated by banning imports of Australian coal. However, China’s own coal production slowed down due to tighter regulations following a series of coal mine accidents. China expanded imports from countries except Australia, causing coal prices to soar and forcing buyers to hold back, resulting in a coal shortage.

China has pledged to halt the rise of carbon dioxide emissions and shift its focus to renewable energy during the 2020s. However, the hurdles to the transition are high, as some believe that revamping the system for transmitting electricity to consumers in remote areas with green energy such as solar power plants and wind power plants will require five times the cost of building new power plants. Although decarbonization is likely to progress in the medium to long term, the demand for coal, with its large supply capacity, is likely to remain strong during the transition period until the supply of clean energy stabilizes.

■ Will the mine be expanded in response to the current coal demand?

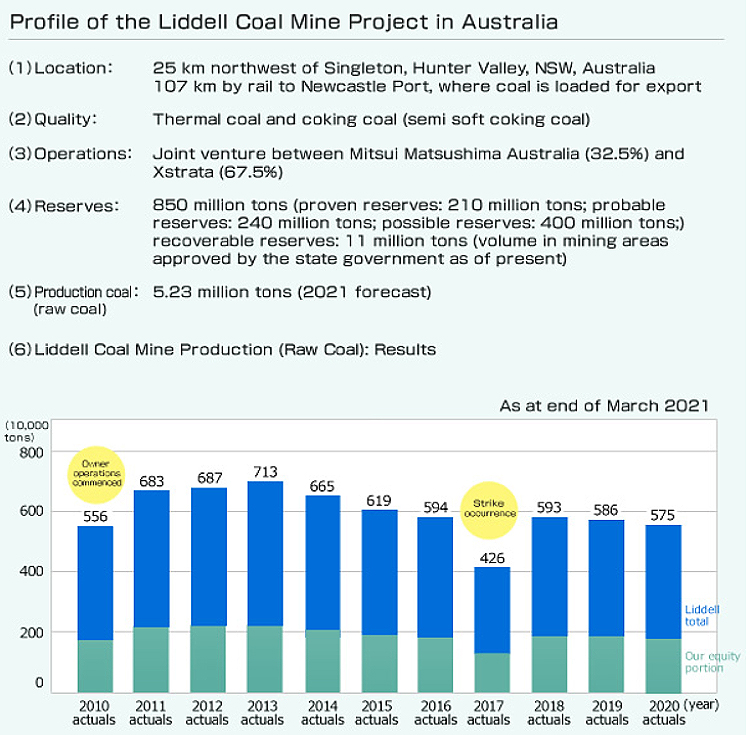

Mitsui Matsushima Holdings jointly operates the Liddell Coal Mine, located in the Hunter Valley area of New South Wales, one of Australia’s major coal-producing regions. With its local subsidiary Mitsui Matsushima Australia and Glencore, a major Swiss resource company, the company produces high-quality thermal coal and coking coal. As the mining of the existing mining area will be finished in about two years, the company seems to be carefully considering whether or not to invest nearly JPY10bn to expand the mining area in terms of profitability and other factors. However, considering the current increase in coal demand and the sharp rise in prices, the company may decide to expand the mine. It is also worth noting that the company is strengthening new non-coal-related businesses such as lifestyle-related businesses in response to the global trend toward decarbonization.

*Excerpt from Mitsui Matsushima Holdings’ corporate website. Xstrata changed its name to Glencore in May 2014.

■ Energy business expected to turn around in the financial results for the July-September period of 2021

In the consolidated financial results of Mitsui Matsushima Holdings for the April-June period of 2021 (first quarter) announced in August, sales fell 30.7% YoY to JPY10.6bn while operating income increased 2.1 times to JPY1.044bn. In spite of the significant sales decrease due to the introduction of the “Accounting Standard for Revenue Recognition” from this fiscal year, profits increased significantly supported by an order increase in the electronic components field of the lifestyle-related business and the acquisition of Systech Kyowa, which handles housing-related materials. The energy business reported a decline in profits, reflecting the January-March period when coal prices were sluggish. Considering the surge in coal prices since April, the energy business is expected to improve in the second quarter.

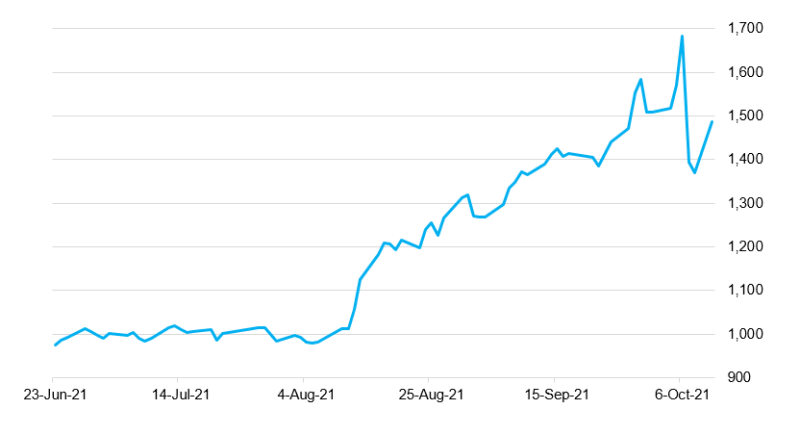

The stock price had been struggling around JPY1,000 since the beginning of the year, but it has been rising since mid-August. Although the surge in resource prices was a tailwind, the decline rate reached 17% in trading on October 7, ranking first in the decline rates on the First Section of the Tokyo Stock Exchange. The overheating state seems to have cooled for the time being. It will be interesting to see whether it will gain momentum again from here.

For alternative data on Japanese stocks

https://corporate.quick.co.jp/data-factory/en/product/