HOME > Products & Services > QUICK Professional

Supporting financial institution sales to

individual investors with

a wide range of information

QUICK provides a variety of support for the promotion of consulting-based sales within the financial retail segment and increased customer satisfaction. In addition to conventional financial information, we offer a full range of customer relationship management (CRM) services. From expanding global investment and the adoption of tablet devices to NISA accounts and other global developments, QUICK has a service to meet every need.

- Retail Sales Support

- Equity Sales

- Investment Trust Sales

- Fixed Income Sales

- Global Equity Sales

- Institutional Sales

- Asset Management Solutions

- Public View

- Information Terminals for Branch Office Visitors

- Branch Office Design

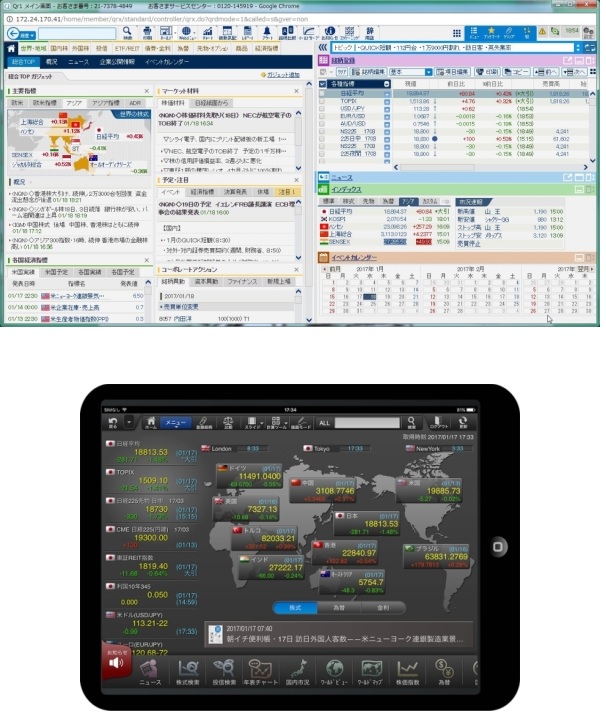

QUICK LevelX r1(Qr1)

Powerful support for securities and financial services.

'QUICK LevelX r1 (Qr1)' is a standard market viewer for securities and financial professionals.

QUICK LevelX r1 (Qr1) features

- User-friendly interface offers clear layout and simple operation

- Highly precise search function enables users to search for related issues and news items together

- In addition to data on Japanese equities, provides global multi-asset information including overseas equities, investment trusts, bonds, currencies, capital, and commodities

- Wide range of comparison and simulation tools helps users to follow investment trusts at the time of sale or after purchase

- QUICK information can be linked into customers’ business systems

- Compatible with multiple devices including tablets and smartphones, and enables information to be shared across devices

- Offers a highly reliable service platform incorporating the latest technology

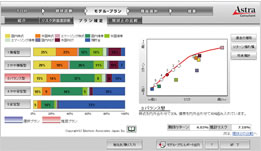

Astra Consultant

A support tool for a financial consultation

Astra Consultant is used in the proposal process of a financial consultation. It produces the best possible investment proposal by using life plan simulation to create an awareness of financial location and matching it to a life plan. It also creates portfolio proposals tailored to a client's particular needs, expectations and risk appetite using objective information and investment theory.

Astra Consultant features

IS-Web FN

Market information with a simple interface

"IS-Web FN" is a web based information service with an easy to use interface that is aimed at a wide spectrum of users from product planning managers in head offices to sales staff at the counter of retail branches. It can be connected by internet or dedicated line and configured to a customer's computer network and environment. It supports information including news, foreign exchange, interest rates, stock prices as well as market indexes, investment trusts and so on that is essential in handling customers at the retail branches of financial institutions.

IS-Web FN features

- Web browser based simple operability.

- Provide information that is essential in handling customers at the retail branches of financial institutions.

Accurate information and tools

supporting financial and capital market professionals

From investment management and monitoring of various financial assets to corporate research, fund-raising, foreign exchange and fixed income, we support the sophisticated operations of financial and capital market professionals with data, tools and advisory services. External alliances with FactSet and other organizations provide us with coverage of 500,000+ issues in more than 70 countries and corporate financial data on approximately 76,000 companies in 120 countries. In addition, QUICK supports customer business with tools linked to 1.8 million networks, macroeconomic data, earnings projections, shareholder information, M&A, human resources information and a variety of other financial databases.

- Equity Finance

- Bond Underwriting

- Equity Dealing

- Equity and Fixed Income Trading

- Cost-Performance Analysis

- Trading Support

- Institutional Investor Sales and Research

- Back Office Data Usage

- Equity Investment and Research

- Fixed Income Investment

- Cost-Performance Analysis

- Trading Support

- Back Office Data Usage

- Fund Management

- Information Sharing

- Market Monitoring

- Bond Issuance

QUICK Workstation

An information service for market

analysis and portfolio management

A terminal type service with value added information and a variety of analysis functions useful for asset management and research departments, also for preparing proposals and research in investment banking and corporate sales departments.

QUICK Workstation features

- Portfolio monitoring in real time, segmented back testing

- Supports stock selection and advanced investment analysis with accurate ASTRA database, one of Japan's largest financial database, and wide ranging market information.

- Supports investment bank business with various credit information such as rating, financial indicators, finance information.

- Real time data monitoring, analysis to assist in trading.

- An all-in-one QUICK multi asset data service.

- Providing various simulation functions for selecting appropriate investments, credit risk management, etc.

QUICK FactSet Workstation

Global company analysis and

highly reliable data coverage.

Nikkei Group’s domestic content, FactSet’s global content and workflow solutions have combined into one workstation.

In this scene

QUICK FactSet Workstation provides solutions for Portfolio Management, Research, Investment Bank, Investor Relations, Corporate Strategy

QUICK FactSet Workstation's data coverage

More than 120 countries, 76,000 companies of fundamentals, estimates, ownership, M&A details, management board members and 1,800,000 series of macro economics.

Keep uptodate with the latest Japanese market trends with the Nikkei Group's data. Keep ahead of the global market trends with FactSet's global data and stay uptodate with Japanese market trends with the real-time Nikkei News, NQN(Nikkei QUICK News) and QUICK News.

QUICK Feed

"QUICK Feed" is a consolidated record based data feed of stock price information from securities exchanges as well as other QUICK data such as company profiles, indices and related information. It is a first rate high speed feed that incorporates in a timely way all system changes and product additions of the securities exchanges.

Major features

Various services depending on needs

Domestic and foreign equities price data is available in either in real-time or delayed depending on needs. "QUICK Feed Super" is a full-flow data feed service covering prices and market depth. "QUICK Feed light" provides a restricted data flow service to reduce data traffic.

Vast data coverage

- Market information on domestic securities exchanges

Supports market information on domestic securities exchanges such as Tokyo Stock Exchange (FLEX, Tdex+), Osaka Stock Exchange (market information, J-GATE) and PTS. Coverage of data includes, price, company profile, market depth, pre-opening quote, reference price, and QUICK's original value-added data.

- Overseas securtiies exchanges

Coverage of data includes securities exchanges in North America and Asia, etc.

- FX, fixed income, and derivatives data

Coverage of data includes real-time information on FX, fixed income, and derivatives from domestic and overseas brokers.

A robust reliable system

- Data distribution servers are located in QUICK premises to minimize setup at users end.

System monitoring for such servers are carried out by QUICK.

- System redundancy is provided with dual data distribution channels.

Easy to use system

- API(QUICK Feed-API) facilitates development of receiving system.

- QUICK's unified interface to allow user to connect easily its system to different securities exchanges.

- QUICK supports regulation changes at domestic securities exchanges.

QUICK Data Files

Reliable price information and issue profiles

QUICK Data Files Service provides accurate data meeting the needs of ALM, risk management and compliance in daily asset management operations. It provides end of day price for domestic listed stocks, bonds, futures, and options in text file format. By receiving QUICK's DDS data into a PC or an integrated back office system, users are able to flexibly use data for portfolio valuations, etc.

Major features

QUICK's high reliable data.

Provides profiles of stocks, bonds and market values.

Complies with Best Execution rule.

- Use priority markets data in mid/back office systems.

- Optional historical data available for regulatory compliance.

Scheduling function to create files automatically.

Easy to use in CSV, XML format for front, middle and back-offices.

A trustworthy corporate partner

also highly regarded for academic applications

QUICK supports appropriate corporate finance with highly reliable information, efficient analysis and the collection and organization of an enormous amount of market data. This contributes to lowering the burden of borrowing costs and mitigating currency exchange risks. We also quickly create analytical reports on competitor companies. As a partner assisting corporate decision making, QUICK supports the formulation and execution of business strategies, realizing enhanced corporate value. Our robust and easy-to-use database is highly regarded by universities and research institutes for its academic applications. We support everyone at the forefront of a wide range of businesses.

- Competitor Company Analysis

- Report Creation

- Currency Exchange and Interest Rate Risk Analysis

- Corporate Financial Data Analysis

- Market Analysis

- Macroeconomic Analysis

QUICKProfessional for Corporation

Services and examples of practical application are introduced

here