InformationMajority of Institutional Investors Support Dual Structure Disclosure via Securities Reports and Integrated Reports – ESG Investment Survey 2025

Dec 19, 2025

QUICK Corp.

On December 4, ESG Research Center of QUICK Corp. (Headquarters: Chuo-ku, Tokyo; President & CEO: Motohiro Matsumoto) released the results of the “ESG Investment Survey 2025,” a survey of Japan-based institutional investors.

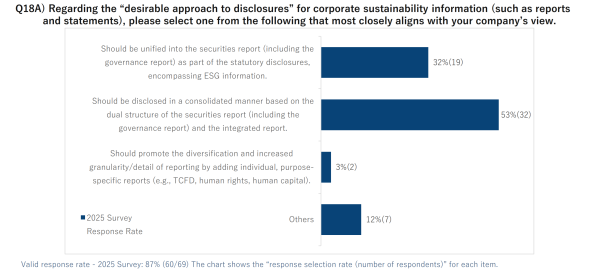

In Japan, voluntary disclosure of corporate sustainability information, such as through integrated reports, is progressing. Meanwhile, Japanese standards are being developed, and sustainability information disclosure in annual securities reports is expected to be expanded. Related information is often fragmented across multiple reports, increasing the burden on both companies preparing the reports and institutional investors reading them. Under these circumstances, the ESG Investment Survey asked about the desirable approach to reporting, and the majority of respondents answered that corporate sustainability information “Should be disclosed in a consolidated manner based on the dual structure of annual securities reports and integrated reports,” surpassing those who responded that it “Should be consolidated into the securities report.” The main survey results are as follows.

Figure 1

Detailed Survey Results

◆53% selected “Should be disclosed in a consolidated manner based on the dual structure of annual securities reports and integrated reports”

Regarding the desirable approach to disclosures for corporate sustainability information, 53% (response selection rate, which represents the ratio of the number of responses to the number of valid responses for each question, same hereinafter) selected “Should be disclosed in a consolidated manner based on the dual structure of the securities report and the integrated report,” surpassing the 32% who selected “Should be consolidated into the securities report.”

The most common reason cited was “Greater ‘freedom of expression’ allows companies to reflect creativity and diversity” (56%).

On the other hand, in the “QUICK Short-term Economic Survey (QUICK Tankan)” conducted by QUICK targeting listed companies (September 2025 survey; period: August 26 – September 4; 187 companies responded), 53% selected “Should be consolidated into the securities report,” and 36% chose “Should be disclosed on a dual structure.” The QUICK Tankan revealed companies’ desire to minimize the number of disclosure documents to avoid disclosure burdens, showing results that contrast with those of institutional investors.

◆Top 3 methodologies remain “ESG integration,” “Engagement,” and “Exercise of voting rights”

The investment methodology most commonly implemented was “ESG integration,” which incorporates ESG factors into investment analysis and decision-making, accounting for 87% and ranking first for the third consecutive year. The second most common methodology was “Engagement,” a constructive dialogue with investors (82%), followed by “Exercise of voting rights” in third place (75%). Although the percentages and rankings fluctuate, the top three methodologies have remained unchanged for five consecutive years since 2021.

◆Progress in Engagement: 45% “Carried out with all target companies”

The survey also revealed that engagement between institutional investors and companies has further advanced. The response “Our management resources and the target companies’ responses were sufficient, and we could carry it out with all the target companies” accounted for 45%, exceeding 27% in 2023 and 32% in 2024. This suggests that not only are institutional investors increasingly securing management resources such as human resources, information, and time, but companies are also responding by placing importance on dialogue.

Furthermore, regarding the response when engagement activities do not improve ESG issues at companies, “Making opinions clear through exercising voting rights” increased to 49%, up 16 points from 2024. Engagement and the exercise of voting rights are methods for shareholders to actively exercise their rights to influence companies, known as “active ownership,” and it appears these two approaches are being used together.

The top three engagement themes prioritized were “Climate change” (84%), “Human capital” (68%), and “Board composition” (59%). The top three themes for 2024 were “Climate change” (91%), “Human capital,” and “Diversity and inclusion (D&I)” (both at 63%).

◆Responses indicating a plan to “reduce the proportion of ESG investments in five years” appeared for the first time in two years

Regarding the question about plans for the proportion of ESG investments to total outstanding assets under management for Japanese stocks in five years, three institutions answered that they would reduce the proportion. It is the first time in two years since the 2023 Survey that there have been responses indicating a plan to reduce the proportion. Of these, one institution (asset manager) cited “Decline in client interest in ESG investments” as the reason.

[About the ESG Investment Survey]

Since 2019, the survey has been conducted annually to investigate how institutional investors evaluate business sustainability and profitability based on information related to environmental (E), social (S), and governance (G) issues, in addition to the financial information of the companies in which they invest. The 2025 Survey marks the seventh in the series.

[Outline of Survey 2025]

Survey target: 276 institutional investors based in Japan selected from the companies that have declared acceptance of the “Japanese Stewardship Code” or are signatories to the Principles for Responsible Investment (PRI)

Number of respondents: 69 institutions (43 asset managers and 26 asset owners)

Survey period: August 18 – October 10, 2025

Click here for the ESG Investment Survey 2025 (Summary)

[QUICK ESG Research Center]

https://corporate.quick.co.jp/en/quick_esg/

[Contact us]

https://corporate.quick.co.jp/en/contact/form_service_en/