Japan Markets ViewImpact of Yield Curve Control Change on Stock Prices – What Industries Are Positively or Negatively Affected?

Feb 01, 2023

[QUICK Money World] The Bank of Japan’s “different-dimensional monetary policy” is approaching a turning point. The Bank of Japan (BOJ) decided to partially revise its easing policy at the Monetary Policy Meeting in December 2022. This decision sent shockwaves through the stock and financial markets. This article takes a close look at the impact of the recent easing policy change on stock prices, the industries affected positively or negatively, and the impact on stock prices if further modifications of the different-dimensional easing are made in the future.

Partial Modification to Monetary Easing Decided at the BOJ’s Meeting in December 2022

At the BOJ’s Monetary Policy Meeting held on December 19-20, 2022, BOJ Governor Kuroda decided to modify the ongoing “Quantitative and Qualitative Monetary Easing with Long- and Short-Term Interest Rate Control.” Specifically, he decided to revise the “Yield Curve Control (YCC)” policy (to make the YCC policy more flexible), which manipulates long- and short-term interest rates through financial market adjustments.

The YCC policy is to apply negative interest rates to short-term interest rates and purchase long-term JGBs to keep the yield on 10-year JGBs at around zero percent. While the interest rate band had been set at “around zero percent” (plus or minus 0.25%), it was decided at the December 2022 meeting to expand the range to “around plus or minus 0.50%.”

Background of the Decision to Partially Revise Different-Dimensional Easing Policy

The BOJ’s statement at the Monetary Policy Meeting explains, “Overseas financial and capital markets have been experiencing increased volatility since early spring this year. This has also been strongly affecting the markets in Japan.” The BOJ added, “We have partially revised the operations in order to improve market functions and facilitate a smoother formation of the overall yield curve, while maintaining an accommodative financial environment.”

Looking overseas, the U.S. Federal Reserve Board (FRB) decided in March 2022 to raise interest rates for the first time since December 2018. In the wake of the COVID-19 pandemic that started in March 2020, governments and monetary authorities around the world embarked on bold monetary easing policies and fiscal stimulus to support the economy. The effects of these measures led to an economic recovery and increased upward price (inflation) pressure. Consequently, the FRB turned to monetary tightening measures to curb inflation.

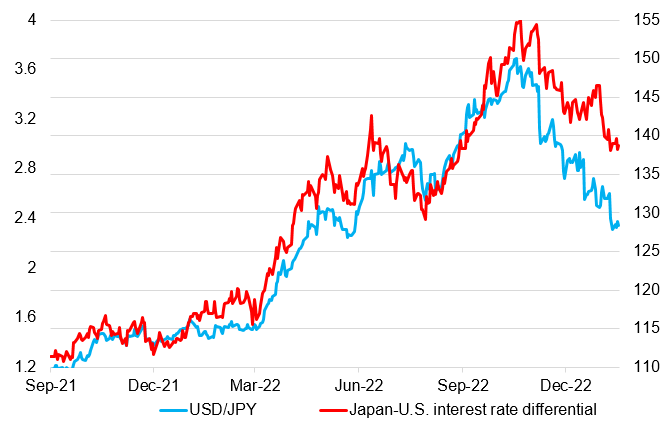

While the FRB continued to raise interest rates even after March 2022, BOJ Governor Kuroda maintained its different-dimensional easing policy. Against the backdrop of widening Japan-U.S. interest rate differentials, etc., the yen depreciated against the dollar. The dollar briefly rose to the 150-yen level in October, from the 115-yen level at the beginning of March.

*Japan-U.S. interest rate differential (10-year JGB yield, red) and U.S. dollar-yen (blue)

The yen’s depreciation increased import prices, which raised the price of daily necessities and directly hit households. The increased burden on households ironically made the monetary easing policy the target of criticism though it was supposed to boost Japan’s economic recovery. Some criticized the different-dimensional easing were promoting unfavorable yen depreciation. This is considered one of the factors that drove the modification of the easing policy.

In addition to the U.S., Europe also moved to tighten monetary policy, increasing the pressure for higher interest rates worldwide. Even under such circumstances, the BOJ seemed to have kept a “lid” on the rise in long-term interest rates through its YCC policy. The BOJ continued to buy large amounts of JGBs to keep interest rates from rising. However, the market function was noticeably declining as a result. This led the BOJ to allow wider band for long-term interest rates.

Impact of Increased YCC Policy Flexibility on Stock Prices

Interest rate hikes in Europe and the U.S. have been putting pressure on increasing long-term interest rates in Japan. Against this backdrop, BOJ Governor Kuroda had previously made negative comments about the widening of long-term interest rate volatility, saying that it would “clearly impede the effectiveness of monetary easing policy.” Therefore, market participants took the latest modification of the easing policy as a “de facto rate hike.”

On December 20, 2022, when the BOJ’s monetary policy revision was announced, news of the BOJ’s decision for a more flexible YCC policy was reported shortly after noon. Then, the yen sharply strengthened in the foreign exchange market. The dollar plunged from the lower 137 yen range to the upper 132 yen range. In response to the sharp appreciation of the yen, a number of stocks were sold in the afternoon session, which started at 12:30 p.m. JST. The Nikkei 225 plunged from the 27,300-yen level to the 26,400-yen level and remained weak until the end of the year. It is evident that the caution over a shift in the monetary easing policy, which had been substantially implemented so far, had a negative impact on stock prices, coupled with the sharp rise in the yen.

Monetary Easing Modification Benefited Banking Stocks; Which Sectors Negatively Affected?

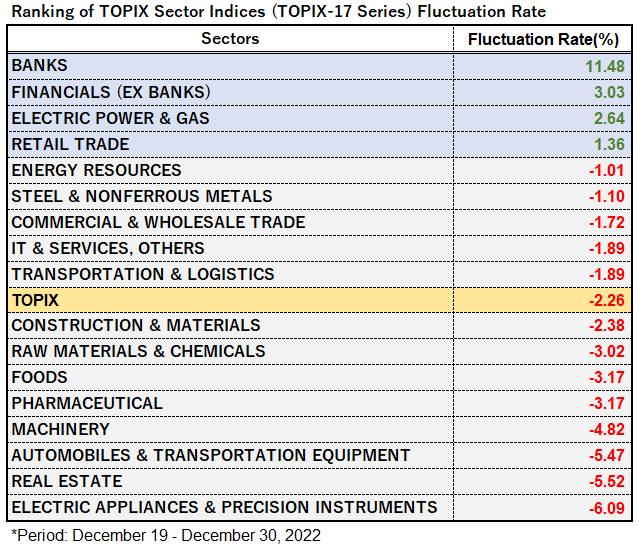

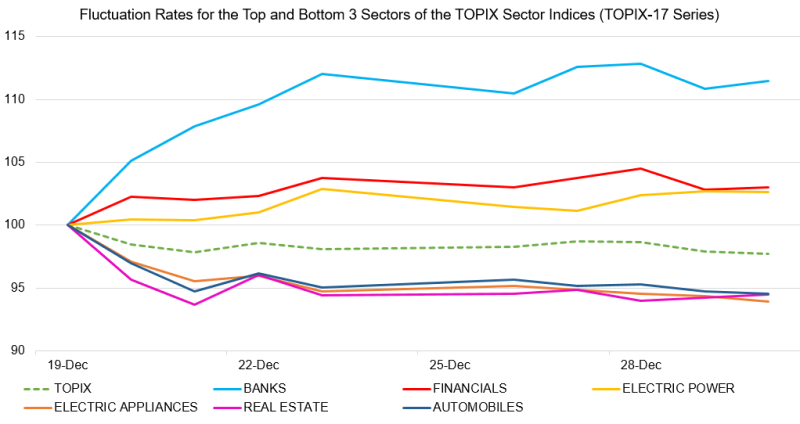

For the stock market overall, this easing modification acted as a downward pressure on stock prices. A look at the fluctuation rates of the TOPIX Sector Indices (TOPIX-17 Series) from December 19 to December 30, 2022 shows that the four industries of “Banks,” “Financials (excluding Banks),” “Electric Power & Gas,” and “Retail Trade” rose. On the other hand, 13 industries including “Electric Appliances & Precision Instruments,” “Real Estate,” and “Automobiles & Transportation Equipment” declined.

The “Banks” sector ranked at the top, with an increase rate of over 11%. Financial institutions, including banks, have been suffering from deteriorating profitability due to negative interest rate policies, etc. If higher interest rates push up lending rates, a positive impact on earnings is expected as a result of an improved interest rate margin. This is likely to have driven stock prices higher. The second-ranked sector, “Financials (excl. Banks),” recorded a 3% gain.

The sector with the largest decline rate was “Electric Appliances & Precision Instruments” down 6%. The “Automobiles & Transportation Equipment” sector fell more than 5%, placing it in third place in terms of the decline rate. The decision to ease monetary policy triggered the appreciation of the yen against the U.S. dollar in foreign exchange markets. This led to selling off stocks in this sector due to concerns over worsening export profitability. “Real Estate” was in second place with a decline of more than 5%. Concerns that rising long-term interest rates would lead to higher mortgage rates and a worsening of the real estate market prompted sell-offs.

*Period: December 19 – December 30, 2022

What is the outlook for stock prices in 2023? Due to the ongoing depreciation of the yen against the dollar in the first half of 2022, many export-related companies have set their assumed exchange rate, which is the premise for their earnings forecasts, toward a weaker yen at around 140 yen to the dollar. This prompted many of these companies to revise their earnings forecasts upward. In addition to the easing policy change this time, the pace of the FRB’s interest rate hikes slowed in the U.S. and the prospect of a halt to the hikes also emerged. If the yen is unlikely to depreciate, it could become a headwind for business performance of Japanese export-related companies. In addition, a higher long-term interest rate will raise the cost of borrowing for companies. This could lower the creditworthiness for companies with large interest-bearing debts, making them face a difficult business environment.

For households, the burden on new mortgage borrowers may increase. In fact, major banks have decided to raise fixed mortgage rates beginning in January 2023. According to a survey of mortgage users conducted by the Japan Housing Finance Agency (in April 2022), more than 70% of mortgage borrowers are using floating interest rates. Since this type of rates, which are affected by short-term interest rates, will remain unchanged, the overall negative impact is expected to be limited. However, it will be necessary to continue monitoring the interest rate trend closely.

Impact on Stock Prices in the Event of Further Modification of Different-Dimensional Easing

BOJ Governor Kuroda decided to partially revise monetary easing in December 2022. However, for the future, he stated, “This is not a step toward an exit strategy. It is unlikely that we will revise quantitative and qualitative easing in the immediate future.” Market participants have started to be concerned that this modification signals “approaching to the end of the different-dimensional easing.” This could have a negative impact on investment sentiment. Meanwhile, many market participants seem to unanimously agree that it is “still a long way off” to make a major change in the different-dimensional easing, such as lifting negative interest rates or suspending quantitative easing.

Yet, if significant monetary easing were to be revised and monetary policy normalized, a negative impact on stock prices may be inevitable, as in the U.S.

The term of BOJ Governor Kuroda will expire in April 2023, and the monetary policy is expected to be steered by the new BOJ governor. To have a clear outlook for stock prices, it will be necessary to keep a close eye on changes in the BOJ’s monetary policy under the new regime.

(Reported on January 24)

For alternative data on Japanese stocks

hhttps://corporate.quick.co.jp/data-factory/en/product/