Japan Markets ViewSignificant Increase in “Engagement with All Target Companies” – ESG Investment Survey 2025

Jan 16, 2026

[Taigi Endo, QUICK ESG Research Center] The “QUICK ESG Investment Survey 2025,” released on December 4, 2025, revealed further progress in “Engagement,” which refers to constructive engagement, or purposeful dialogue between investors and companies. The response “We could carry it out with all the target companies” accounted for 45% (response selection rate, which represents the ratio of the number of responses to the number of valid responses for each question, same hereinafter). It is an increase of 13 points compared to the “2024 Survey.” This suggests that institutional investors are engaging in dialogue by preparing management resources, such as personnel, and companies are responding accordingly.

“Engagement” Ranks Second After “ESG Integration”

Source: QUICK ESG Investment Survey 2025

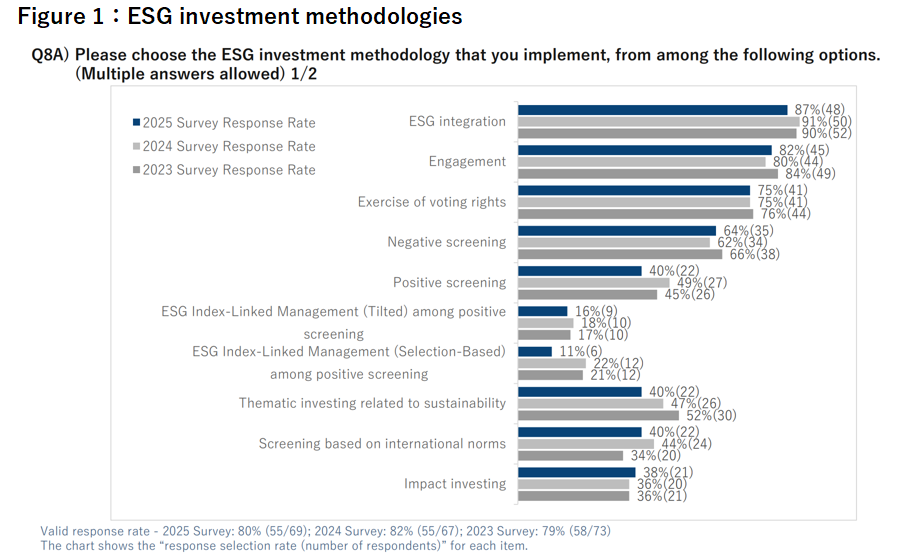

First, let us take a look at the positioning of “Engagement” among ESG investment methodologies. Regarding “The investment methodology most commonly implemented,” “ESG integration”—incorporating ESG factors into investment analysis and decision-making—topped the list for the third consecutive year (87%, down 4 points from the “2024 Survey”). This was followed by “Engagement” (82%, up 2 points) and “Exercise of voting rights” (75%, unchanged from the previous year) (Figure 1). Although percentages and rankings fluctuated, partly due to changes in the participating institutions, the top three methodologies have remained the same for five consecutive years since 2021.

Engagement and the exercise of voting rights are referred to as “Active Ownership.” This is an ESG investment methodology where investors actively exercise their shareholder rights to influence corporate behavior. In response to a question about actions taken when engagement activities do not improve ESG issues, the most common answer was “Making opinions clear through exercising voting rights” (49%). This was a 16-point increase compared to the “2024 Survey.” The result suggests that engagement and the exercise of voting rights are being implemented together as a set.

Engagement: 45% “Carried out with all target companies”

Source: QUICK ESG Investment Survey 2025

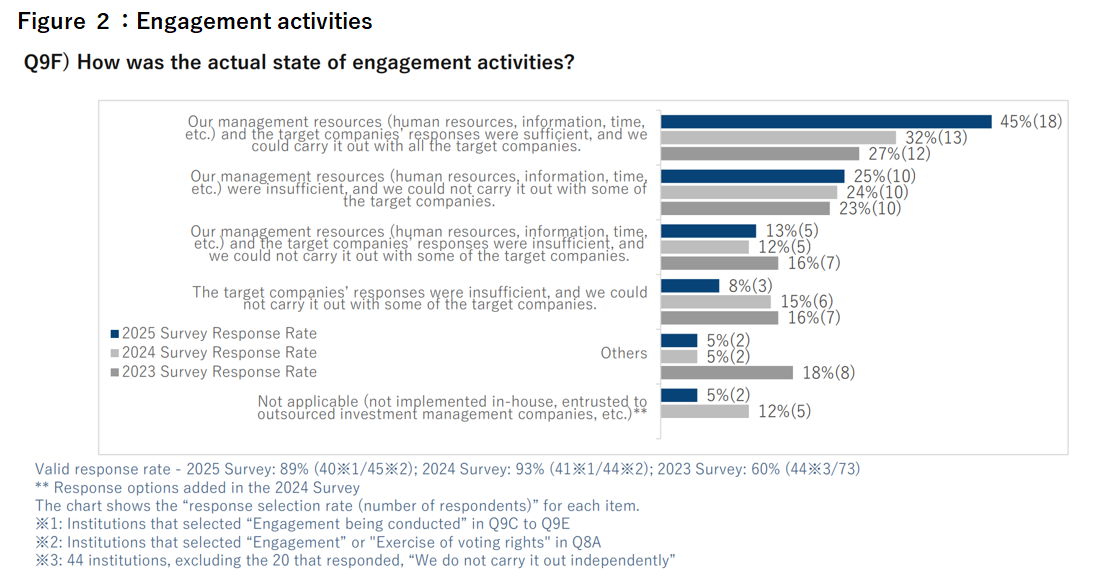

In a question asking about the actual status of engagement, the respondents selecting “Our management resources (human resources, information, time, etc.) and the target companies’ responses were sufficient, and we could carry it out with all the target companies” accounted for 45%, exceeding 32% in the “2024 Survey” and 27% in the “2023 Survey” (Figure 2). In a separate question, 47% of respondents answered, “A specialized department or division and dedicated personnel are in place” for areas such as responsible investment, ESG research, and engagement. This is the same percentage as in the “2024 Survey.” It appears that many institutional investors are maintaining their organizational structures.

Additionally, a total of 45% responded, “We could not carry it out with some of the target companies.” This was a 6-point decrease from the “2024 Survey.” The breakdown of reasons was as follows: “Our management resources were insufficient” (25%, up 1 point), “Our management resources and the target companies’ responses were insufficient” (13%, up 1 point), and “The target companies’ responses were insufficient” (8%, down 7 points). These results suggest that companies are also making progress in engagement.

Engagement Themes: “Human Capital” and “Board Composition” Are on the Rise

Source: QUICK ESG Investment Survey 2025

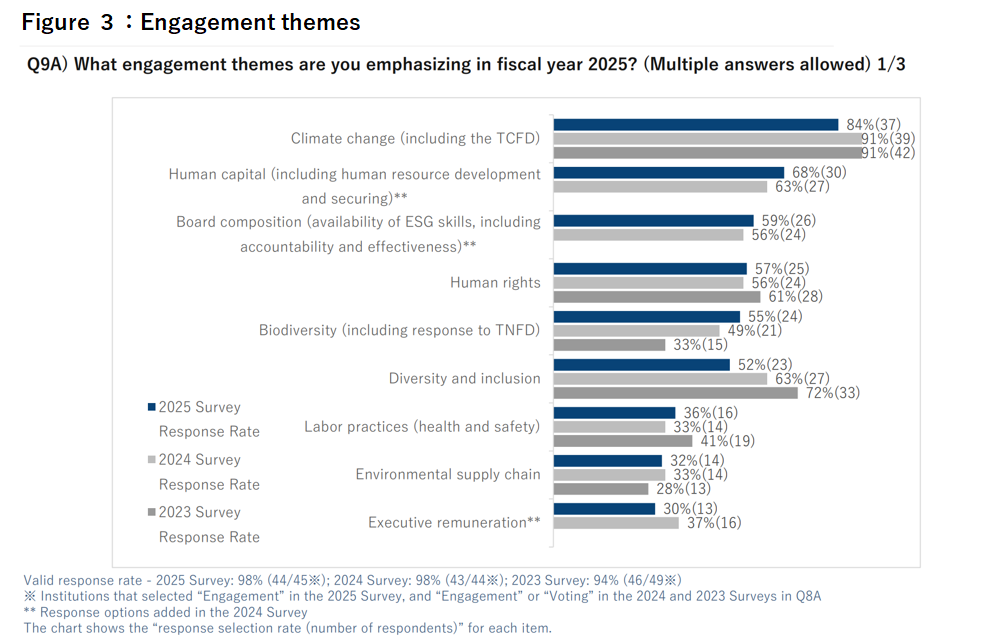

The top three engagement themes prioritized were “Climate change” (84%), “Human capital” (68%), and “Board composition” (59%). In the “2024 Survey,” the top themes were “Climate change” (91%), “Human capital,” and “Diversity and inclusion (D&I)” (both at 63%) (Figure 3). In the current survey, the percentage for “Human capital” rose. Conversely, “D&I” fell to 52%. This indicates fluctuations even among human resource-related themes.

It appears that engagement is being conducted to enhance corporate value over the medium to long term by treating human resources as “capital.” Additionally, “Board composition” rose in rank from fourth place (56%) in the “2024 Survey.” “Human capital” is classified under the Social (S) category, and “Board composition” falls under the Governance (G) category of ESG issues, respectively. However, board composition is also a theme related to “human resources,” and is considered to contribute to enhancing corporate value. This appears to have influenced the survey results.

Engagement with Over 50 Companies: Governance is the Most Frequent Category

In a question asking how many companies they conducted engagement in the categories of Environment, Social, and Governance, five institutions responded “200 companies or more” for all three categories. In contrast, for the “100 companies or more, but less than 200 companies,” four institutions conducted engagement on environmental and social issues, while eight institutions did so on governance issues. When totaling those who engaged with “50 companies or more,” 20 institutions implemented engagement on governance issues, surpassing the 17 institutions addressing environmental issues and the 16 institutions working on social issues. This trend has remained unchanged since the “2023 Survey.” It appears that many institutional investors engage with companies on governance themes.

Source: QUICK ESG Investment Survey 2025

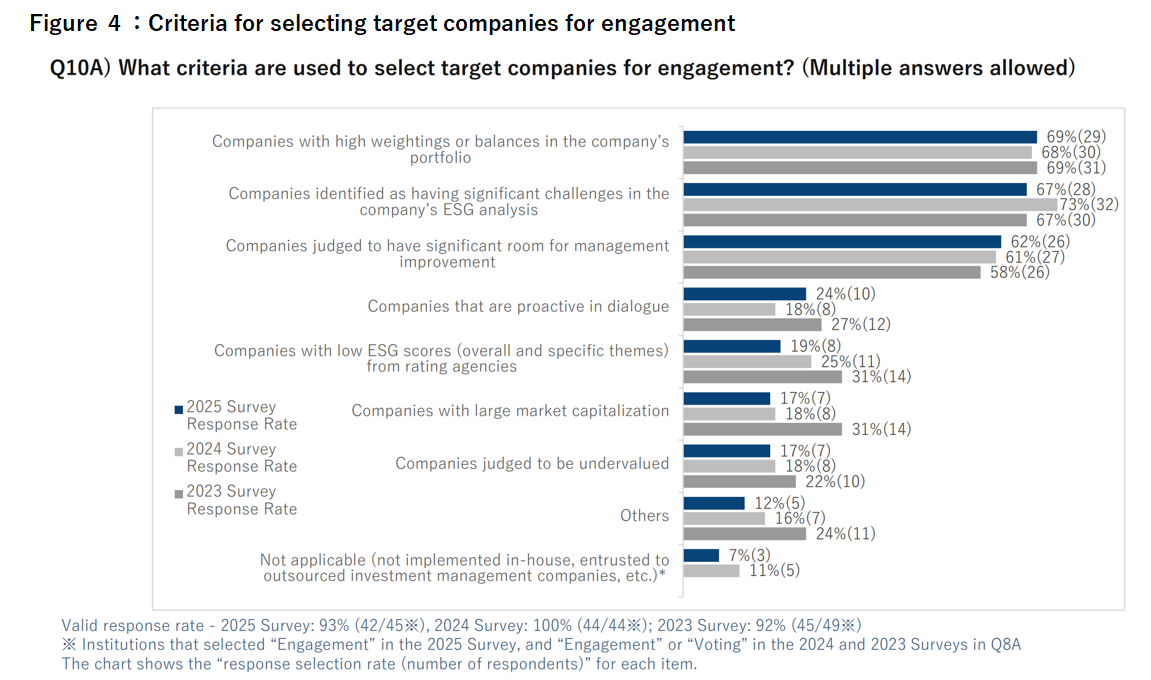

Regarding the standards for selecting target companies subject to engagement, the most common response was “Companies with high weightings or balances in the company’s portfolio” (69%, up 1 point), rising from second place in the “2024 Survey.” The second most common response was “Companies identified as having significant challenges in the company’s ESG analysis” (67%, down 6 points). The third was “Companies with significant room for management improvement” (62%, up 1 point) (Figure 4). Although the first and second rankings swapped from the previous year, the top three selection standards have remained unchanged since the “2021 Survey.”

“Prompting Action Through Collaborative Engagement” Drops by 7 Points

Finally, I would like to address the methods used to understand issues and prompt action from engagement target companies. The most common response was “Explaining the correlation between initiatives and enhancement of corporate value” (67%). This rose from third place (57%) in the “2024 Survey.” “Enhancing corporate value” appears to be a key phrase for engagement. The second most frequent response was “Dialoguing with multiple layers, including management” (64%, down 2 points from the “2024 Survey”). The third was “Having analysts present” (60%, up 1 point).

Meanwhile, “Prompting action through collaborative engagement” (43%, down 7 points) ranked sixth, dropping one position from the “2024 Survey.” Since 2024, a series of reports have highlighted institutional investors and financial institutions withdrawing from international initiatives. These include “Climate Action 100+,” which urges companies to take climate action, and various sub-groups of the “Glasgow Financial Alliance for Net Zero (GFANZ),” a coalition of financial institutions aiming for net zero. The background involves the “anti-ESG” movement, which originated in the U.S. This movement criticizes collaborative efforts by institutional investors and financial institutions to promote decarbonization as a “climate cartel.” While it remains unclear to what extent this sentiment has permeated the Japanese market, the decline in collaborative engagement is a somewhat concerning trend.

The ESG Investment Survey has been conducted annually since 2019. This seventh survey was conducted from August 18 to October 10, 2025. The survey was distributed to 276 Japan-based institutional investors that have either accepted the “Japanese Stewardship Code” or are signatories to the “Principles for Responsible Investment (PRI).” Responses were received from 69 institutions. The breakdown comprises 43 asset managers and 26 asset owners, including insurance companies and corporate pension funds.

(Reported on December 4, 2025)

Click here for the ESG Investment Survey 2025 (Summary)

[QUICK ESG Research Center]

https://corporate.quick.co.jp/en/quick_esg/

[Contact us]

https://corporate.quick.co.jp/en/contact/form_service_en/