Japan Markets ViewMitsui & Co. (8031) Tops ESG Rankings; Daifuku (6383) Jumps to 20th: Correlation Found Between Environment and Human Capital Scores at End of September

Nov 05, 2025

[Taigi Endo, QUICK ESG Research Center] The Arabesque Group’s ESG evaluation service “ESG Book” ranked the “ESG Performance Score PLUS (EPSP)” of Japanese companies as of September 30, 2025, and Mitsui & Co. (8031) topped the list. The company has maintained the top position for four consecutive quarters on a quarter-end basis, starting from the end of December 2024. Daifuku (6383) attracted attention by jumping to 20th place, a significant leap from its 116th position a year ago (Figure 1).

The ESG Performance Score is an indicator evaluated across 26 categories based on the Sustainability Accounting Standards Board (SASB) standards. ESG Book also calculates five “Dimension Scores”: “Environment,” “Social Capital,” “Human Capital,” “Business Model & Innovation,” and “Leadership and Governance.”

The “CORE” scores are based on a company’s disclosed information. On the other hand, the “PLUS” scores reflect media news and information from non-governmental organizations (NGOs) and other sources in addition to a company’s public information and are updated more frequently. Both types of scores are calculated on a scale of 0 to 100, with a higher score indicating better performance.

A comparison of the top 10 Japanese companies by EPSP with the list from one year ago shows four new entrants. The companies that remained in the top 10 are Mitsui & Co. (ranked 4th at the end of September 2024), Kubota (6326, previously 2nd), Kao (4452, previously 3rd), Unicharm (8113, previously 8th), Asahi Group Holdings (2502, previously 7th), and ITOCHU (8001, previously 1st). In contrast, when compared to the rankings from three months prior at the end of June 2025, the only change in the top 10 was the entry of Unicharm, which was previously ranked 14th.

In the 11th to 20th positions, Daifuku, at 20th place, saw its EPSP rise by 8.74 points (13.98%) to 71.27 compared to a year ago. Its stock price also increased by JPY1,981.5 (71.75%) to JPY4,743 during the same period. Looking at Daifuku’s Dimension Scores (all of which are “PLUS” scores), its “Environment” score rose by 18.54 points (28.49%) to 83.62, and its “Social Capital” score increased by 11.05 points (20.76%) to 64.28. Daifuku also maintains a high “Human Capital” score of 77.00. The company is a constituent of the “JPX-Nikkei Index Human Capital 100,” which is calculated by JPX Market Innovation & Research (JPXI) and Nikkei Inc.

According to the “Sustainability News” section on Daifuku’s website, the company announced on February 14, 2025, that it had been selected for the highest-rating “A List” for the first time by CDP, a non-profit organization that runs a global environmental information disclosure system. This selection was in recognition of Daifuku’s commitment to climate change and its transparency in information disclosure. On June 6 of the same year, the company also announced that it had disclosed information based on the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD). It appears that these various initiatives have been positively evaluated.

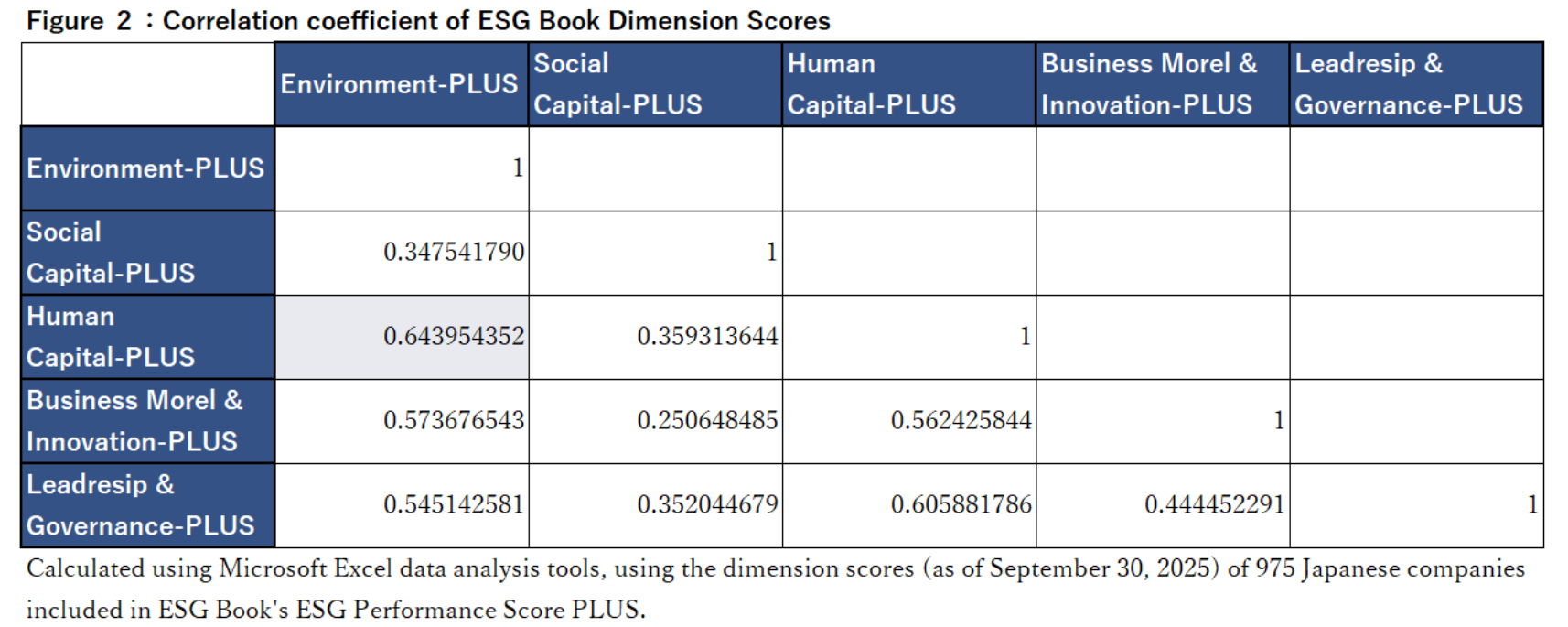

An analysis of the correlation between the five Dimension Scores for the 975 Japanese companies covered by ESG Book was conducted using Microsoft Excel’s data analysis tools, with the results shown in Figure 2. The correlation coefficient between the Environment and Human Capital scores was the highest, at around 0.64, suggesting a positive correlation.

Hiroshi Amemiya, Japan Branch Representative for ESG Book (Arabesque S-Ray), tested the hypothesis that “companies excelling in human capital may also excel in environmental performance” in an article contributed on June 27, 2025 (Note 1). The data for Japanese companies as of the end of September supports this hypothesis.

A report titled “More Than A Buzzword,” published by ESG Book on June 10, 2022 (Note 2), concludes, “Our analysis reinforces the premise that diversity and environmental performance are closely interlinked.” As Mr. Amemiya points out, there are exceptions, and it is necessary to examine each company individually. However, it appears that companies with excellent diversity are generally also addressing environmental issues such as climate change.

(Reported on October 3)

(Note 1) Hiroshi Amemiya, “[ESG Book] Do Companies with High Human Capital Scores Also Have High Environmental Performance?” June 27, 2025 (Japanese)

(Note 2) Min Low, “ More Than A Buzzword: Assessing the financial and transparency effects of corporate gender diversity” 2022 Update.

Discover datasets unique to the Japanese equity market

Visit QUICK Data Factory: https://corporate.quick.co.jp/data-factory/en/

Disclaimer

https://corporate.quick.co.jp/en/terms/#disclaimer