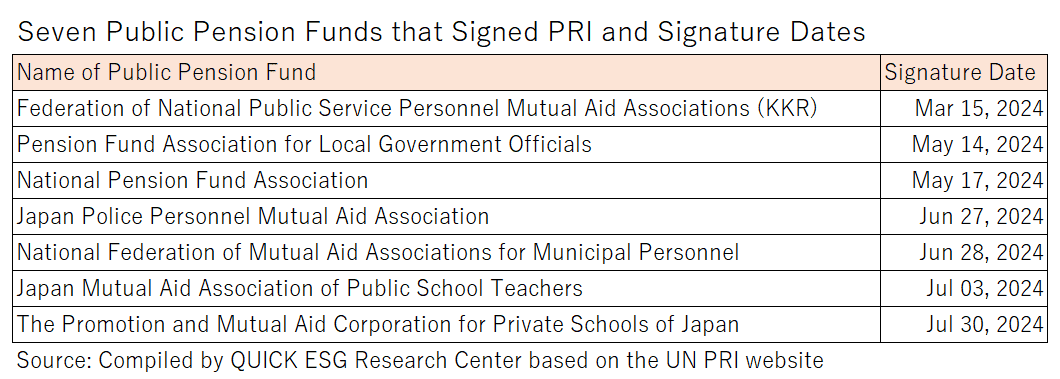

Japan Markets ViewJapan’s Seven Public Pension Funds Sign PRI, Fulfilling Prime Minister Kishida’s Commitment

Aug 08, 2024

[Taigi Endo, QUICK ESG Research Center] Seven public pension funds in Japan signed the UN Principles for Responsible Investment (PRI) from March to July in 2024. Last October, the PRI’s annual conference, “PRI in Person 2023,” was held in Tokyo. In his keynote speech, Prime Minister Fumio Kishida announced that “seven representative public pension funds, worth of 90 trillion yen in AUM, would start preparations for becoming signatories to the PRI.”

On the PRI website, the signature of public pension funds to the PRI was announced successively. It started with the Federation of National Public Service Personnel Mutual Aid Associations (KKR) in March, followed by the Pension Fund Association for Local Government Officials and the National Pension Fund Association in May, the Japan Police Personnel Mutual Aid Association and the National Federation of Mutual Aid Associations for Municipal Personnel in June, the Japan Mutual Aid Association of Public School Teachers in early July, and finally by the Promotion and Mutual Aid Corporation for Private Schools of Japan on July 30.

The PRI was launched in 2006 by then UN Secretary-General Kofi Annan to encourage ESG investment. It consists of six principles, including “We will incorporate ESG issues into investment analysis and decision-making processes.” Signing the PRI is to declare one’s commitment to emphasizing ESG investment. According to the PRI website, as of July 28, the total number of signatories was 5296, of which 138 were Japanese organizations.

Opinion polls conducted by media outlets showed that the Kishida Cabinet’s approval rating plummeted in October 2023 and has remained stagnant since then. However, Prime Minister Kishida earned high praise at the PRI in Person 2023, both inside and outside Japan. He received a round of applause when he emphasized, “Our objective is that public pension funds reinforce their work on sustainable finance and spread the movement to the whole financial market.”

The Government Pension Investment Fund (GPIF), the largest public pension fund in terms of assets, signed the PRI in 2015, providing an impetus to accelerate ESG investment in Japan. If asset owners such as pension funds endorse ESG investment, it will undoubtedly lead to initiatives of asset managers entrusted by such asset owners.

There are only four corporate pension funds that have signed the PRI so far, which are the pension funds of SECOM, Eisai, Higo Bank, and The San-in Godo Bank. The next focus will be on whether public pension funds will trigger ESG investment by corporate pension funds.

(Reported on August 1)

QUICK ESG Service

https://corporate.quick.co.jp/en/quick_esg/

Alternative datasets on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/