Japan Markets ViewESG Investment Survey 2024 Reveals Positive Rating of Impact of Non-financial Activities on Stock Prices and Dissatisfaction with Disclosure

Apr 11, 2025

[Taigi Endo, QUICK ESG Research Center] “ESG Investment Survey 2024,” released by QUICK ESG Research Center on December 26, 2024 found that the majority of institutional investors positively evaluated the impact of corporate non-financial strategies and sustainability initiatives on stock prices. On the other hand, many institutional investors responded that the disclosure of non-financial information in general and information leading to social impact assessment was insufficient.

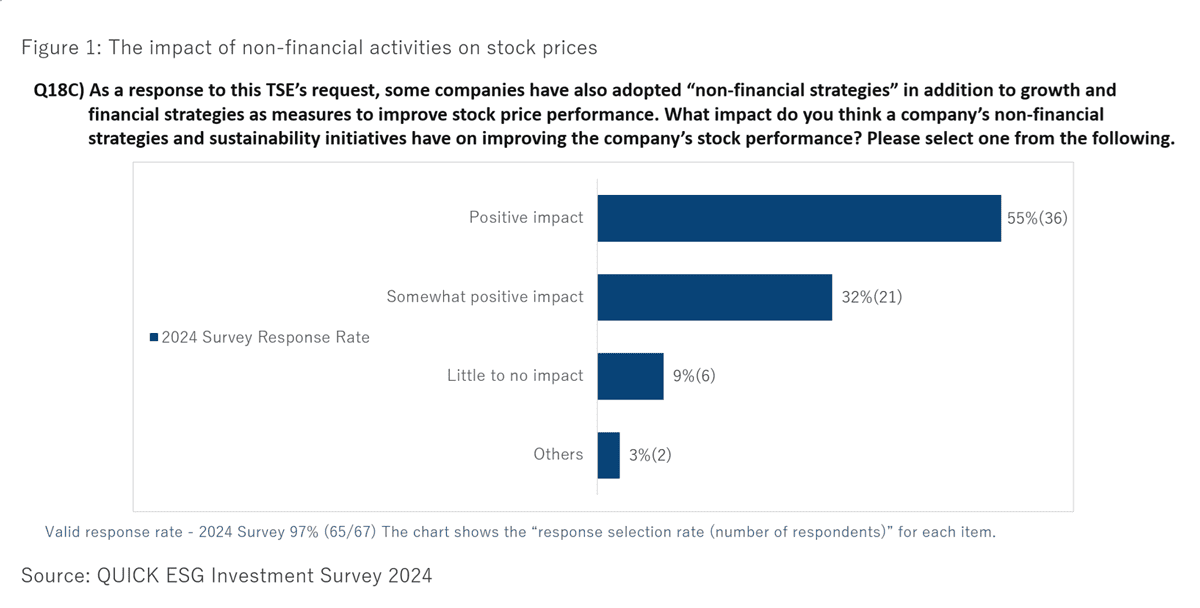

55% said non-financial activities have a “positive impact” on stock prices

Some companies cited ESG activities, in addition to growth and financial strategies, as part of the “Action to Implement Management that is Conscious of Cost of Capital and Stock Price” that the Tokyo Stock Exchange (TSE) requested of companies listed on the Prime and Standard Markets in March 2023.

According to the Corporate Governance Reports of the TOPIX 100 constituent companies, Sekisui House, Ltd. (Ticker Code: 1928), for example, states they aim to sustainably enhance return on equity (ROE) and strengthen their cash return generation capability by enhancing resource efficiency and promoting growth investment. They also describe they will strive to reduce capital costs by further promoting ESG management and target the sustainable enhancement of corporate value, including price to-book ratio (P/B ratio), through the synergistic effects of these initiatives.

In addition, Chugai Pharmaceutical Co., Ltd. (4519), while acknowledging that “ESG initiatives, for example, can be a profit compressing factor in the short run”, claims that “they can help increase the profitability of capital investment and reduce the capital cost in the future.” Regarding the company’s stock price, the report states “the Company actively engages in dialogue with shareholders and investors, and ensures that its growth potential and non-financial value are properly and adequately assessed by the market by communicating its medium- to long-term growth strategy and enhancing information disclosure.”

Furthermore, Mitsubishi Estate Co., Ltd. (8802) explains while allocating resources to growth investments, and implementing a flexible capital policy based on market trends, as well as through initiatives to respond to environmental concerns and other social issues and by increasing social value through the enhancement of human capital, they will increase market valuation, which will lead to an improved P/B ratio.

In this survey, nearly 90% of institutional investors appreciated these efforts with “Positively impact” (55%; percentage of valid responses, the same applies hereinafter) and “Somewhat positively impact” (32%). The survey target was limited to institutional investors that have endorsed the “Japan’s Stewardship Code” or the Principles for Responsible Investment (PRI). However, the survey results encourage companies to pursue non-financial strategies and sustainability efforts from the perspective of financial return in terms of stock prices.

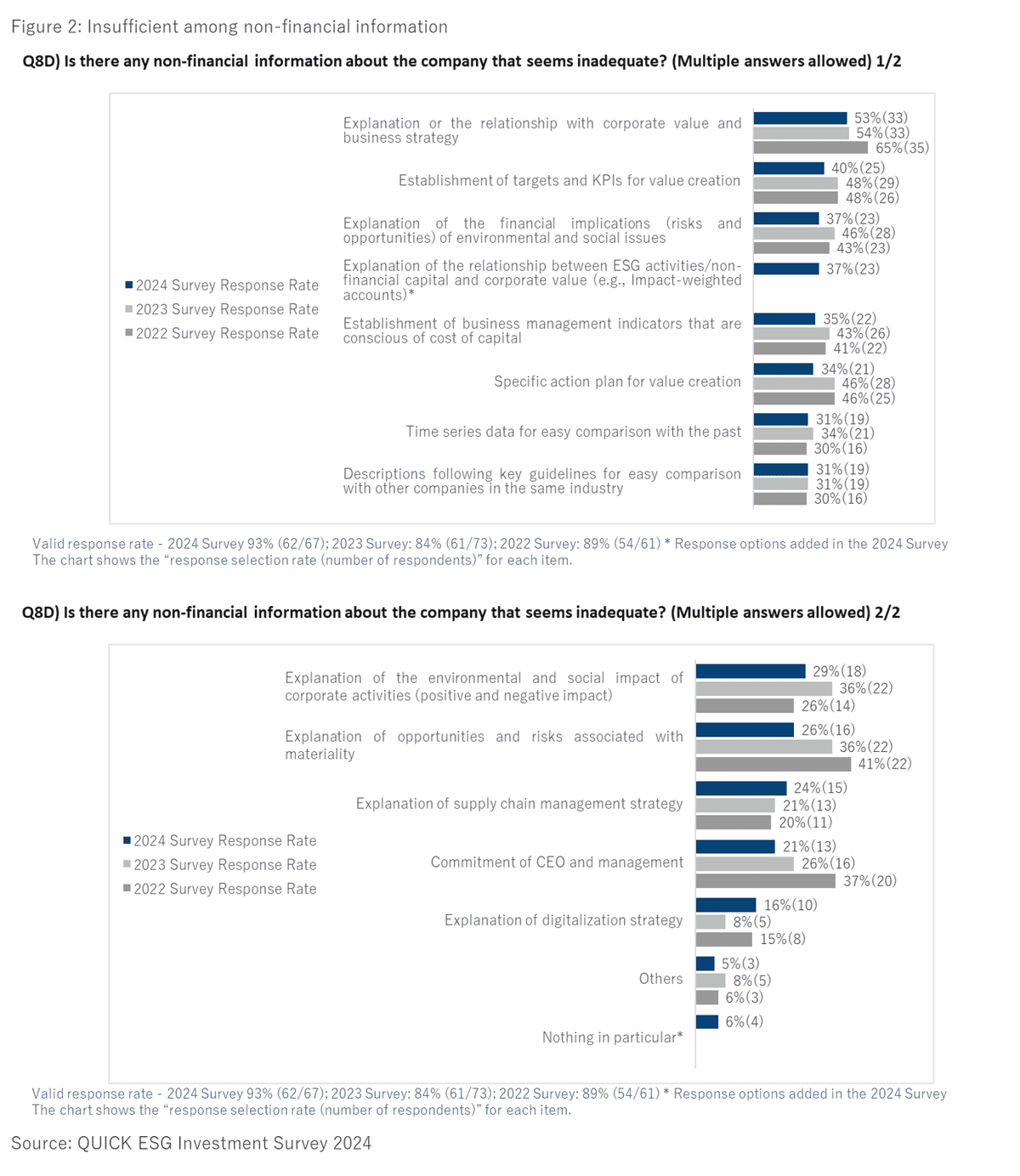

37% said disclosure of “the relationship between ESG activities and corporate value” was insufficient among non-financial information

Meanwhile, dissatisfaction with corporate sustainability information disclosure was noticeable. When asked about “Non-financial information about the portfolio companies that seems inadequate,” only 6% of respondents selected “Nothing in particular.” The most common response was “Explanation of the relationship with corporate value and business strategy” (53%), followed by “Establishment of targets and KPIs for value creation” (40%). Their rankings remained the same for the third year in a row.

The third most popular response was “Explanation of the financial impact (risks and opportunities) of environmental and social issues” (37%). In the “Others” section of open-ended response, one respondent pointed out “Lack of quantitative information in the description of scenario analysis (of climate change, etc.); Abstract expressions such as ‘Impact: Medium’ are used.” Some companies indicate the degree of impact with a range of amounts, such as “large: 10 billion yen or more, medium: 1 billion yen or more but less than 10 billion yen, and small: less than 1 billion yen.” If “medium” is indicated without a range of amounts, it may be difficult to figure out the risk level.

Tied for third place at 37% was “Explanation of the relationship between ESG activities/non-financial capital and corporate value (e.g., Impact-weighted accounts),” which was added as a response option in the 2024 Survey. “Impact-weighted accounts” is an attempt, led by Harvard Business School and others, to quantify the impact of the social and environmental changes resulting from corporate activities. The survey confirmed that a certain number of institutional investors demand quantitative disclosure of social impact as well as the financial impact of risks and opportunities such as climate change.

How do investors seeking these disclosures intend to use them for ESG investments? The results below illustrate some of their intentions. As ESG factors addressed through ESG integration, 16% of respondents chose “Social impact (creation of positive impact, control of negative impact).” In addition, as an engagement theme emphasized, 12% selected this response option.

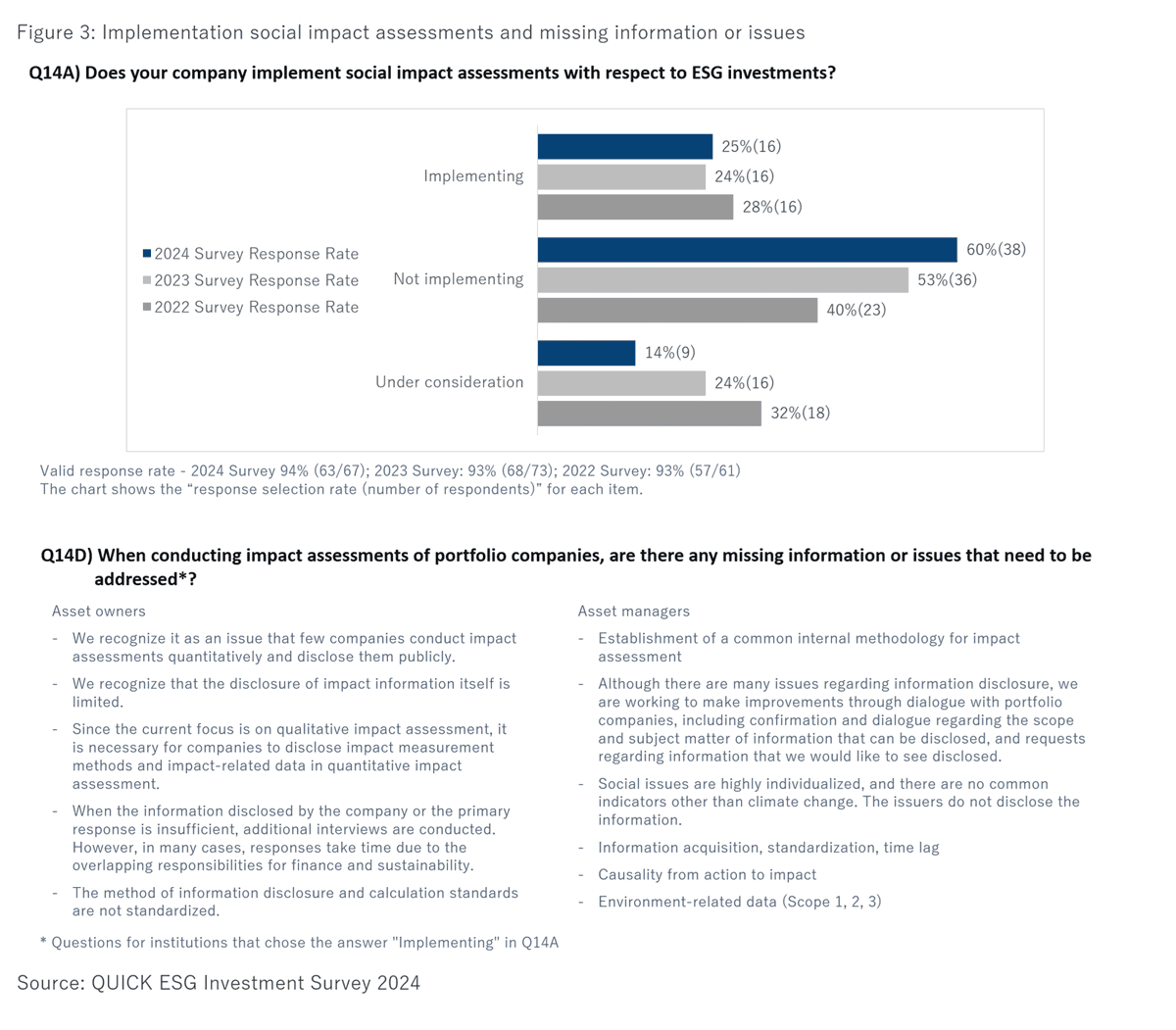

25% conducted impact assessment, and 81% said the information needed for the assessment was “not sufficient.”

Then, is there progress in impact investing and impact assessment by institutional investors? Impact investing is a type of investment to generate positive social and environmental impacts as well as financial returns. It refers to a method of measuring and reporting impacts with a clear intent to create these impacts.

Institutional investors implementing “impact investing” as an investment methodology accounted for 36%, the same as in the 2023 Survey. Although it is 10 points higher than 26% in the 2021 Survey, its growth is sluggish. In response to the question, “Do you conduct social impact assessments for ESG investments?” 25% of respondents chose “Implementing,” up only 1 point from the 2023 Survey.

This survey asked, “When conducting an ‘impact assessment’ of a portfolio company, do you have sufficient information (publicly disclosed or undisclosed) necessary for the assessment from the portfolio company or other entities? To this question, 81% of the respondents answered “Not sufficient.” This is similar to the aforementioned question, “Non-financial information about the company that seems inadequate.” It seems that information disclosure required for social impact assessment also has challenges, which is one of the reasons why impact assessment and impact investing have not been widespread.

In response to the open-ended question about “Insufficient information and challenges in implementation,” institutional investors conducting social impact assessments noted that “few companies conduct and disclose their impact assessments quantitatively.” The survey also asked the question about issues or challenges concerning efforts to explain the “Relationship between ESG activities/non-financial capital and corporate value,” such as impact-weighted accounting. To this question, the majority of respondents (52%) selected, “The number of cases and published analysis results are not sufficient enough to make use of them.”

The key to the spread of “impact investing” appears to be the visualization of impact. To dispel the view that “there is no relationship between non-financial activities and financial corporate value,” verification through the accumulation of case studies is indispensable. The shift from “investment for profit” to “sustainable investment,” which increases value and reduces risk by incorporating ESG factors, is likely to continue. For further development, “visualization of the financial impact of ESG activities” would be necessary.

(Reported on December 30, 2024)

[Outline of Survey]

| Name: | ”QUICK ESG Investment Survey 2024” |

| Survey target: | Japan-based 267 institutional investors selected from the companies that have declared acceptance of the “Japan’s Stewardship Code” or are signatories to the Principles for Responsible Investment (PRI) |

| Number of respondents: | 67 institutions (44 asset managers and 23 asset owners) |

| Survey period: | August 19 – October 10, 2024 |