Japan Markets View“ESG Investment Survey 2023” Reveals Returns, Standards, and Human Resources as Challenges to Investment Expansion

Mar 05, 2024

[Taigi Endo, QUICK ESG Research Center] “ESG Investment Survey 2023,” released by QUICK ESG Research Center on January 30, revealed three key issues for expanding ESG investments: returns, ESG standards, and dedicated human resources.

In the survey for 2023, marking its fifth year, 73 institutions participated out of the 265 eligible respondents. Although the response rate was less than 30%, the number of asset owners (asset holders), including “pension funds” such as corporate pension plans and mutual aid associations, was 27, a significant increase from 13 in the previous survey.

“Relatively Low Returns” Being One of the Reasons for Reducing ESG Investments

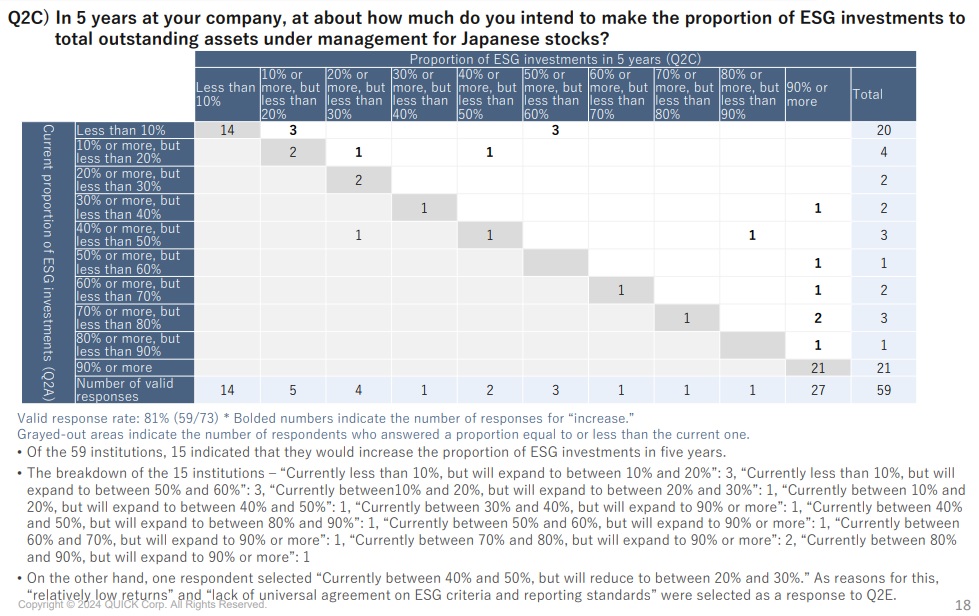

In a question asking about the ratio of ESG investments to total assets under management in Japanese stocks, one institution responded that it would “reduce the ratio in five years.” This was the first time since the survey started this question in 2021 that a respondent indicated an intention of “reducing” the ratio. One of the reasons for the reduction is “relatively low returns.”

After Russia’s invasion of Ukraine on February 24, 2022, stock prices of companies related to energy with high greenhouse gas (GHG) emissions, which “ESG money” avoids, generally rose. Since the returns of the institution that responded “will reduce the ESG investment ratio” were unavailable, we conducted an examination with reference to Government Pension Investment Fund (GPIF), the largest institutional investor promoting ESG investments.

According to the “Annual Report Fiscal Year 2022,” GPIF invests in domestic equities, domestic bonds, foreign equities, and foreign bonds in four equal portfolios, with the balance of domestic equities at JPY50.3337 tn as of the end of March 2023. Time-weighted rate of return (the rate of return after eliminating the impact of investment principal inflows and outflows) for FY2022 (fiscal year ending March 31, 2023) was 5.54%, lower than the benchmark Tokyo Stock Price Index (TOPIX) including dividends, which was 5.81%.

“Lack of Universal Agreement on Standards” Being Another Reason

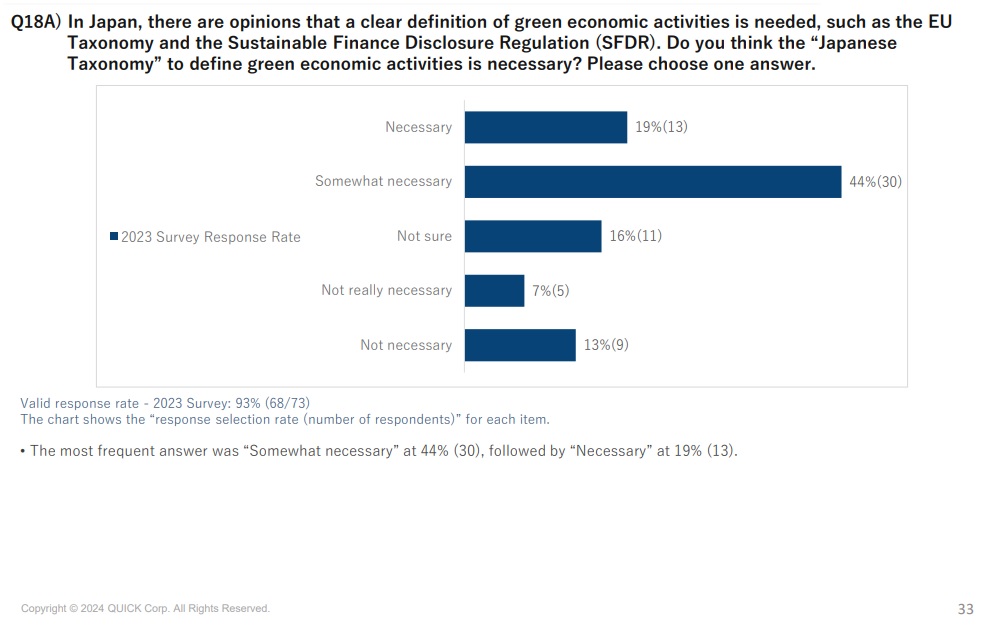

“Lack of universal agreement on ESG criteria and reporting standards” is another reason for “reducing” the ratio of ESG investments by the institution that gave this answer. The lack of ESG-related standards is the second challenge in expanding the ratio of ESG investments. To a question in the 2023 Survey asking the need for the Japanese Taxonomy, which classifies economic activities that contribute to sustainability from an environmental perspective, a total of 63% of respondents (percentage of valid responses, the same applies hereinafter) chose “Necessary” or “Somewhat necessary.”

The most common reason for the necessity of the Japanese Taxonomy was “Desirable to have clear standards for information disclosure” (65%), followed by “To prevent “greenwashing” disguised as environmental measures” (60%) and “Desirable to have clear standards for investment decisions” (47%).

In March 2023, the UN Principles for Responsible Investment (PRI) released a report titled “DOES JAPAN NEED A SUSTAINABLE FINANCE TAXONOMY?” and made policy recommendations based on the survey results. According to the survey, 58% of the respondents agreed that Japan should develop a sustainable taxonomy.

In May 2021, the Financial Services Agency, the Ministry of Economy, Trade and Industry (METI), and the Ministry of the Environment released “Basic Guidelines on Climate Transition Finance.” In addition, METI has developed a “roadmap for promoting transition finance” for each industry sector. Although Japan has such guidance, a certain number of investors would prefer to have clear standards.

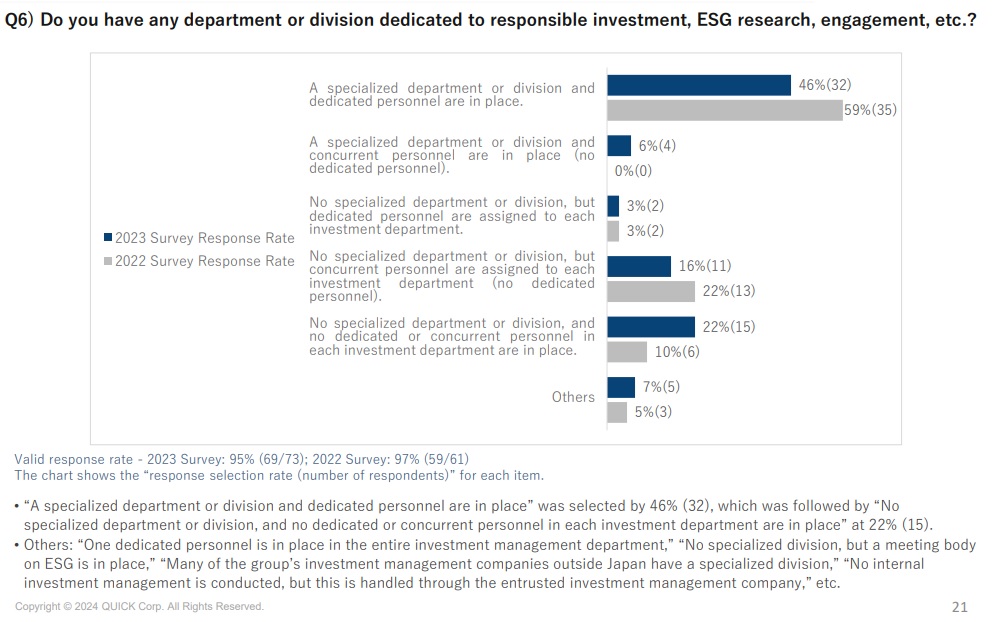

22% Responded, “No Specialized Department, Division, or Personnel” for ESG

In the 2023 Survey, a majority of respondents (58%) chose “having analysts present in dialogue” as a way to encourage target companies to respond in engagement activities. Meanwhile, in the 2022 Survey, which had slightly different response options, 38% selected “having sector analysts present in dialogue.” This is an increase of 20 percentage points over the simple comparison. Dedicated personnel is the third challenge. ESG covers a wide range of environmental, social, and governance issues. Dedicated personnel are becoming increasingly important for institutions conducting their own engagements.

On the other hand, 22% of the respondents chose “No specialized department or division, and no dedicated or concurrent personnel in each investment department are in place.” The percentage of respondents who selected “A specialized department or division and dedicated personnel are in place” was 46%, a decrease of 13 percentage points from the 2022 Survey. It raises some concern, even if this is because some asset owners are entrusting their engagements to their outsourced asset managers.

According to “The Future of Jobs Report 2023” released by the World Economic Forum in May 2023, “Sustainability Specialists” ranked second only to “AI and Machine Learning Specialists” among the fastest-growing job categories. The investment industry is not the only one in need of specialists in the transition to an environmentally conscious and sustainable society. However, the development, acquisition, and success of human resources are also likely to be key to the expansion of ESG investments.

[Outline of Survey]

| Name: | “QUICK ESG Investment Survey 2023” |

| Survey target: | Japan-based 265 institutional investors selected from the companies that have declared acceptance of the “Japanese Stewardship Code” or are signatories to the Principles for Responsible Investment (PRI) |

| Number of respondents: | 73 institutions (46 asset managers and 27 asset owners) |

| Survey period: | August 21 – October 10, 2023 |