Japan Markets View[Vol. 1] Calculation Rules for Next-Generation TOPIX and Forecast for Constituent

Sep 30, 2024

Satoshi Anma, QUICK Corp.

Last updated on October 29, 2024

Overview

On June 19, 2024, JPX Market Innovation & Research(JPXI)released a series of materials, including “Revisions of TOPIX and Other Indices,” and disclosed the calculation rules for the next-generation TOPIX. Following this, JPXI conducted the index consultation from June 19 to August 18, 2024, to obtain a wide range of opinions from market participants. On September 27, 2024, JPXI released the materials “Overview of Revisions of TOPIX and Other Indices (Update)” and “Summary of Public Opinions on “Revisions of TOPIX and Other Indices.” According to these materials, a new re-evaluation point will be added to the phased weighting reduction process for stocks that are to be excluded from the TOPIX after the first periodic replacement (stocks subject to transitional measures). If a stock meets the criteria for selecting existing constituents, the subsequent weighting reduction will be suspended. There are no major changes to the other calculation rules from the original ones. In two-part reports, I break down the new rules for calculating the next-generation TOPIX from the materials by JPXI and forecast the constituent replacement. The first report shows how the calculation rules change and the transition schedule for the next-generation TOPIX.

Background

The Tokyo Stock Exchange (TSE) introduced the three market sections in April 2022: Prime, Standard, and Growth, replacing the TSE 1st Section, 2nd Section, Mothers, and JASDAQ (Standard and Growth). In conjunction with this, the TSE revised the rules for calculating the TOPIX, making it an index not bounded by the market sections. Based on the newly defined formula for tradable shares, the TOPIX component ratio of stocks with a market capitalization of less than JPY10 bn in tradable shares has been reduced in stages. The reduction has been taken place once every three months from October 2022 and will continue until January 2025, for a total of 10 times. And finally, all such stocks will be excluded from the TOPIX. It had been announced that the TOPIX constituents would be limited to the Prime Market listed stocks during the phased weighting reduction, and that the rules for calculating the TOPIX after the completion of the weighting reduction would be disclosed later. The details have been revealed in the JPXI’s materials released on June 19 and September 27, 2024.

Rules for Calculating Next-Generation TOPIX

(1) Aim

JPXI stated as follows in “Revisions of TOPIX and Other Indices” publicized on June 19, 2024: “The aim of revising the TOPIX calculation rules this time is to cover all TSE market sections while ensuring consistency of the index, and to deepen the TOPIX concept (a market benchmark that broadly covers the Japanese stock market and functions as a target for investment). Specifically, the revisions will be made to further expand the coverage and functionality of the index as an investment target through such measures as covering all TSE market sections and periodically replacing constituents with a greater emphasis on liquidity.” Given that the size of TOPIX-linked funds is approximately JPY100 tn, a major change in the TOPIX calculation rules and a large-scale replacement of constituent stocks would make it difficult to maintain the consistency of the index. Not only that, the replacement of stocks could have a large market impact. The revision of the new TOPIX calculation rules is deemed to be aimed at avoiding such situations. At the same time, it aims to eliminate low-liquidity stocks through separating the index from the market sections and introducing a mechanism for periodic replacement of constituents in line with the concept of the revision.

(2) Calculation Rules

(i) Eligible Stocks

Previously, all stocks listed on the TSE 1st Section were TOPIX constituents. In the current TOPIX, where the phased weighting reduction is in place, only stocks newly listed on the Prime Market are added to the TOPIX. The stocks eligible for the next-generation TOPIX announced this time are domestic common stocks listed on any of the Prime, Standard, and Growth Markets.

(ii) Periodic Replacement

For the existing TOPIX, no periodic replacement of constituent stocks has been conducted. On the other hand, the next-generation TOPIX will have a periodic replacement of constituents once a year on the last business day of October, with the last business day of August as the base date. Stocks subject to periodic replacement are Prime, Standard, and Growth Market listed stocks as of the base date. From these stocks, the population for stock selection is formed by excluding securities to be delisted, securities on special alert, and securities newly listed in the month containing the base date (excluding technical listings). For stocks newly listed in the month containing the base date, whether or not they will be added to the TOPIX is determined in accordance with the “Non-Periodic Addition” process, which will be described later.

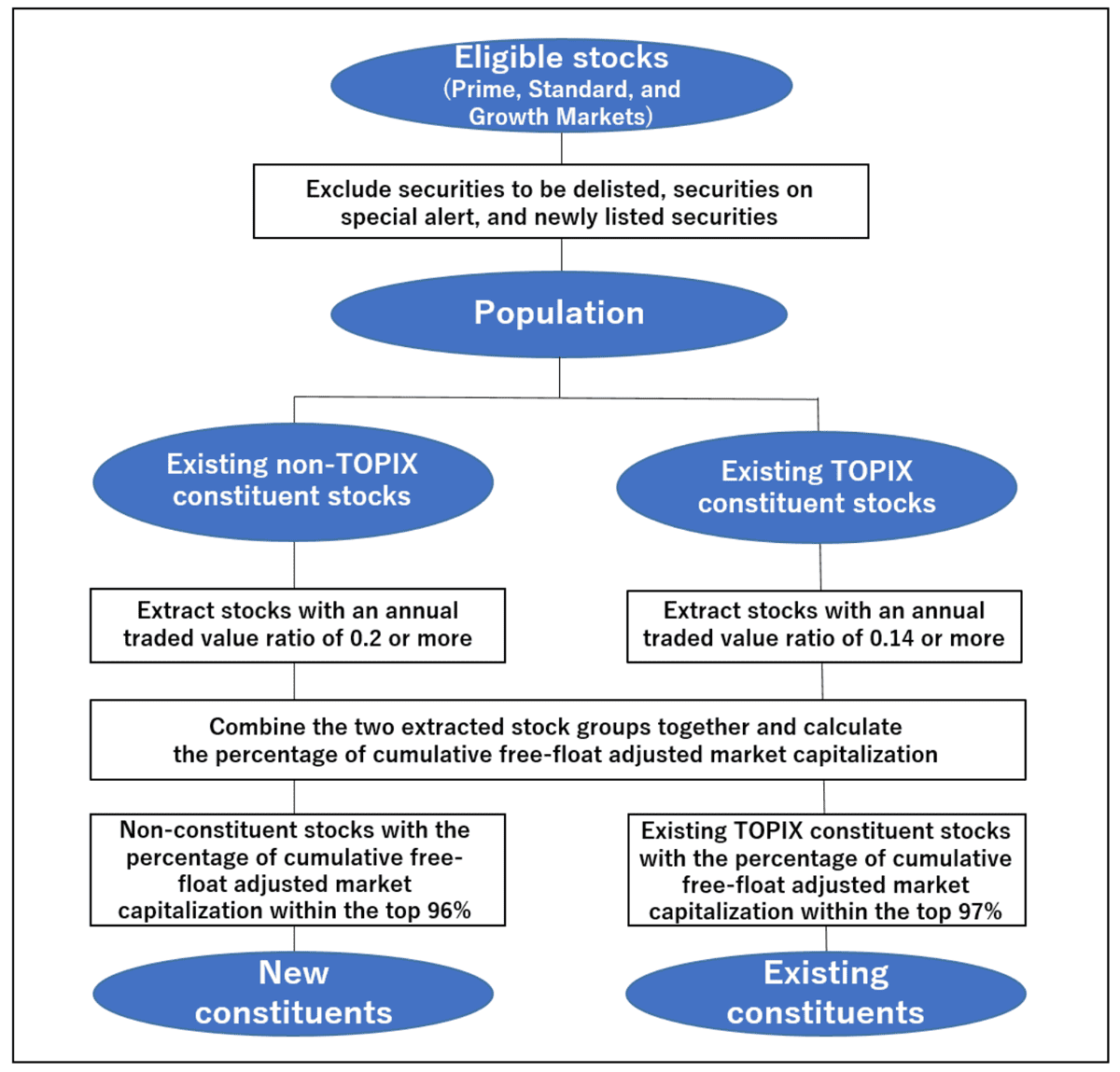

Two criteria adopted for the selection of stocks subject to periodic replacement are: (i) annual traded value ratio (Note 1); and (ii) percentage of cumulative free-float adjusted market capitalization (Note 2). In order for existing non-TOPIX constituent stocks among the population to be newly added to TOPIX through periodic replacement, they must meet the criteria (for selecting new constituents): an annual traded value ratio of 0.2 or more; and the percentage of cumulative free-float adjusted market capitalization within the top 96% of the population. On the other hand, for the existing TOPIX constituents to remain in the TOPIX after periodic replacement, they must meet the criteria (for selecting existing constituents): an annual traded value ratio of 0.14 or more; and the percentage of cumulative free-float adjusted market capitalization within the top 97%. Existing TOPIX constituents that fail to meet the criteria for selecting existing constituents will be excluded from the TOPIX. The criteria for selecting existing constituents have been relaxed compared to those for selecting new constituents. This is considered to be a measure to prevent TOPIX constituents from being replaced too frequently through periodic replacements, which would increase the index turnover rate. To mitigate the impact on the stock market, the transitional measures described later will be applied for the first periodic replacement.

(Note 1) Annual traded value ratio

An annual traded value ratio is calculated by summing the monthly traded value ratios for the most recent 12 months, including the month containing the base date. For stocks that have been listed for less than one year, the annual traded value ratio is calculated by multiplying the total of monthly traded value ratios from the month of listing to the month of the base date by 12 and dividing by the number of months in the relevant period. A monthly traded value ratio is calculated by multiplying the median daily traded value in TSE’s trading sessions for the month by the number of business days in the month and dividing by free-float adjusted market capitalization on the last business day of the month.

(Note 2) Percentage of cumulative free-float adjusted market capitalization

follows. First, the population is divided into TOPIX non-constituent and constituent stocks. Then, the TOPIX non-constituent stocks with an annual traded value ratio of 0.2 or more are extracted. In addition, the TOPIX constituent stocks with an annual traded value ratio of 0.14 or more are extracted. The two groups of stocks thus extracted are put together. Then, such stocks are sorted in descending order of free-float adjusted market capitalization; and the free-float adjusted market capitalization is accumulated in descending order starting with the stock with the largest value. The percentage of cumulative free-float adjusted market capitalization is calculated by dividing this cumulative value by the sum of the free-float adjusted market capitalization of all stocks in the two groups combined. Note that the average of daily free-float adjusted market capitalization for the month containing the base date is used as the free-float adjusted market capitalization.

[Process for Selecting New and Existing Constituent Stocks through Periodic Replacement]

Source: Compiled by QUICK based on data from JPXI

(iii) Non-Periodic Addition

Under the former TOPIX, stocks newly listed on the TSE 1st Section were added to the TOPIX on the last business day of the month following their listing dates. Under the current TOPIX, stocks newly listed on the Prime Market are added to the TOPIX on the last business day of the month following each listing date. Under the next-generation TOPIX, new constituent stocks will be added on the last business day of the month following their listing dates. The stocks to be selected as constituents are those newly listed on the Prime, Standard, or Growth Market whose free-float adjusted market capitalization, calculated by the stock price on the last business day of the month containing the listing date, exceeds the minimum free-float adjusted market capitalization of the stocks within the top 95% as of the previous periodic replacement.

(iv) Transitional Measures

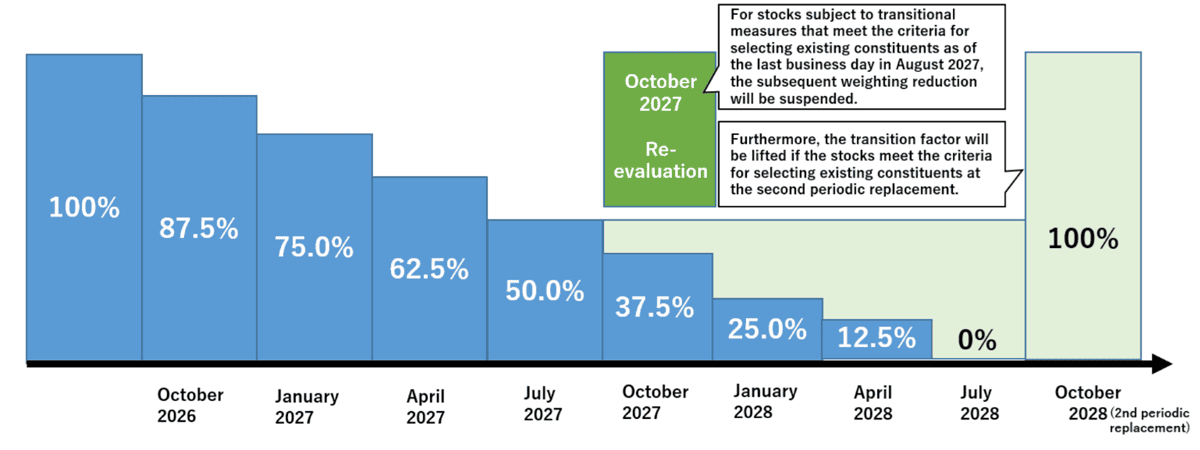

The first periodic replacement under the next-generation TOPIX calculation rules will be made with the last business day of August 2026 as the base date. To mitigate the impact on the stock market, transitional measures will be taken. For stocks to be excluded from the TOPIX following the first periodic replacement (stocks subject to transitional measures), their weightings will be reduced in stages. Specifically, a value called transition factor is set, which is multiplied by Free Float Weight. The factor will be decreased from 100% to 0% in eight stages on a quarterly basis from the last business day of October 2026 to the last business day of July 2028 in increments of 12.5%.

According to “Overview of Revisions of TOPIX and Other Indices (Update),” released by JPXI on September 27, 2024, the re-evaluation will be implemented in the phased weighting reduction process. Specifically, the re-evaluation will be conducted in October 2027, with the last business day of August 2027 as the base date. For stocks subject to transitional measures that meet the criteria for selecting existing constituents (an annual traded value ratio of 0.14 or more; and the percentage of cumulative free-float adjusted market capitalization within the top 97%) as of the base date, the subsequent phased weighting reduction will be suspended. Furthermore, the transition factor will be lifted if the stocks for which phased weighting reduction has been suspended meet the criteria for selecting existing constituents at the second periodic replacement in October 2028.

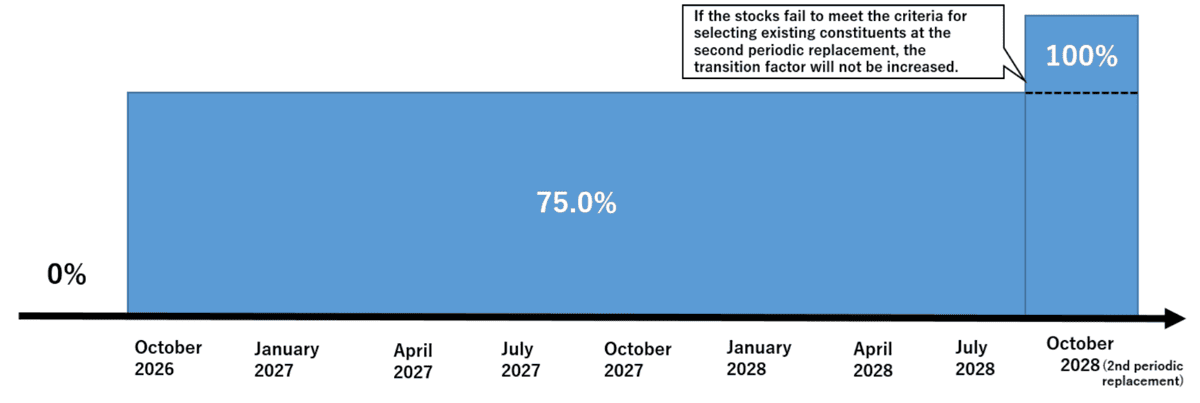

For stocks to be added to the TOPIX following the first periodic replacement, their weightings will be increased in two stages with the transition factor at 75% on the last business day of October 2026 and at 100% on the last business day of October 2028 (the date of the second periodic replacement). However, the weighting will not be increased from 75% to 100% for the stocks that are selected as new constituents in the first periodic replacement but not selected in the second periodic replacement.

[Transition Factors for Stocks to Be Excluded from the TOPIX]

[Transition Factors for Stocks to Be Newly Included to the TOPIX]

(3) Schedule

The schedule for the transition to the next-generation TOPIX is as follows.

June 19, 2024: Publication of “Revisions of TOPIX and Other Indices”

June 19 – August 18, 2024: Index consultation

September 27, 2024: Publication of “Overview of Revisions of TOPIX and Other Indices (Update)”

October 2026 – July 2028: First periodic replacement (Base date: the last business day of August 2026; Phased weighting reduction)

October 2027: Re-evaluation (Base date: the last business day of August 2027)

October 2028: Second periodic replacement (Base date: the last business day of August 2028)

Thereafter, a periodic replacement is carried out in October of each year, with the last business day of August of that year as the base date.

The second report features a forecast based on the most recent data for the replacement of constituent stocks when the current TOPIX is shifted to the next-generation TOPIX.

Reference: Website of the Japan Exchange Group “Revisions of TOPIX and Other Indices”

https://www.jpx.co.jp/english/markets/indices/governance/index-consultation/20240619-01.html