Japan Markets ViewValue Stocks Strike Back – Market Reforms and Interest Rate Hikes Providing a Tailwind

Feb 13, 2025

[Keiichi Nakayama, QUICK Market Eyes] The Japanese stock market appears to be in a slow but steady trend when viewed over a longer period.

Continued: Value Stocks Strike Back

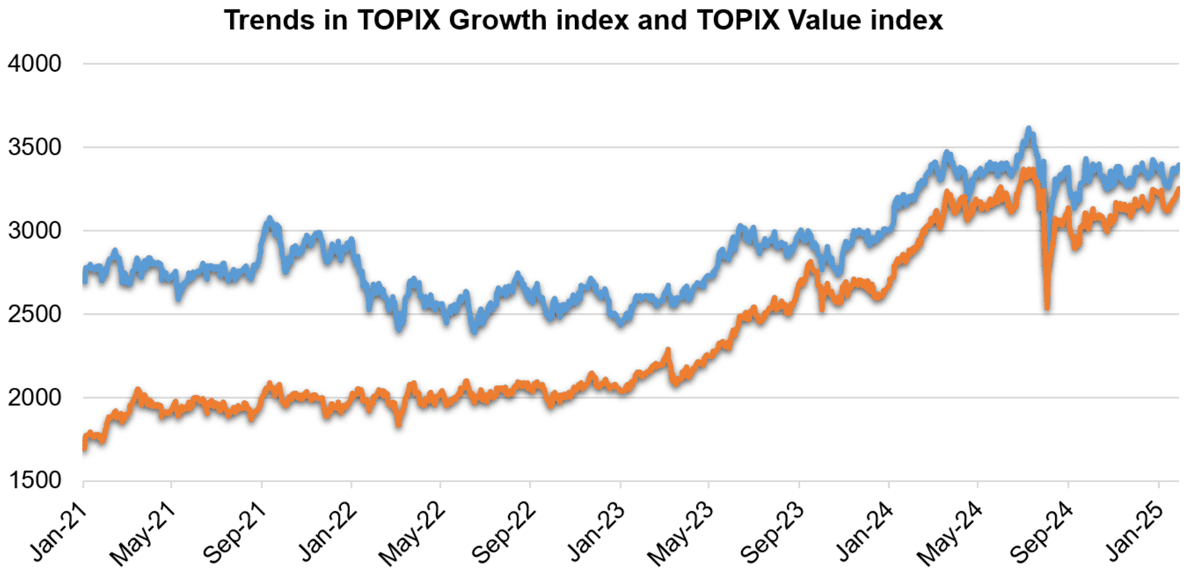

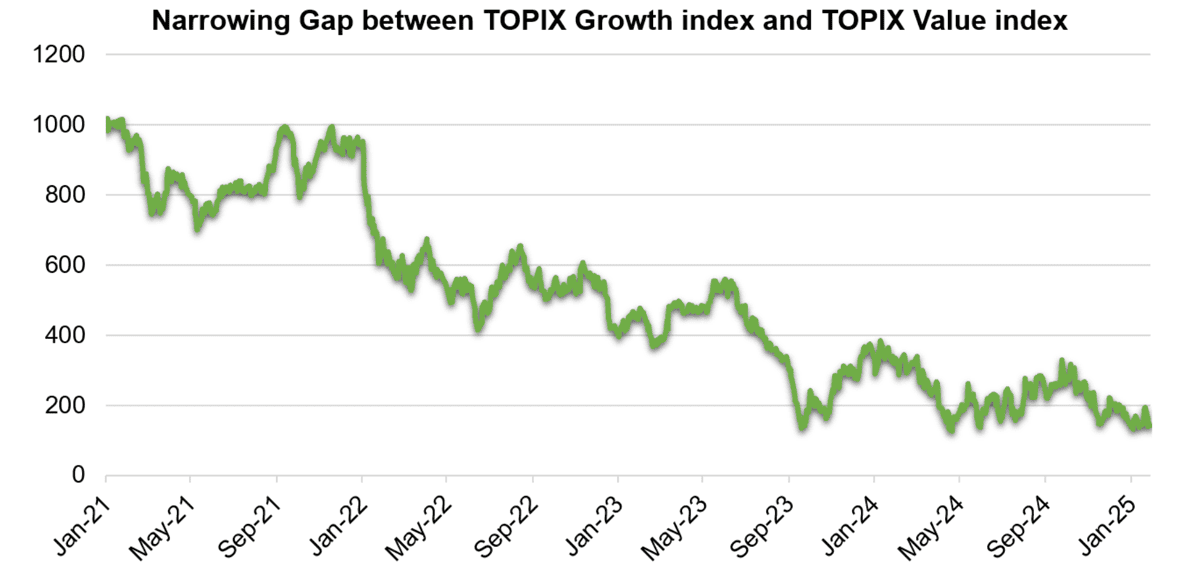

Value stocks is continuing to strike back slowly. As the Bank of Japan (BOJ) moves toward the normalization of monetary policy, funds are being directed to the companies and industries that are expected to benefit from the move, including banking sector. The gap is gradually narrowing between TOPIX Growth index, composed of constituents with relatively high P/B ratios, and TOPIX Value index, comprising constituents with relatively low P/B ratios. Value stocks may yet continue to strike back.

*Difference between TOPIX Growth index and TOPIX Value index

Makoto Furukawa, chief portfolio strategist at Nomura Securities, noted, “Uncertainty over the risk of tariffs by President Trump is limiting the shift of funds to auto stocks among value stocks, while financial stocks are likely to attract funds.” Most recently, the entire market was volatile in the wake of the DeepSeek shock. However, stocks that were lagging relative to the market and bank stocks showed a solid performance.

There are multiple tailwinds for value stocks. They are the Tokyo Stock Exchange’s (TSE) market reforms and the BOJ’s interest rate hikes. In March 2023, the TSE requested companies to take “Action to Implement Management That Is Conscious of Cost of Capital and Stock Price.” The request was addressed to all companies listed on the Prime and Standard Markets regardless of their P/B ratios. It is also known as a “request for improvement of low P/B ratios.” Therefore, according to a market participant, “at first, a basket of stocks with improved P/B ratios among those with low P/B ratios was very popular.”

Currently, the BOJ’s interest rate hikes are providing the wind for value stocks at their back, especially banking stocks. The BOJ decided to raise interest rates for the first time since July 2024 at its Monetary Policy Meeting, which was held on January 23 and 24. The policy rate was raised to 0.50%, the highest level in 17 years. A consensus has formed in the market that the BOJ will raise interest rates moderately every six months or so. Mr. Furukawa of Nomura Securities stated, “The risk of U.S. President Trump’s tariffs has become a fog for investors. Until the risk is completely cleared, investors are likely to focus on the BOJ’s interest rate hikes, and money will continue to flow into financial stocks.”

Expectations for Increased Engagement with Institutional Investors

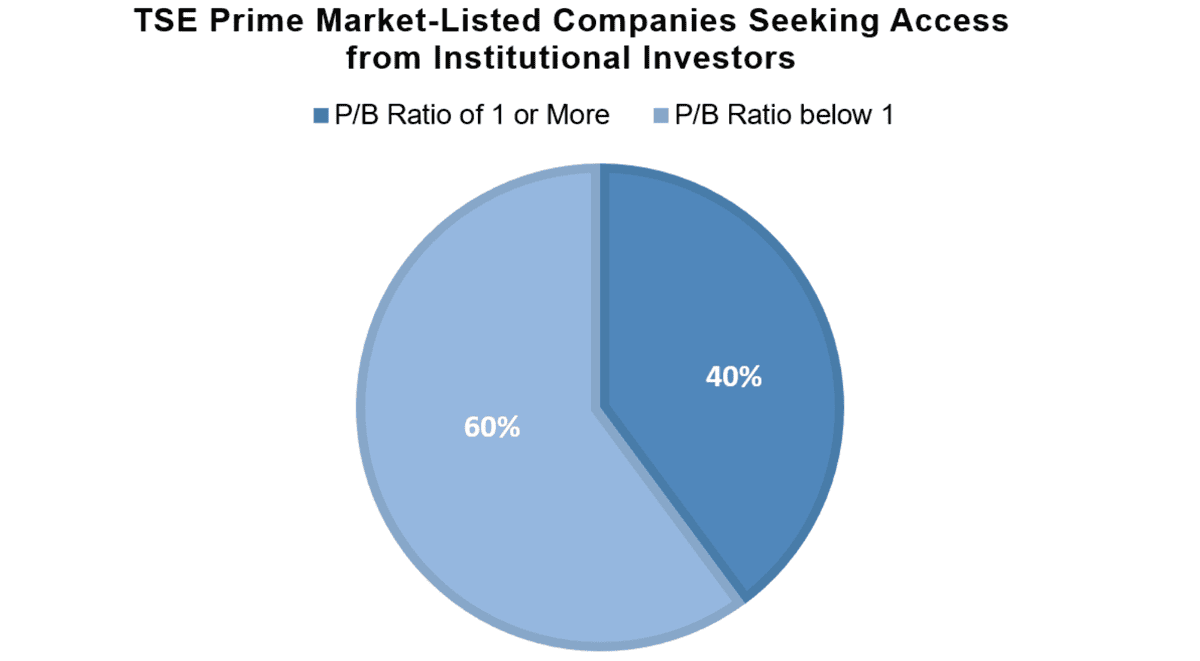

Corporate actions resulting from the TSE’s ongoing reforms may increase momentum for reevaluating value stocks. On January 15, the TSE revised the list of companies’ responses to the “Action to Implement Management That Is Conscious of Cost of Capital and Stock Price,” and newly specified companies that wish to be contacted more actively by institutional investors. Of the 163 Prime Market listed companies that applied for more active contact, 60% were companies with a P/B ratio below one.

*Compiled based on TSE’s materials

Chizuru Morishita, a researcher at NLI Research Institute, noted, “The effect is expected to enhance transparency and engagement between companies and investors.” According to Ms. Morishita, the TSE’s market reforms, which are expected to continue, “will provide an opportunity to create a market that is beneficial to both companies and investors.”

Hiromi Yamaji, CEO of Japan Exchange Group (JPX), stated at the January 30 press conference that the movement of companies wishing to contact institutional investors was “off to a good start.” Mr. Yamaji also explained, “It would be best that the reevaluation of value stocks will spread through the accumulation of positive examples.” Many companies in Japan still have a P/B ratio below one. Expectations are high that further corporate activity will encourage the reevaluation of value stocks.

(Reported on February 4)

Related dataset

Do you want to know more about banks in Japan?

Answer is in QUICK Finer Compass (Bank-Specific Financial Data)

Related articles

Tokyo Stock Exchange Continuing to Advance Reforms in 2025 – Growing Expectations for Changes in Companies and Markets

Value Stocks Continuing to Strike Back – Selected by Investors Anticipating Positive Interest Rates