Japan Markets ViewValue Stocks Continuing to Strike Back – Selected by Investors Anticipating Positive Interest Rates

Jun 14, 2024

[QUICK Market Eyes] Value stocks continue to strike back. The normalization of Japan’s monetary policy will open up a world of positive interest rates. Selective buying is taking place in the banking and insurance stocks, which are expected to benefit from this trend. As a result, funds are gradually flowing into value stocks. For a long time, TOPIX Value has been underperforming TOPIX Growth in absolute value. However, the situation may reverse in the future.

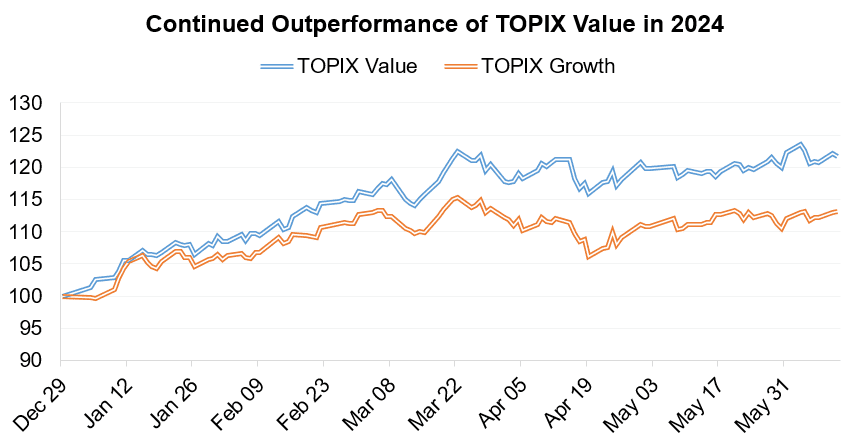

TOPIX Value has risen 21.6% from the end of last year through June 11, a better performance than TOPIX Growth (up 13.1%). Compared to the Nikkei Stock Average, which has a high ratio of growth stocks, the TOPIX with a high ratio of value stocks is also revising upward.

* Calculated with the end of 2023 as 100.

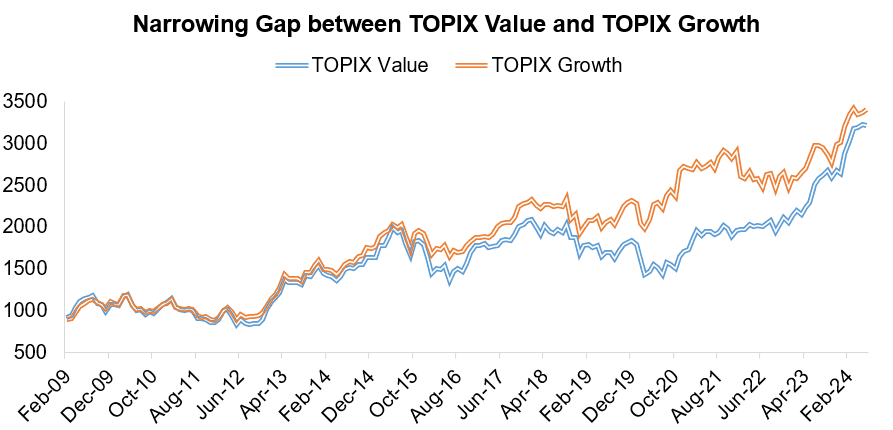

Looking back, TOPIX Value and TOPIX Growth were almost at the same level until around 2010. Thereafter, however, the latter continued to outperform the former. In November 2020, during the COVID-19 pandemic, the absolute value difference between the two indices had widened to over 1,000 points. After that, the gap steadily narrowed.

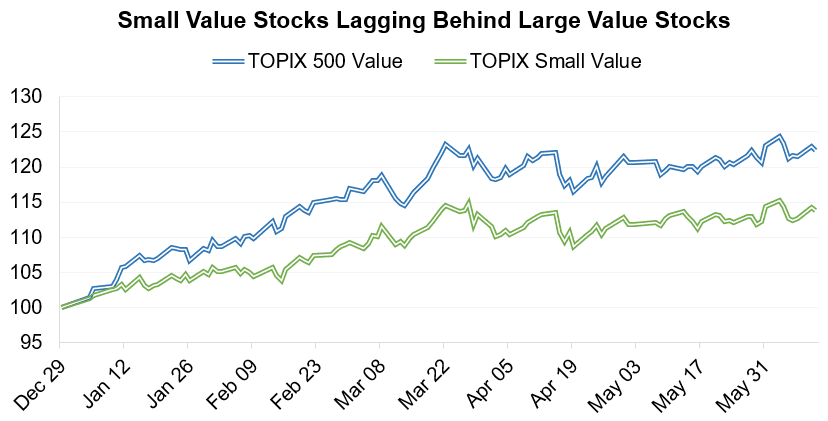

Fumio Matsumoto, chief strategist at Okasan Securities, views that “the market will continue to be dominated by value stocks, albeit moderately.” He attributes the strong performance of value stocks over the past three years to a reaction to the overweighting toward growth stocks in earlier years. Yet, Mr. Matsumoto also factors in the outlook for Japan’s monetary policy measures, etc. The request by the Tokyo Stock Exchange for “Management Conscious of Cost of Capital and Stock Price” has prompted share buybacks and dividend hikes. Mr. Matsumoto expressed his view, saying, “Large-cap stocks have been factored into the market to a certain extent, but the recovery in small- and mid-cap value stocks, which have lagged behind, will progress.”

* Calculated with the end of 2023 as 100.

Foreign investors also seem to be less inclined to lean toward growth stocks in the near term. Nozomi Moriya, strategist at UBS Securities, spoke with investors at an event in Hong Kong at the end of May. During the discussion, she mentioned, “There was momentum toward spreading out holdings in value stocks rather than keep holding stocks with high valuations (investment scale), such as semiconductor stocks.” She also recalled that stocks with low P/B ratios, such as steel stocks, were relatively appealing to foreign investors.

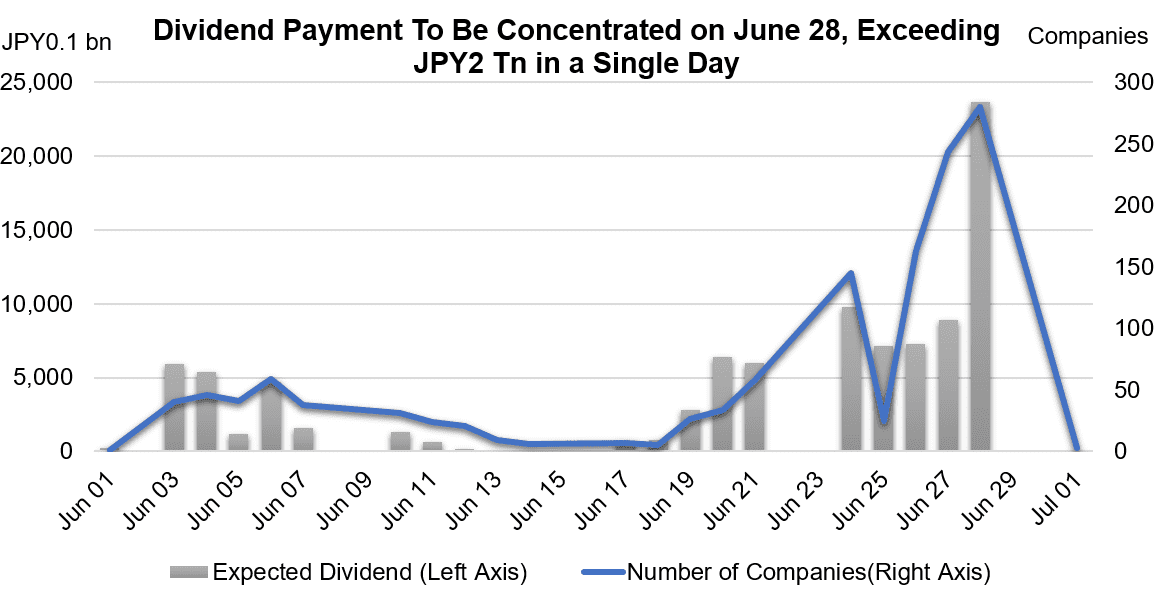

Regarding near-term events, Takehiko Masuzawa, trading head at Phillip Securities Japan, noted, “We are watching to see if growth stocks perform better than value stocks because dividends will be paid out at the end of June.”

Based on the QUICK’s data, dividend payments are most concentrated on June 28, with 280 companies paying a total of JPY2.3 tn. Mr. Masuzawa says, “There will be no impact from dividends to passive investors, who reinvest in futures in advance. What we should pay attention to is the movement of funds after dividends are paid to individual investors and active investors.” He considers that value stocks are the main source of dividend payments, part of which will be reinvested in equities, thereby tightening the supply-demand balance.

* Compiled based on the QUICK’s data.

The Nikkei 225 reached a record high of 40,888.43 on March 22, 2024. The TOPIX, on the other hand, has yet to reach its all-time high of 2884.80 recorded on December 18, 1989. There are persistent expectations that a world of positive interest rates will return to Japan after a long absence, and that funds will gradually move into value stocks. With the ongoing change in Japanese companies’ consciousness of the cost of capital, there are high hopes for a future in which TOPIX representing all Japanese equities, which have become value stocks in the world, will reach its record high.

(Reported on June 13)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/