Japan Markets ViewTwo Conflict Views on Right to Shareholder Proposal – Could Debate Advance Corporate Governance in Japan?

Jun 24, 2025

[Keiichi Nakayama, QUICK Market Eyes] Quiet disagreement is emerging over shareholder proposals in Japan, which will be one of the focal points of the annual general meetings (AGMs) in June 2025. Japan is considered a country where shareholder proposals are easier to make than in Europe, the U.S., and other countries. Some argue that the hurdle for the right to have such proposals should be raised. On the other hand, there are opposing views on the grounds that corporate governance in Japan is still in its infancy. It is difficult to find a conclusion to the conflicting views. Thus, we need to watch carefully how the debate between these conflicting views develops and whether the next actions of companies and investors will advance corporate governance in Japan, which has just started.

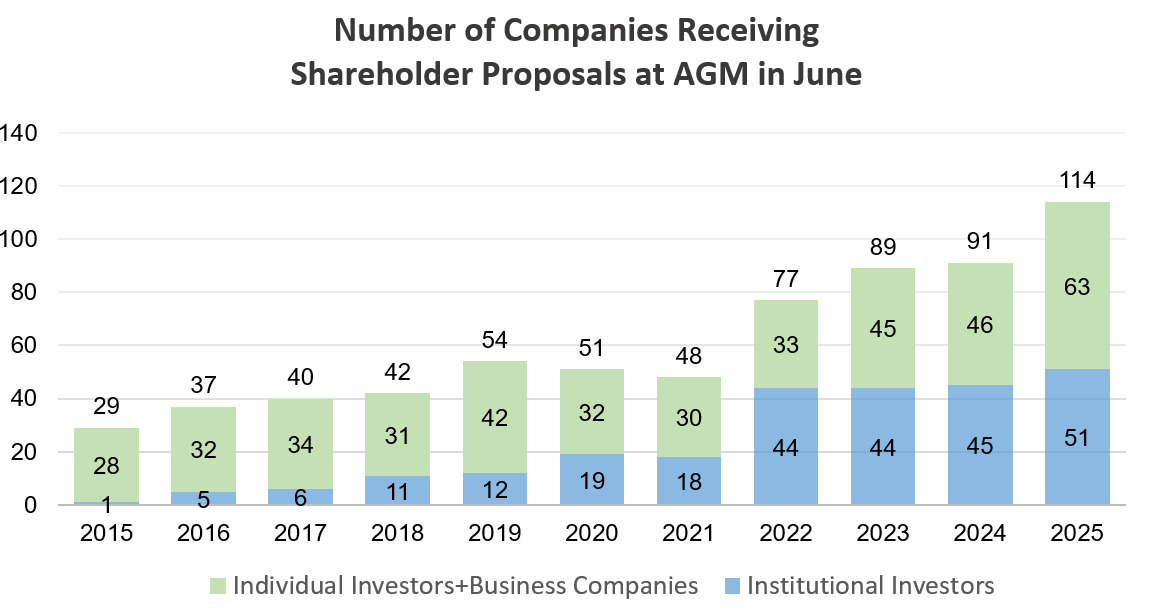

Over 110 Companies Receive Shareholder Proposals for AGMs in June 2025, Totaling Approximately 400 Proposals

Shareholder proposals are increasing significantly at AGMs, which are concentrated in June. According to data compiled by Sumitomo Mitsui Trust Bank, a record 399 shareholder proposals were submitted to 114 companies as of June 9. While shareholder proposals by institutional investors such as activists are increasing, many proposals are also coming from individual investors and business companies.

*Source: Sumitomo Mitsui Trust Bank

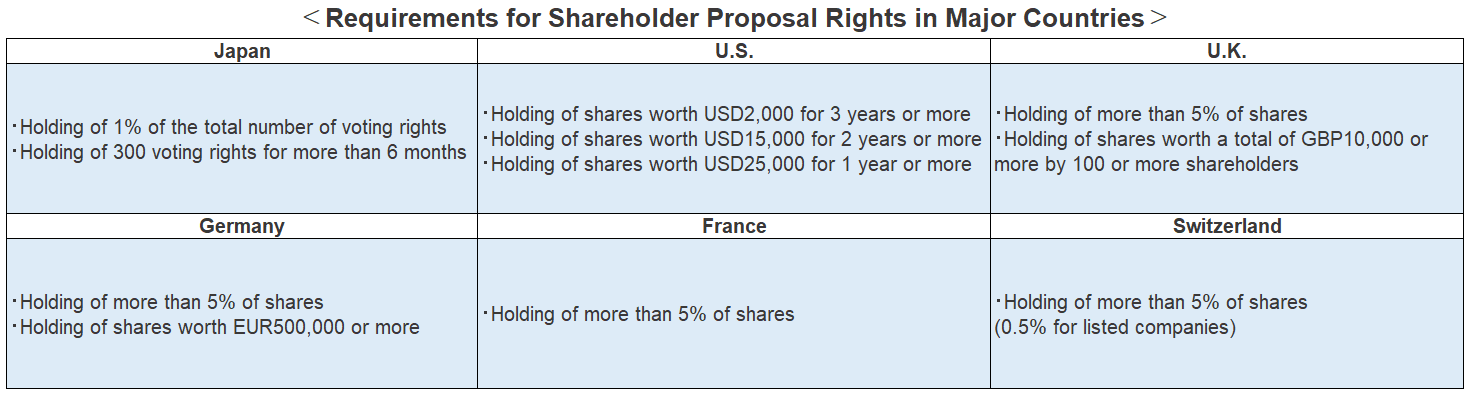

One of the reasons behind the increase in shareholder proposals is the ease of making proposals. In Japan, shareholders who hold at least 1% of the voting rights or 300 voting rights for at least six months have the right to make shareholder proposals. In 2018, the share trading unit was unified from 1,000 to 100 shares. In addition, the Tokyo Stock Exchange’s request to lower the minimum investment amount prompted many companies to carry out stock splits. As a result, the threshold for the right to make shareholder proposals was lowered.

*Source: Compiled based on data from Daiwa Institute of Research (DIR).

Opinions and Counterproposals on Raising Hurdles for or Abolishing Shareholder Proposal Rights

In 2025, opinions were raised that the requirements for exercising shareholder proposal rights are too low. The Ministry of Economy, Trade and Industry’s “Study Group on Corporate Governance toward the Enhancement of Earning Power” compiled a report in January. It clearly stated, “Among the requirements for the right to make shareholder proposals, the requirement based on the number of voting rights (300 voting rights) should be abolished.” In February, the Kansai Economic Federation submitted a written opinion stating that the “requirement of 300 voting rights should be abolished” and requested that the current requirement of 1% or more be raised to 5%, the same level as in the U.K. and Germany. If the 300-voting-rights requirement is abolished, proposals from individual investors are expected to decrease significantly.

Meanwhile, the UTokyo Center for Applied Capital Markets Research (UTCMR), which has been advocating the revitalization of capital markets, compiled a rebuttal proposal in April. The UTCMR pointed out that institutional investors in the Japanese market often do not pay attention to small and mid-cap companies, and many companies lack engagement. The UTCMR noted that recently, there has been an increase in shareholder proposals by individual investors who offer constructive dialogue and suggestions. UTCMR Fellow and Japan Catalyst analyst Yugo Oshima, who compiled the proposal, stated, “Proposals by individual investors may be the only remaining means of engagement,” and called for the development of a Japanese-style corporate governance system.

*Source: UTCMR, “Opposing Higher Thresholds for Shareholder Proposals”

Yutaka Suzuki, chief researcher at Daiwa Institute of Research, explained that the 300 voting rights requirement for shareholder proposals “is intended to allow individual investors to make shareholder proposals.” Based on discussions at the Legislative Council and other bodies so far, he believes that “it would be difficult to ‘abolish’ the requirement of 300 voting rights, as the abolition would make it hard for individual investors to exercise their voting rights.” On the other hand, he expressed the view that “it is conceivable to raise the standard of 300 voting rights, or to require cost burden in cases where the ratio of votes in favor of a proposal is low.”

A market participant commented, “The emergence of two conflicting views is a sign that the development of the Japanese stock market itself and corporate governance reforms are still in progress,” according to a strategist at a securities firm in Japan. This is a manifestation of the conflict between the opinions of companies and investors in the process of structural change in the Japanese market. In addition, “The reduction of cross-shareholdings has forced companies to take off the protective armor of stable corporate shareholders, and they have to become more resilient. In such a situation, a certain structure is necessary to maintain a sense of tension through shareholder proposals” (consultant).

Recently, AGMs have been transforming into a forum for building a fan base, including individual investors, and for dialogue. Kentaro Watanabe, a researcher at Sumitomo Mitsui Trust Bank’s Corporate Governance Consulting Department, says, “In the past, companies often rejected shareholder proposals. However, with the increase in constructive proposals, companies are gradually accepting proposals more widely, considering shareholders more.”

The issue of raising the hurdle for the right to make shareholder proposals is at odds at this point, and it is difficult to find a final landing place. We would like to wait for a forum for discussion to hear the opinions of more companies and investors. Meanwhile, as Japan finally stands on the threshold of corporate governance reform, it is beginning to attract renewed attention from investors around the world. We will need to keep a long-term eye on the next steps in corporate governance reform, which will require companies and investors to gather naturally, engage in dialogue, and improve engagement.

(Reported on June 12)

Shareholders’ Meeting Resolution Data (EDINET)

https://corporate.quick.co.jp/data-factory/en/product/data051/

Discover datasets unique to the Japanese equity market

Visit QUICK Data Factory:

https://corporate.quick.co.jp/data-factory/en/