Japan Markets ViewTSE’s Request for Management Conscious of Capital Cost and Stock Price – Disclosure of Discrepancies with Investors

Nov 21, 2024

[QUICK Market Eyes] On October 31, the Tokyo Stock Exchange (TSE) held its 18th Council of Experts Concerning the Follow-up of Market Restructuring. One of the main agenda items was an update on “Action to Implement Management that is Conscious of Cost of Capital and Stock Price,” which the TSE requested companies to take in March 2023. In addition, preliminary explanations were given on the key points and case studies of companies’ responses not aligned with investors’ perspectives. Just over a year and seven months have passed since the TSE made the request, and the discussions at the council have raised the issue of information dissemination on the “capital cost reform.”

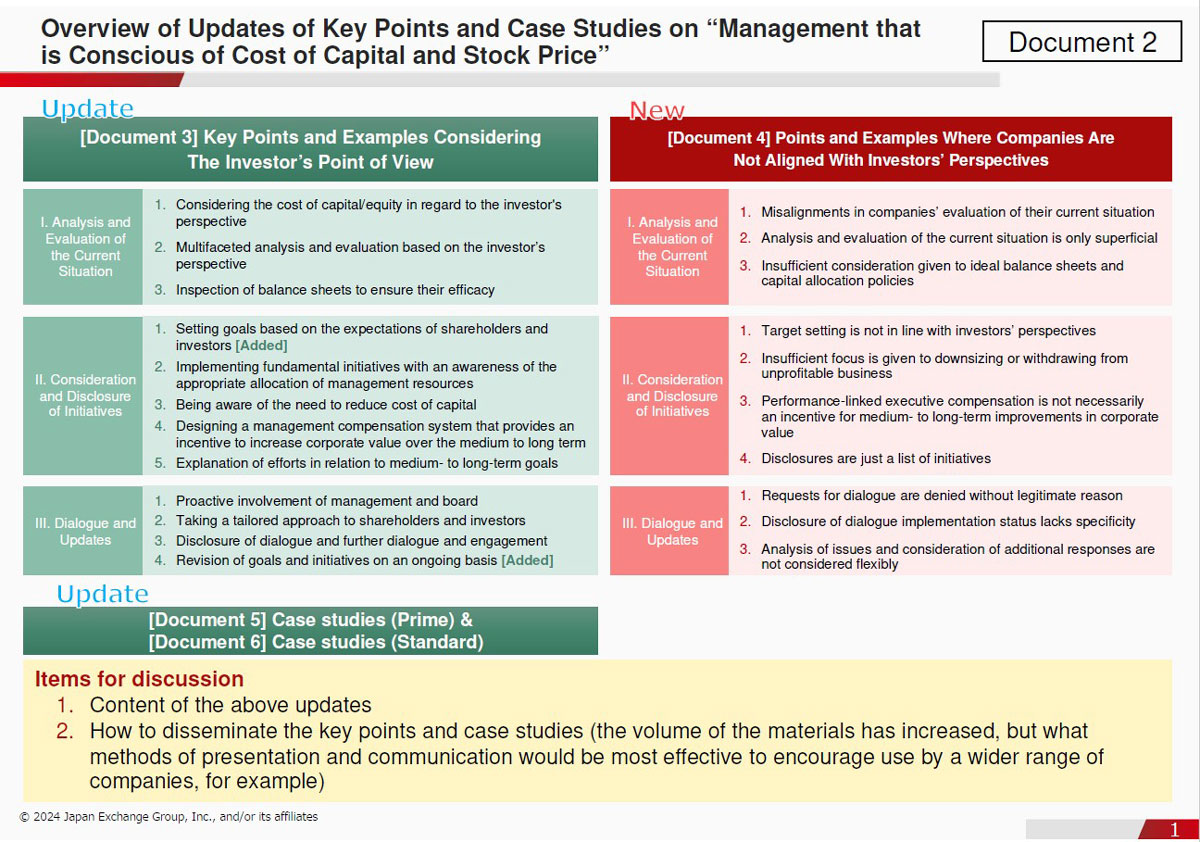

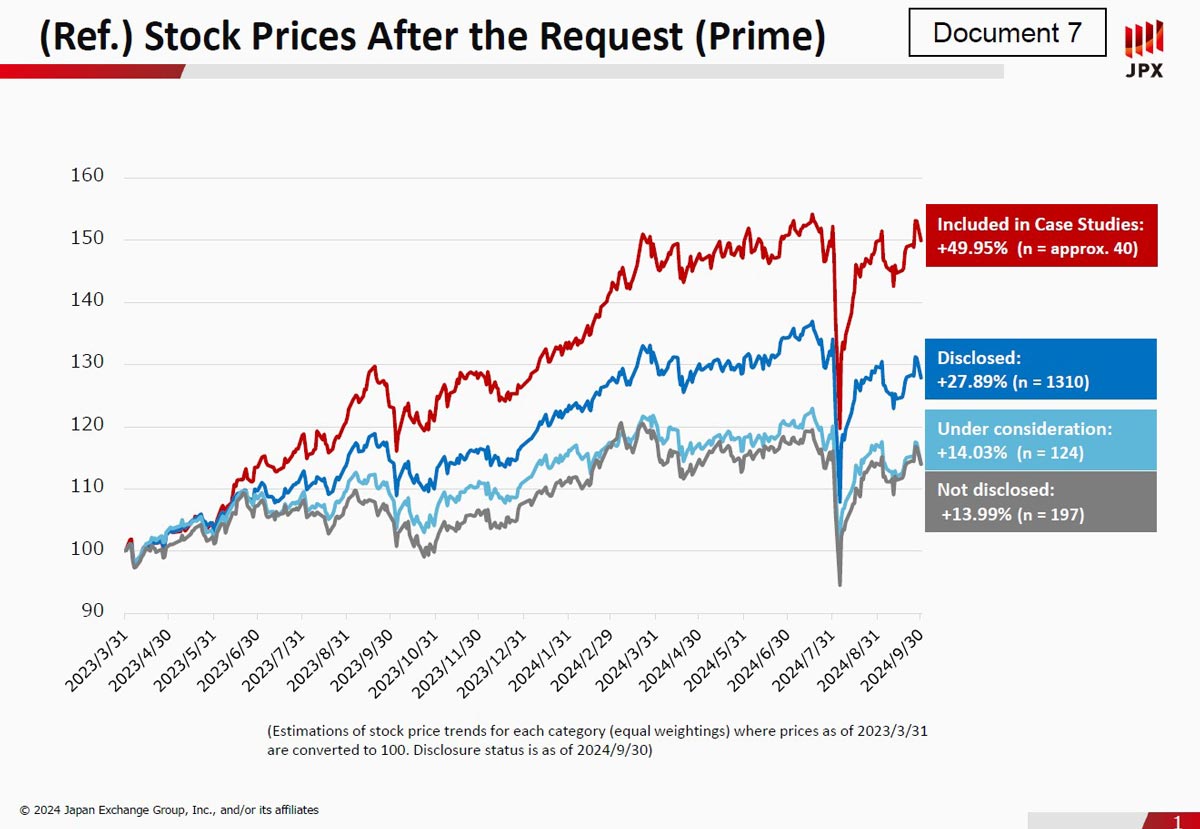

The TSE, the council’s secretariat, presented a total of 10 documents at the 18th council meeting. Documents 1 through 7 relate to capital cost reform. The documents covered a wide range of content. Among them was an update of Key Points and Case Studies on “Management that is Conscious of Cost of Capital and Stock Price,” published in February. They represent examples of “unfavorable disclosure,” so to speak, including corporate responses to the request not in line with the investors’ viewpoints. The documents also covered market assessments, such as the stock price transition according to the corporate response status after the TSE’s request. An updated collection of case studies by companies listed on the Prime and Standard Markets, based on interviews with investors, has yet to be published but is set to be disclosed by the end of November.

*Excerpt from the TSE’s 18th Council of Experts Concerning the Follow-up of Market Restructuring

https://www.jpx.co.jp/english/equities/follow-up/b5b4pj000004yqcc-att/dh3otn000000jhus.pdf

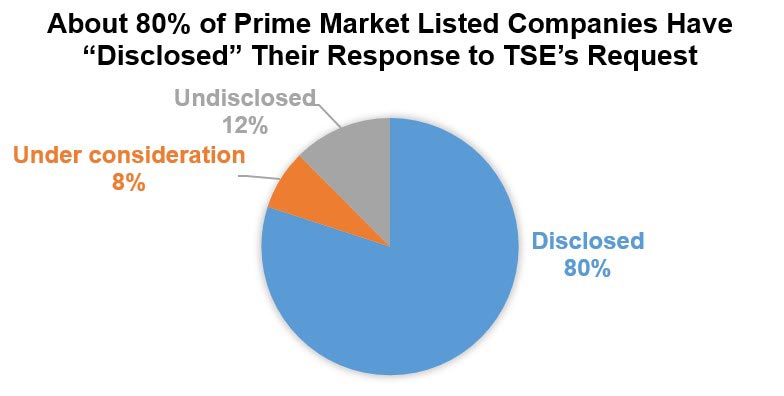

Initially, the TSE’s request to companies for capital cost was said to be an “unprecedented request from a stock exchange.” However, an increasing number of companies, especially those listed on the Prime Market, are taking action to this request. About 80% of the TSE’s Prime Market listed companies have “disclosed” their response to TSE’s request, while 8% are “under consideration” and 12% have “not disclosed.” The TSE also provided an example of market evaluation, showing that a group of companies with “disclosed” status had better stock price performance than those with “not disclosed” or “under consideration” status.

*Compiled based on the materials published by TSE and QUICK data. Response status was as of the end of September.

*Excerpt from the TSE’s 18th Council of Experts Concerning the Follow-up of Market Restructuring

https://www.jpx.co.jp/english/equities/follow-up/b5b4pj000004yqcc-att/dh3otn000000jhvb.pdf

On the other hand, there are differences in companies’ actual responses, and many disclosures are “not aligned” with investors’ perspectives. For this reason, the TSE interviewed over 300 investors in Japan and overseas to compile the “gap cases,” summarizing them into 10 key points. For example, they contain a case study of “Misalignments in companies’ evaluation of their current situation,” where a company uses a cost of equity that is far from the level recognized by investors and does not lead to effective target setting and initiatives. There was also a case of “Analysis and evaluation of the current situation is only superficial,” such as a case in which a company was promoting initiatives in its mid-term management plan to improve corporate value as a response to the request for “Management that is Conscious of Cost of Capital and Stock Price.”

The market has high expectations for the TSE’s initiatives. In a report dated November 1, Nozomi Moriya, strategist at UBS Securities, commented, “The TSE’s follow-up and corporate actions will continue and progress.” In addition to shareholder returns, corporate profitability improvement is expected through increased business restructuring, according to Ms. Moriya. In a report released on the same day, Naoya Fuji, equity strategist at Nomura Securities, noted, “The TSE seems to consider that there is room for many companies to improve their disclosures.” He also stated, in addition to expectations for the effect of discipline on companies, “We hope that dialogue between investors and companies will progress in light of this collection of case studies.”

Information Penetration Issues

At the 18th council meeting, the TSE asked the participating members about effective ways to disseminate the key points to make it easier for companies to use them. According to the meeting minutes released in November, one member pointed out, “Given the substantial volume, it may be useful for those who can read through it thoroughly but might feel cumbersome for many others.” The member also commented that a clear message will help avoid uneven dissemination of information.”

Other member suggested using video as a means of disseminating information. In fact, a market participant commented, “The TSE has been continuing to implement capital cost-related initiatives in detail and has published many materials. However, there are many cases where companies do not understand the key points” (Japanese securities firm). Another said, “It is hard to say that the TSE’s initiatives have been properly disseminated to companies thoroughly” (Japanese securities trader in charge of corporate clients).

In August, reflecting on the situation more than a year after the request for capital cost, the TSE indicated that “reform has just begun.” At the same time, the TSE expressed its commitment to pursuing the quality, not quantity, of listed companies. There are signs that Japan is beginning to resolve some of its unique practices that may be unfamiliar to investors outside of Japan, such as its recent efforts to reduce cross-shareholdings. Having said that, Japan is still fundamentally unfamiliar with capital cost. It is just at the beginning of a long road that will lead to increased value in the Japanese market, with various companies voluntarily taking action to address capital cost. Continued attention should be paid to the efforts of companies to address this issue.

(Reported on November 13)

Related dataset

QUICK Licensed News: QUICK original news on the Japanese market

https://corporate.quick.co.jp/data-factory/en/product/data016/