Japan Markets ViewTSE Top Executive’s Regional Tour: Journey to Instill the Investor Perspective

Dec 10, 2025

[Keiichi Nakayama, QUICK Market Eyes] “The Tokyo Stock Exchange is a partner to listed companies.” Moriyuki Iwanaga, President & CEO of the Tokyo Stock Exchange (TSE), spoke these words powerfully to corporate executives at hotels in Ishikawa and Fukui Prefectures on November 26, 2025. Mr. Iwanaga and the Listed Company Support Group, which was established within the TSE in January 2024, have been continuing their regional tour. They have been explaining changes in trading systems and the importance of management based on an investor’s perspective at seminars across Japan to promote understanding. We explored the reality behind this stance of the TSE top executive personally standing close to listed companies.

Mr. Iwanaga and his team visit various locations as lecturers for these seminars with the cooperation of various securities companies and market participants. This time, Nomura Securities hosted the seminars in the three Hokuriku prefectures, including Toyama Prefecture, the previous day. This is the second time the event has been held in this region, following the one in January 2025. At the Kanazawa venue in Ishikawa, 15 people from eight companies participated. At the Fukui venue, 18 people from nine companies attended. Corporate executives listened intently to the voice of the TSE leader. A representative from Nomura Securities, the host, stated: “The TSE top executive explains institutional changes and key points directly to regional listed companies. This leads to a change in the mindset of corporate executives.”

*Scene of the seminar in Kanazawa City, Ishikawa Prefecture

Spanning 33 pages, the distributed materials cover diverse topics, including progress on the “Action to Implement Management That Is Conscious of Cost of Capital and Stock Price,” a request of listed companies in March 2023, the implementation status of support (such as dialogue sessions and seminars), revisions to Growth Market listing criteria, and the expansion of the individual investor base through the Nippon Individual Savings Account (NISA). Just before the lecture, Mr. Iwanaga carefully reviewed materials summarizing the market capitalization of participating companies and the status of their response to the cost of capital request. During the seminar, he focused his explanation on information that would be useful to them.

For example, he presented the track record of past seminars while unraveling the history of initiatives such as the prompt and thorough implementation of timely disclosure. Following the extension of trading hours in November 2024, many companies still simply push back timely disclosures, such as financial results announcements, to after the close of trading. Mr. Iwanaga explained factors like stock market liquidity and once again called for “prompt disclosure.” He also showed a comparison indicating that understanding is penetrating among companies participating in the seminars.

There was a moment towards the end of the seminar when he spoke with renewed emphasis. Amidst the increasing number of items companies must address due to requests and system changes, he explained, “The TSE is not just making various requests. We also have a strong desire to work hard together to support you if you wish to achieve them.”

*Scene of the seminar at the Fukui venue in Fukui Prefecture

After the seminar, Mr. Iwanaga and the participating companies socialized for about an hour at each venue. The president of a manufacturer listed on the Standard Market, who participated for the first time, said: “Through this lecture, I learned about the richness of the TSE’s support system. I intend to leverage it from now on.” An executive of a certain company, who used to be a finance professional, commented: “The TSE used to be more bureaucratic than government offices. However, it has changed significantly.”

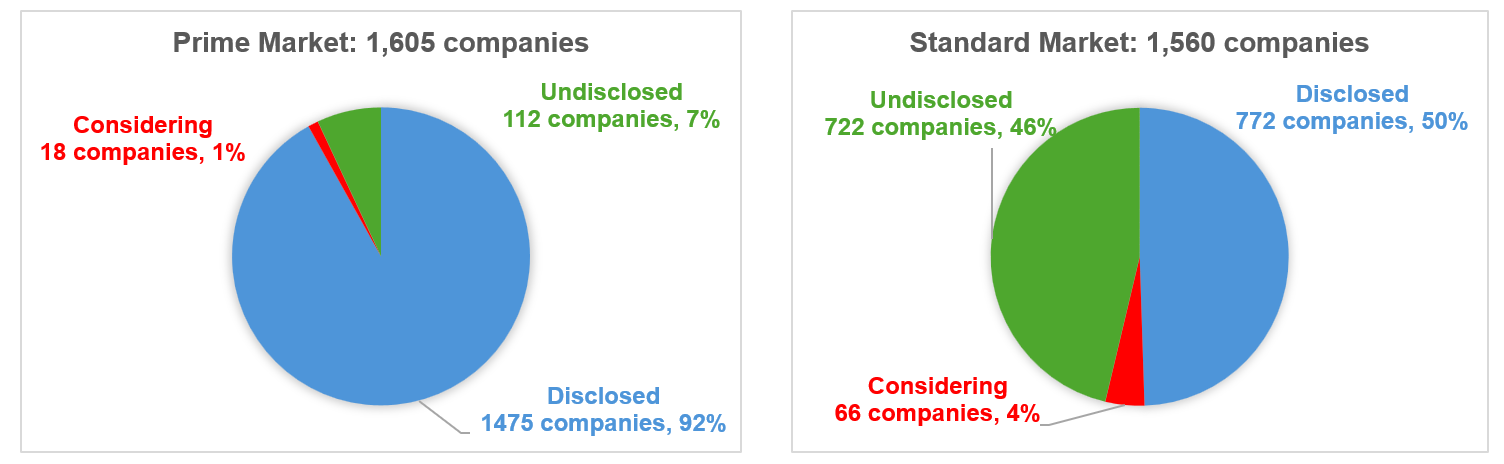

An IR representative from a Standard Market company, participating for the second time at the Fukui venue, said: “I am embarrassed to say that our company has not yet been able to respond to the ‘cost of capital request’.” They explained that the management has a commitment to avoiding half-hearted efforts. On the other hand, about half of the companies listed on the Standard Market are already responding to or considering the request. The representative stated that they will move towards a response because the pressure is rising.

*TSE data on two markets’ disclosure status as of October 2025

This marked the 42nd seminar where Mr. Iwanaga had personally visited a regional area. He has interacted with over 750 companies. When asked how long he would continue the regional tour, Mr. Iwanaga said: “I will go anywhere, anytime, as long as I am called to come and explain [to companies and market participants].” He also smiled and added: “It is indeed encouraging when listed companies tell me, ‘We are glad we came.’”

A fund manager at an institutional investor commented: “The trinity of movements—requests and reforms by the TSE, steps toward change by companies, and progress in dialogue with investors—is leading to the positive development of the Japanese market.” We expect that the TSE’s top executive personally engaging with regional companies will gradually bring about change in Japanese businesses.

(Reported on December 4)

Related article:

https://corporate.quick.co.jp/en/japanmarketsview/equity/ir-professionals-gather-at-tse-to-explore-minds-of-institutional-investors/

QUICK Data Factory:

https://corporate.quick.co.jp/data-factory/en/

Disclaimer:

https://corporate.quick.co.jp/en/terms/#disclaimer