Japan Markets ViewTokyo Stock Exchange Prioritizes Quality over Quantity

Aug 28, 2024

On August 19, the Tokyo Stock Exchange (TSE) held the 17th Council of Experts Concerning the Follow-up of Market Restructuring. The council reviewed the “Action to Implement Management that is Conscious of Cost of Capital and Stock Price,” which the TSE requested companies to take in March 2023. Based on this review, the TSE announced the proposed measures to be taken. While acknowledging the reaction of many companies to the request, the TSE stated that “reforms are still on the way” and indicated its intention to emphasize “quality” over “quantity” of listed companies.

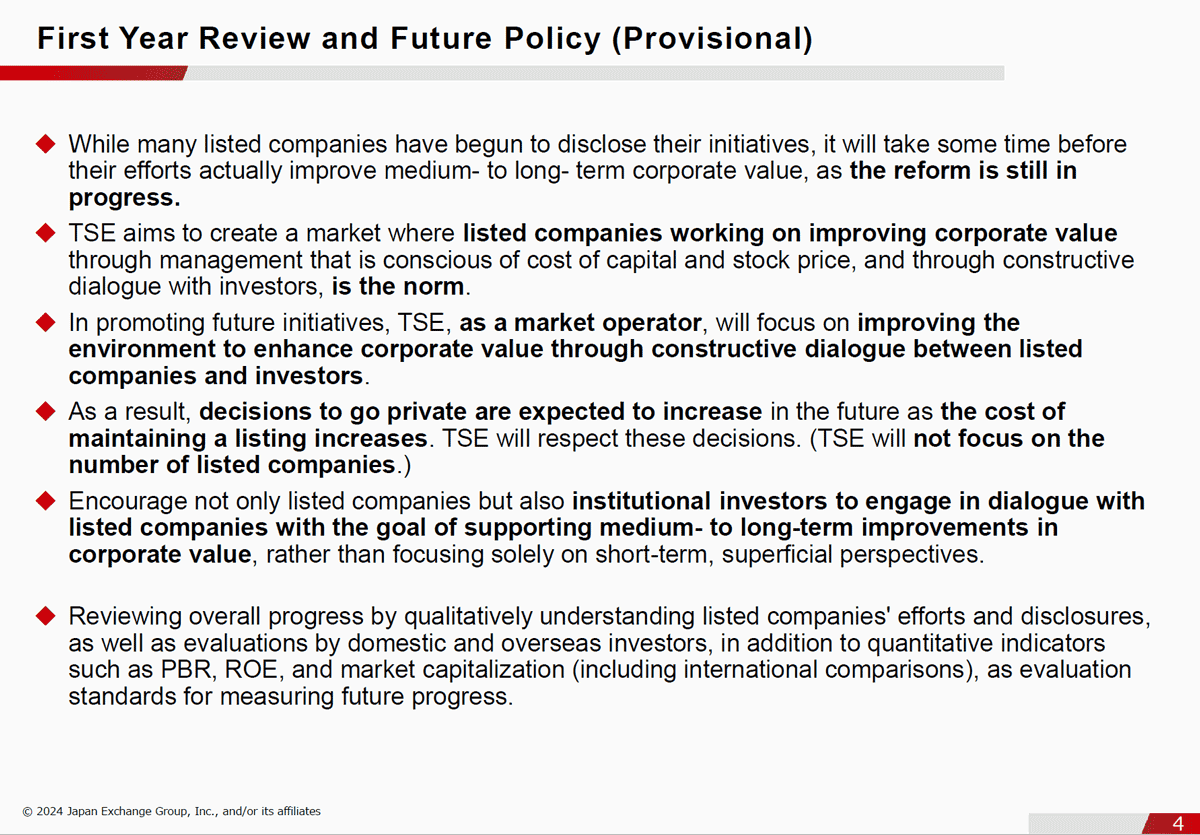

The fourth page of the document released by the TSE contains ”First Year Review and Future Policy (Provisional),” which summarizes the TSE’s future direction. The TSE aims to create a market where it is “natural” for companies to work on increasing their value. As a result, it is assumed that the number of management decisions to go private will increase due to higher listing maintenance costs. However, the TSE also clearly stated that it respects such decisions and “will not focus on the number of listed companies.”

*Excerpt from the materials of the 17th Council of Experts Concerning the Follow-up of Market Restructuring

https://www.jpx.co.jp/english/equities/follow-up/b5b4pj000004yqcc-att/dh3otn000000csa7.pdf

One market participant was surprised to see the document, saying, “I knew that the TSE had a policy of increasing the number of listed companies, but I wonder if they have abandoned such a policy.” Atsushi Kamio, Senior Researcher at Daiwa Institute of Research (DIR), also noted, “The TSE’s emphasis on quality has become even clearer.”

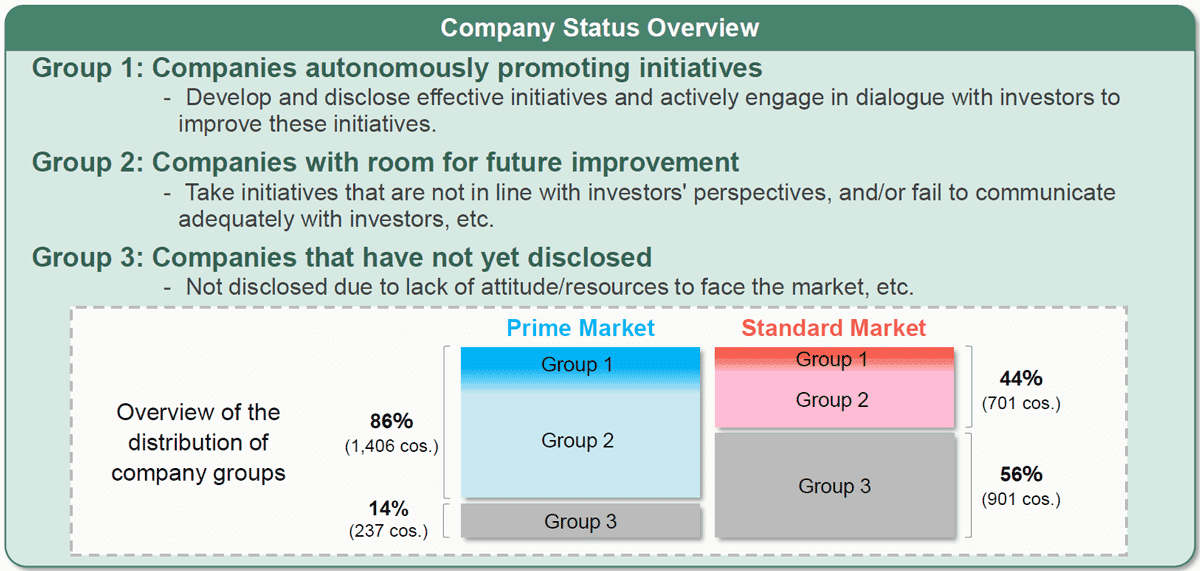

In the material released this time, the TSE summarized the status of disclosure on “Action to Implement Management that is Conscious of Cost of Capital and Stock Price.” As of the end of July, 1,406 or 86% of the Prime Market listed companies disclosed their status, including the status of “under consideration.” On the other hand, only 701 or 44% of the Standard Market listed companies disclosed their status.

Since June, the TSE has interviewed over 60 companies, including Japanese and overseas institutional investors. As a result, the TSE has categorized the corporate status into the following three major groups: (1) “Companies autonomously promoting initiatives,” which develop and disclose effective initiatives and actively engage in dialogue with investors to improve these initiatives; (2) “Companies with room for future improvement,” which take initiatives that are not in line with investors’ perspectives, and/or fail to communicate adequately with investors, etc.; and (3) “Companies that have not yet disclosed,” which have not disclosed due to lack of attitude/resources to face the market, etc.

*Excerpt from the materials of the 17th Council of Experts Concerning the Follow-up of Market Restructuring

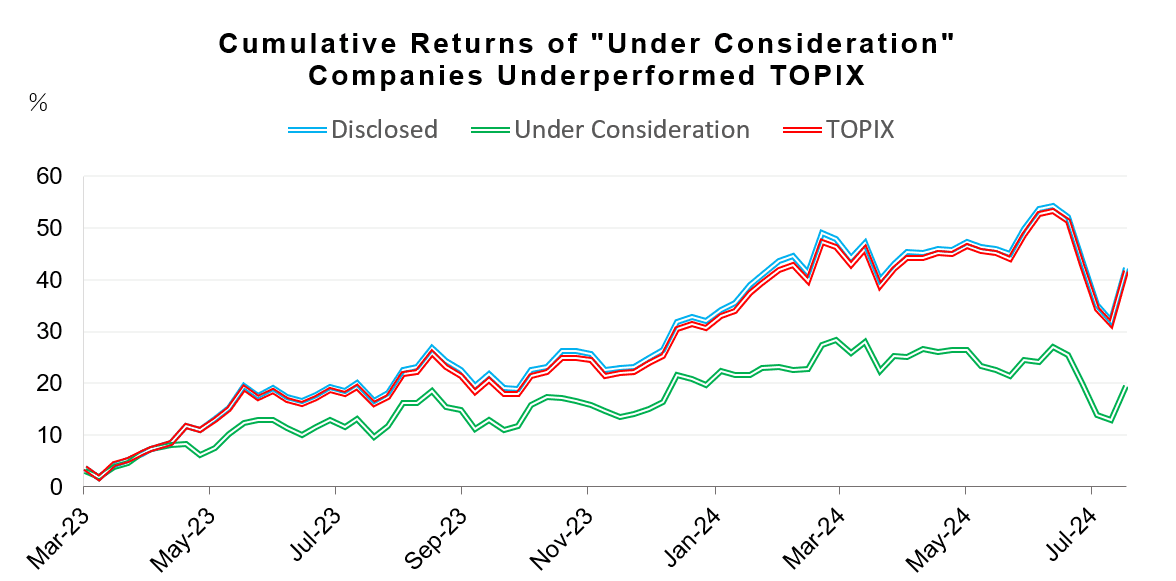

In order to resolve issues with groups of companies that have a misalignment with investors’ perspectives, the TSE plans to compile a list of points that investors expect and gaps between investors and companies in early November. Based on the list of action statuses to the request, compiled monthly by the TSE, a comparison was made using the QUICK terminal’s “backtesting” function. The result shows that the cumulative returns (market capitalization) of the companies with the status of “under consideration” underperformed the Tokyo Stock Price Index (TOPIX). The TSE intends to encourage companies “under consideration” to shift the status to “disclosed” within a certain period of time.

*Cumulative returns of the companies with “disclosed” or “under consideration” status extracted from the list released by the TSE: Weights are market capitalization, and the benchmark is TOPIX constituents.

Mr. Kamio of DIR suggests that “investors will need to look more closely at corporate behavior and changes.” Specifically, close attention should be paid to the seeding of future growth, the attitude of management, and the corporate attitude toward dialogue, which are conscious of the cost of capital. At this point, the TSE has presented only a “draft,” and details will be revealed later this fall. We would like to take a long-term perspective on whether the changes in corporate “quality” resulting from the TSE’s efforts will be evaluated as “quality” in the market as a whole.

(Reported on August 22)

Related dataset

QUICK Licensed News: QUICK original news on the Japanese market

https://corporate.quick.co.jp/data-factory/en/product/data016/