Japan Markets ViewTokyo Stock Exchange Continuing to Advance Reforms in 2025 – Growing Expectations for Changes in Companies and Markets

Jan 28, 2025

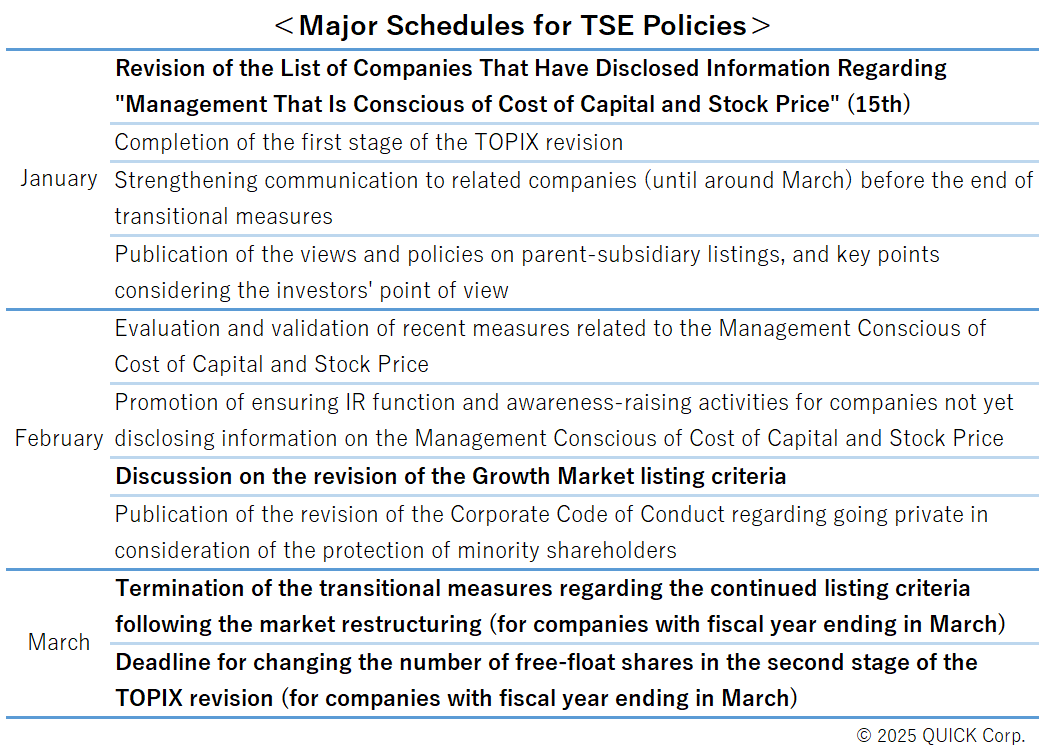

[Keiichi Nakayama, QUICK Market Eyes] The year 2025 marks two full years since the Tokyo Stock Exchange (TSE) requested companies to take “Action to Implement Management that is Conscious of Cost of Capital and Stock Price.” The TSE, leading the reform, will not stop moving forward and is poised to further promote the reform. With the term “cost of capital” becoming increasingly popular among companies, there are expectations for changes in the corporate structure and an improvement in the quality of the market as a whole. This article summarizes the TSE’s initiatives to be undertaken in the near term.

Revised List of Companies That Have Disclosed Responses to TSE’s Request on “Cost of Capital”; 193 Companies Wish to Have More Active Contact from Institutional Investors

Since January 2024, the TSE has been publishing the List of Companies That Have Disclosed Information Regarding “Action to Implement Management that is Conscious of Cost of Capital and Stock Price.” The list is compiled based on the reports on corporate governance (CG reports), and released around the 15th of each month. Starting from January 2025, the TSE specifies on the list whether companies wish to have more contact from institutional investors for engagement, as well as the contact information of the departments in charge of engagement. With these changes, the TSE aims to support companies making proactive efforts. On January 15, the TSE published the “List of Companies That Have Disclosed Information Regarding ‘Action to Implement Management that is Conscious of Cost of Capital and Stock Price’ (as of the end of December 2024).” According to the list, as of the end of December 2024, a total of 193 companies had applied for more active contact from institutional investors, including 164 Prime Market listed companies and 29 Standard Market listed companies.

*Compiled based on the material below by the TSE and various interviews

Revision of the List of Companies That Have Disclosed Information Regarding “Management That Is Conscious of Cost of Capital and Stock Price”

One market participant said, “We receive many inquiries from companies about whether they should apply for more active contact from institutional investors, and what other companies think about it. We explain to the companies that they need to be prepared to make a serious effort if they make such an application.” This is because if they express a desire to have more contact from institutional investors, they will likely receive more inquiries than before from investors outside Japan, hedge funds, and activist investors. As a result, companies may face increased costs in various aspects of responding to the engagement. The preliminary explanation indicated that about 60 companies had applied. However, according to the disclosure on January 15, close to 200 companies made an application. This suggests the seriousness of the companies’ response to the engagement.

In March, the “transitional measures” regarding the continued listing criteria, which were established to mitigate the drastic changes in the market restructuring in 2022, will gradually come to an end. The transitional measures apply to companies that do not meet the continued listing criteria in the new market sections, in terms of “tradable share ratio,” “market capitalization of tradable shares,” etc. As of the end of December 2024, 66 Prime Market listed companies, 150 Standard Market listed companies, and 46 Growth Market listed companies were subject to the transitional measures.

At the press conference in December 2024, Hiromi Yamaji, CEO of Japan Exchange Group (JPX), said, “From the beginning of 2025, the JPX plans to strengthen communication with individual companies subject to the transitional measures.” Mr. Yamaji also explained the JPX’s commitment to providing thorough information to investors once again. The termination date of the transitional measures varies depending on each company’s fiscal year-end. If a company does not meet the continued listing criteria after the transitional measures expire, it will, in principle, enter a one-year improvement period. If the company fails to meet the continued listing criteria during the improvement period, it will be delisted through the designation as Securities Under Supervision or Securities to Be Delisted.

As a further follow-up of the market restructuring, the TSE is poised to take action, such as revising the listing criteria for the Growth Market, along with announcing its views and policies on parent-subsidiary listings, and key points considering the investor’s point of view. In particular, the Growth Market, an emerging market in Japan, continues to be lackluster overall. The TSE is expected to embark on a specific study on measures to revitalize the market, such as changing the continued listing criteria that should be met in order to maintain the listing.

Takatoshi Itoshima, strategist at Pictet Asset Management (Japan), believes “TSE’s market restructuring continues to evolve, and we can expect to see improvements in the quality of companies and the markets themselves.” On the other hand, a strategist at a Japanese securities firm who recently visited Asia noted, “Investors’ expectations that ’something will change in Japan as a whole’ as in the first half of 2023 are fading. Some overseas players may not return to the Japanese market unless corporate changes and Japanese stocks as a whole gain more strength.” Expectations that Japanese stocks will continue to rise further based on a sense of hope alone are dwindling. While Japanese companies tend to have the follow-the-others mentality, a chain of changes is likely necessary.

(Reported on January 16)

Related article

Tokyo Stock Exchange Travelling Across Japan to Promote “Request for Management Conscious of Cost of Capital”

If you are looking for datasets unique to the Japanese equity market, visit QUICK Data Factory:

https://corporate.quick.co.jp/data-factory/en/