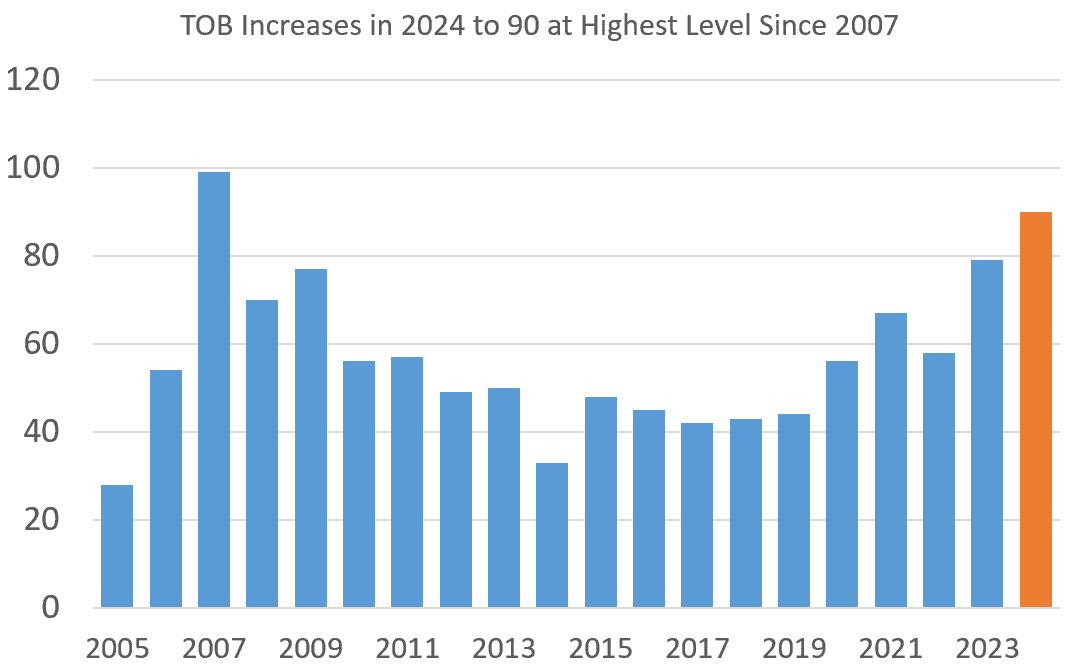

Japan Markets ViewTOB Increases to Highest Level since 2007 – Acquisitions without Consent as New Trend

Dec 05, 2024

[Keiichi Nakayama, QUICK Market Eyes] Takeover bids (TOB) by companies are on the rise, and management buyouts (MBO) are also gradually increasing. In addition, new trends are emerging, such as “acquisition without consent” and TOB price hikes, which have been somewhat taboo in the Japanese market until now. These trends can be seen as part of companies’ gradually advancing efforts to reevaluate their own value. Enhanced metabolism in the Japanese stock market may help boost the valuation of Japanese stocks.

TOB Cases Increase to Highest Level since 2007 and New Trends Emerging, Incl. Acquisitions without Consent

The number of TOB cases increased in November when companies’ financial results announcements for the April-September period of FY 2024 were in full swing. According to the QUICK data, as of November 22, more than 90 TOBs for other companies have been announced in 2024. This number has already surpassed 79 cases in 2023 and is the highest level since 2007 in terms of number of cases.

*Compiled based on the QUICK data.

Fumio Matsumoto, chief strategist at Okasan Securities, noted, “The significance of listing itself for a company and the awareness of corporate management are changing somewhat.” Previously, companies mainly chose to go public to enhance their name recognition or attract human resources. In the meantime, various costs associated with the listing have been rising recently. Mr. Matsumoto commented, “Companies are increasingly choosing whether to protect themselves by delisting through an MBO, which some companies have done, or to pursue further growth by acquiring other companies.”

New trends are also emerging. One is a move of raising TOB prices. A typical example is the TOB for FUJISOFT (9749) by the U.S. investment funds KKR and Bain Capital. In most TOB deals, an acquirer and an acquiree negotiate behind the scenes, and the acquiree expresses its support for the deal when the TOB is announced. On the other hand, KKR and Bain Capital have been bumping competing proposals and raising the acquisition price.

Increase in Broadly Defined Acquisitions without Consent

Hidenori Yoshikawa, chief consultant at Daiwa Institute of Research (DIR), noted an increase in “broadly defined” acquisitions without consent are increasing. “Narrowly defined” are those in which the board of directors of the acquiree expresses an unequivocal opinion “against” the acquisition of shares by the acquirer. In contrast, “broadly defined” refers to an act of initiating a takeover without the prior consent of the acquiree.

According to Mr. Yoshikawa, broadly defined acquisitions without consent have been increasing because of “changing perception of corporate value.” Factors on the side of acquisitions include the need for drastic growth triggered by changes in the external environment, such as the COVID-19 pandemic. He also cited various other environmental changes as factors. They include the formulation of the Guidelines for Corporate Takeovers by the Ministry of Economy, Trade and Industry, and the progress of corporate governance reforms based on the Corporate Governance Code.

Some market participants expect TOBs and MBOs to increase continuously. Mr. Yoshikawa at DIR expressed the view, “We are likely to see an increase in acquisitions without consent targeting the high technological capabilities of Japanese companies, and movements conscious of listing costs by companies with parent-subsidiary listings.” One strategist at a Japanese securities firm also commented, “Based on the trend, the number of TOB cases will continue to increase beyond the beginning of 2025.”

In particular, delisting through an MBO can have a secondary effect on the stock market. Some consider that the investment funds circulating in the market will be reinvested in other companies, which may result in boosting the market as a whole. It has been pointed out that the number of companies in the Japanese stock market is relatively large compared to the market size. We need to keep a long-term eye on whether the increase in TOBs and MBOs will result in an enhanced market’s metabolism and make the Japanese market more attractive.

(Reported on November 27)

If you are interested in the data related to this article, please contact us:

https://corporate.quick.co.jp/en/contact/form_service_en/