Japan Markets ViewSuccessive Unwinding of Cross-Shareholdings and Resulting Downward Pressure on Stock Prices

Jun 18, 2024

Financial institutions have successively announced plans to “eliminate cross-shareholdings.” Under such circumstances, the treatment of cross-shareholding stocks is likely to have a significant impact on stock prices. Based on the cross-shareholding stocks data offered by QUICK, a financial information provider, we examined the impact on prices of “cross-shareholding stocks,” which are expected to come under selling pressure.

■Stocks Subject to Downward Pressure as a Result of Unwinding Cross-Shareholdings

The three major non-life insurance groups have announced plans to eliminate their cross-shareholding stocks, which have a market value of roughly JPY9 tn in total, over the next few years. They plan to sell about JPY1.5 tn first in the fiscal year ending March 31, 2025. The elimination of cross-shareholdings raises concerns about a supply-demand imbalance for the stocks to be “sold.”

Cross-shareholdings are intended to maintain relationships with business partners, but have been criticized for lowering capital efficiency and management discipline. While unwinding cross-shareholdings have been viewed favorably as a way to improve corporate governance, there are also concerns about selling pressure.

■Performance Analysis of Cross-Shareholding Stocks

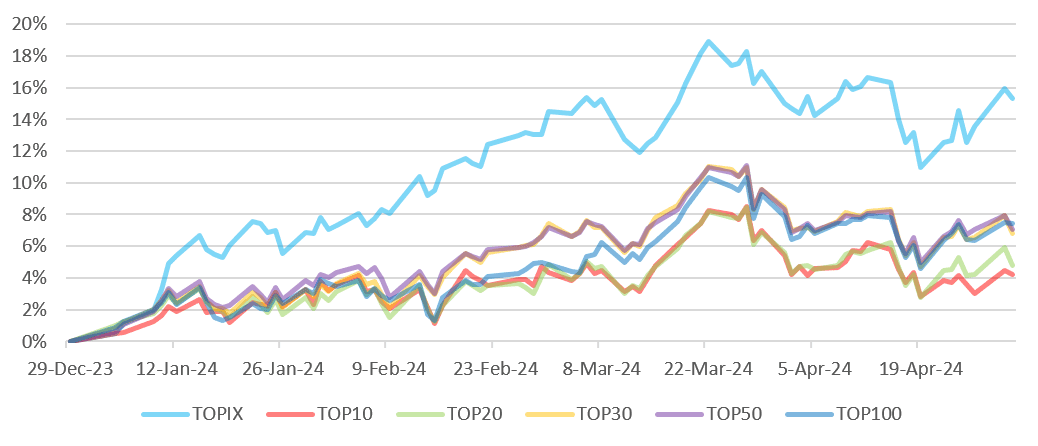

This article examines the performance of cross-shareholding stocks held by non-life insurers and banks. From among such stocks, we selected the stocks with high cross-shareholding ratios, and created portfolios for each category (TOP 10, 20, 30, 50, and 100). The chart below shows their performances since the beginning of the year.

The results show that stocks with high cross-shareholding ratios clearly underperform the TOPIX, which is used as the benchmark. Cross-shareholding stocks are attracting attention as a stock price factor, while the prices of such stocks facing a strong downward pressure seem sluggish across the board.

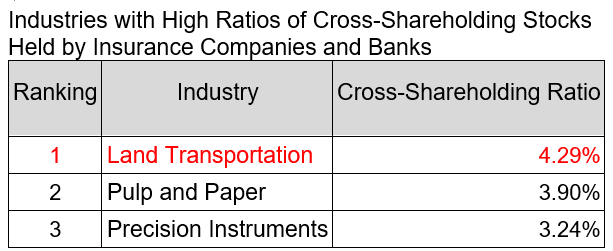

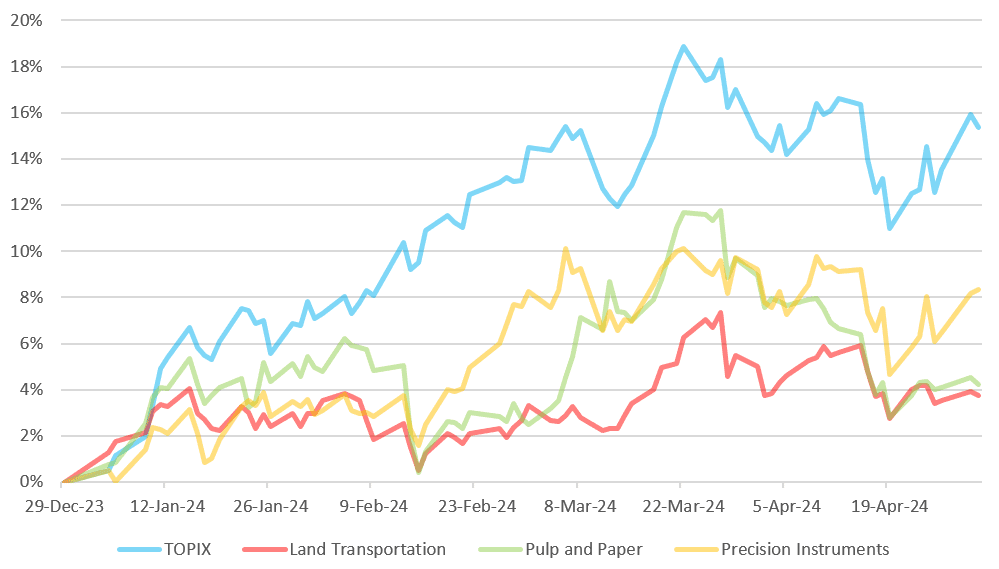

■Cross-Shareholding Ratio by Industry Sector

Insurance companies and banks hold a wide range of cross-shareholding stocks. Although some of these stocks are performing well in some industries, stocks in the industries with high cross-shareholding ratios are underperforming. For example, the land transportation industry enjoys strong business performance driven by increased inbound travelers to Japan, but its stock prices remain sluggish.

■Concerns over Supply-Demand Imbalance May Not Stay Long, but Caution Needed for Short Selling

Stocks with high cross-sharing ratios held by insurance companies and banks are generally underperforming, but caution should be exercised when selling short cross-sharing stocks. A high cross-sharing ratio does not necessarily mean the stock price will fall, as companies often absorb such share sales through share buybacks.

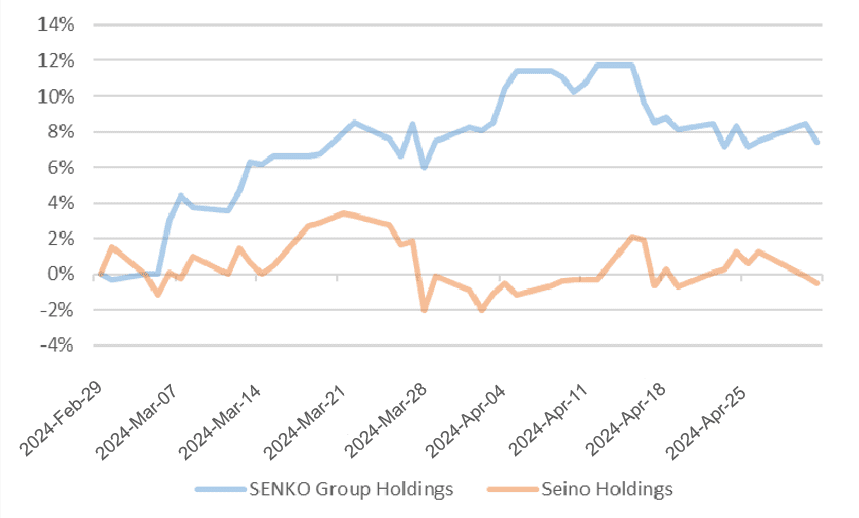

Let’s take a look at stock price performance in the land transportation industry after insurance companies and banks announced plans to “eliminate cross-shareholding.” SENKO Group Holdings (9069) announced a share buyback to prevent stock price declines in response to the sale of cross-sharing stocks. On the other hand, Seino Holdings (9076) has not conducted a share buyback since major non-life insurers announced the sale of cross-sharing stocks. The company has been unable to eliminate selling pressure, resulting in stagnant stock prices.

There is a clear gap between companies that can absorb selling pressure through share buybacks and those that cannot. Therefore, it is important to use financial and historical share buyback data to identify companies that can respond to selling pressure. The next issue will examine the actual situation of companies holding cross-shareholding stocks.

QUICK offers data on cross-shareholdings and share buybacks of individual companies. These data are highly recommended for use in investment decisions and analysis of relationships among companies.

QUICK Data Factory: a marketplace for alternative data and applications in Japan

https://corporate.quick.co.jp/data-factory/en/

Contact us:

https://corporate.quick.co.jp/en/contact/form_service_en/