Japan Markets ViewResurging Bank Stocks – Rising Loans Boosts Expectations of Earnings Growth for Regional Bank Stocks

Dec 19, 2024

[Kanako Nagashima, QUICK Market Eyes] Regional bank stocks have been rising noticeably in the stock market since the beginning of December. In addition to growth in corporate lending, there are high expectations for improved profit margins through higher interest rates in anticipation of the Bank of Japan’s (BOJ) additional interest rate hike. The timing of the BOJ’s policy change is still a matter of opinion. Meanwhile, with the monetary policy normalization that has finally begun, investor activity is likely to continue in anticipation of medium- to long-term earnings growth in bank stocks.

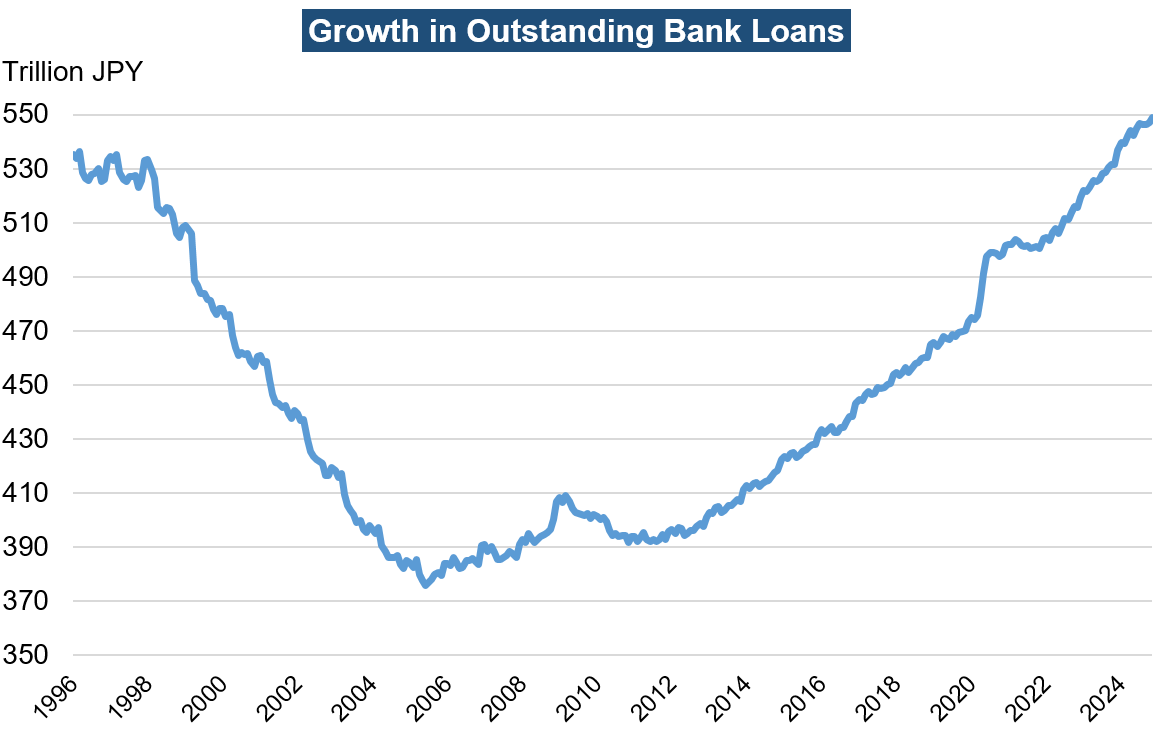

Steady Growth in Outstanding Bank Loans

Outstanding bank loans have seen a significant increase. According to data published by the BOJ, the average amount outstanding of total bank loans has been growing steadily since 2012, reaching JPY549.1607 tn as of the end of November 2024. If interest rates rise associated with the monetary policy normalization amid strong corporate demand for funds, there are high expectations for improved interest margins for the banks as a whole.

*Prepared by QUICK based on the BOJ’s “Principal Figures of Financial Institutions (Monthly Figures)”

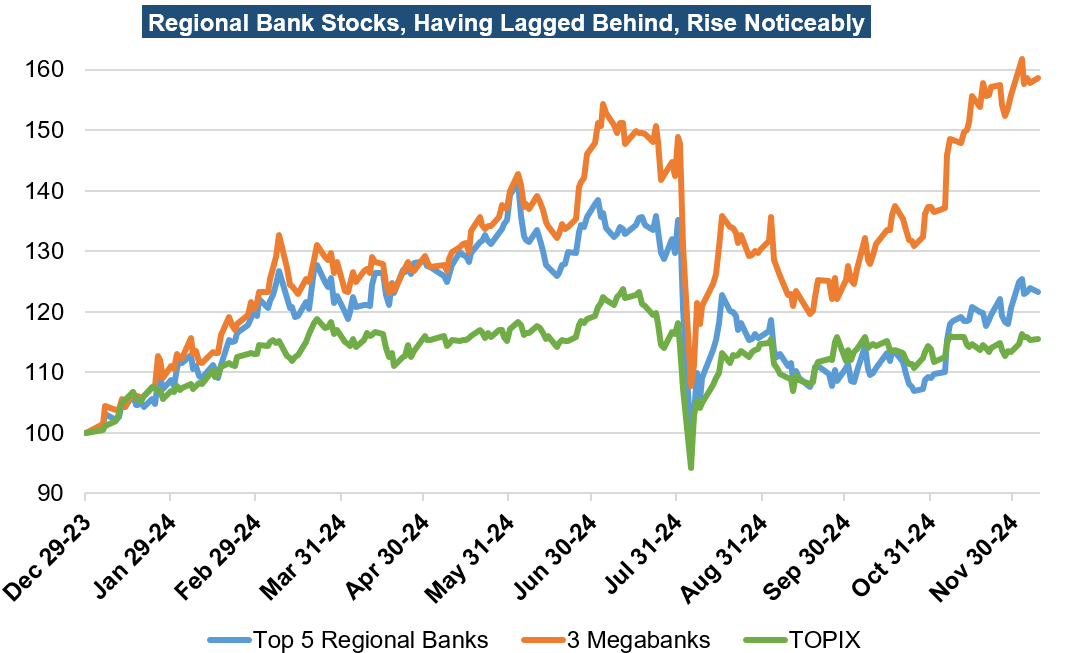

Regional bank stocks are particularly notable for their recent stock price gains. Takuma Ikemoto, market analyst at Tokai Tokyo Intelligence Laboratory, commented, “Compared to megabanks, regional banks have a higher proportion of business in Japan and are more susceptible to the BOJ’s expected revisions.”

Since the market plunge in August, regional bank stocks have relatively lagged megabank stocks. Comparing the performance of the three megabanks and the top five regional banks by market capitalization since the beginning of the year, megabank stocks rose 60%, while regional bank stocks were up only 23%. Ahead of the BOJ’s Monetary Policy Meeting to be held on December 18-19, investors are gradually buying relatively undervalued regional bank stocks.

*Data for megabanks are composite indices for the three banks; Mitsubishi UFJ Financial Group (8306), Sumitomo Mitsui Financial Group (8316), and Mizuho Financial Group (8411). Data for regional banks are composite indices for the top five banks by market capitalization; Concordia Financial Group (7186), The Chiba Bank (8331), Fukuoka Financial Group (8354), Shizuoka Financial Group (5831), and Kyoto Financial Group (5844). Relative comparison with the end of 2023 set at 100

Stock Prices to Be Corrected If Rate Hike Postponed?

Opinions remain divided over the timing of the BOJ’s monetary policy change. While most in the market expect that the BOJ will decide on a rate hike at its December or January 2025 Monetary Policy Meeting, some predict a rate hike after the Meeting in March.

In a report dated December 11, Masamichi Adachi, chief Japan economist for UBS, noted, “A rate hike will not take place on December 19. The risks of the economy and inflation overheating are low. Especially with so many uncertainties, such as the Trump 2.0 trade policy and the political situation in Japan, there is no need for the BOJ to rush into policy normalization.” Mr. Adachi expects the timing of the policy change to be “in January, March, May, or somewhere in between.”

Mr. Ikemoto of Tokai Tokyo Intelligence Laboratory pointed out, “Bank stocks are rising in anticipation of the BOJ’s expected additional interest rate hike in December or January. If the BOJ postpones the rate hike, they may be forced to make a correction.” Bank stocks may be swayed by the BOJ’s policy management in the short term, but the BOJ’s monetary policy normalization toward a world with interest rates has just begun. The resurgence of bank stocks is likely to be an ongoing market theme into 2025.

(Reported on December 13)

Related dataset

QUICK Finer Compass (Bank-Specific Financial Data)

https://corporate.quick.co.jp/data-factory/en/product/data034/

If you are seeking for the data related to this article, contact us:

https://corporate.quick.co.jp/en/contact/form_service_en/