Japan Markets ViewQUICK Holds Seminar on Building IR Capabilities to Realize Corporate Value from Investor Perspective

Dec 25, 2025

[Keiichi Nakayama, QUICK Market Eyes] On December 10, QUICK held the “Seminar on Strengthening IR Capabilities to Realize Corporate Value from Investor Perspective” for investor relations (IR) representatives of listed companies. Guest lecturers were invited to speak on two themes: enriching IR from an investor’s perspective and defining disclosure that transforms corporate value. Over 40 representatives from listed companies attended the event, listening attentively. Some participants commented, “Considering our internal situations, there were many ‘painful truths’ to hear.”

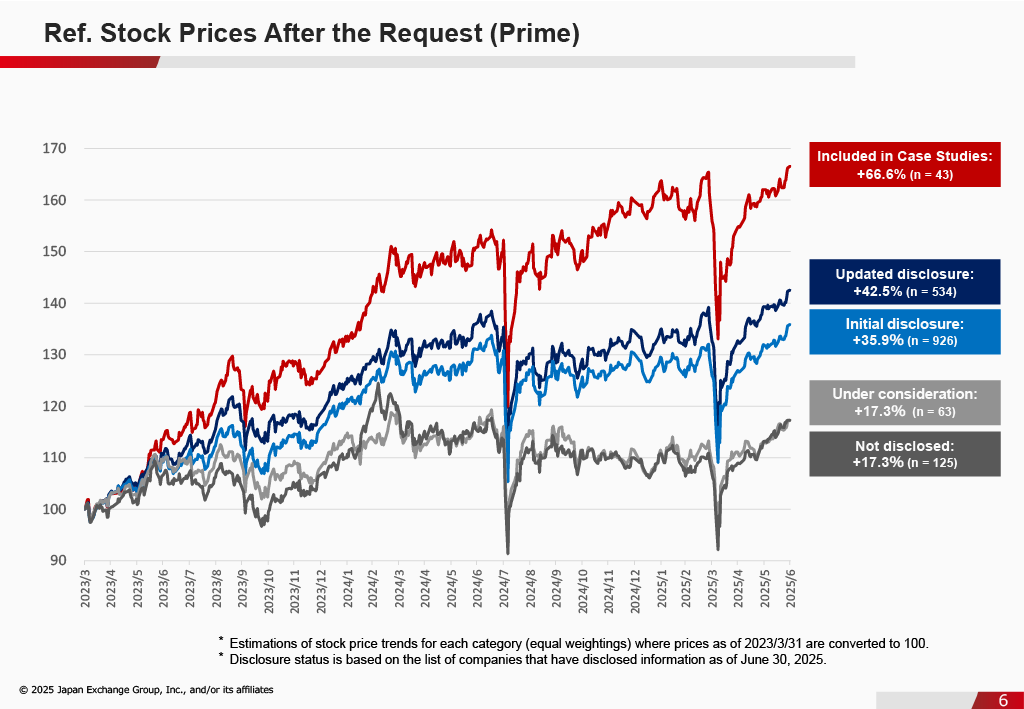

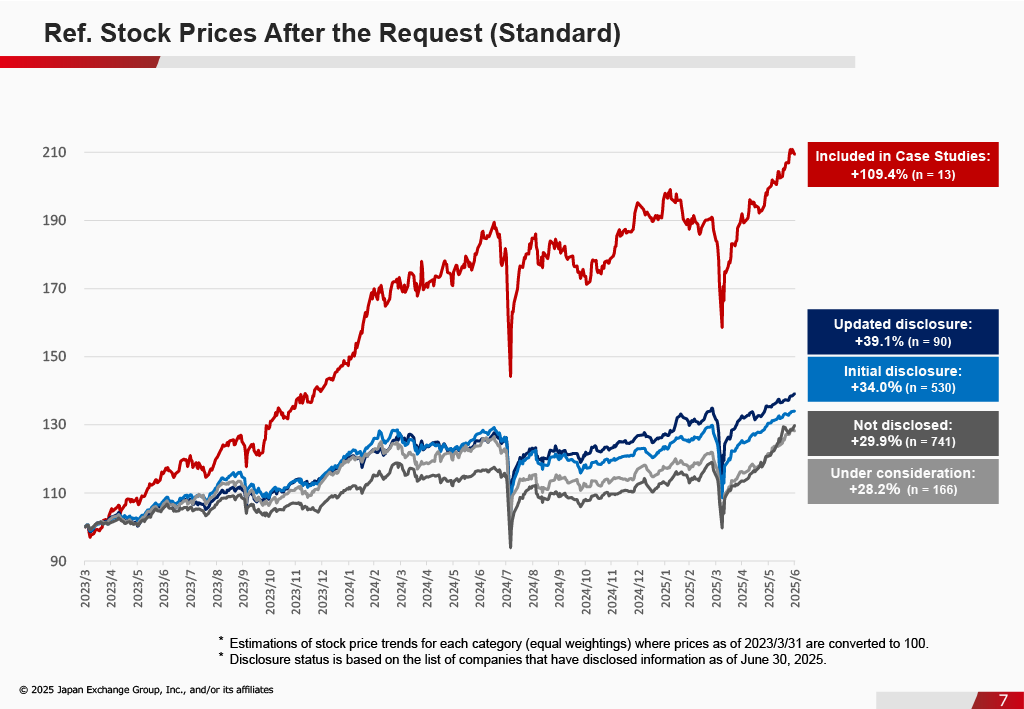

In the first part, Minori Ishikawa from the Listed Company Support Group, Listing Department of the Tokyo Stock Exchange (TSE), delivered a lecture titled “Toward Improvement of Corporate Value and Enrichment of IR.” She explained that the significance of corporate IR activities lies in their contribution to the improvement of corporate value over the medium to long term. She also presented facts regarding market valuations, specifically stock price trends differed based on disclosure status regarding “Management Conscious of Cost of Capital and Stock Price,” which the TSE requested in 2023.

*Source: Tokyo Stock Exchange, “Future Initiatives Regarding ‘Management That is Conscious of Cost of Capital and Stock Price’”

She also presented examples where improvements are expected, based on specific evaluations from investor interviews conducted by the TSE. She called for securing sufficient resources for the IR structure, close coordination with management, active involvement of management, and honest and detailed disclosure of business performance trends. Following the lecture, an IR representative from a certain company confided, “Within my company, there are departments that are reluctant to disclose detailed performance information, which makes our IR work challenging.” The representative stated that they intend to connect the insights from this lecture to their internal activities.

In the second part, Atsushi Kamio, Senior Researcher at Daiwa Institute of Research (DIR), delivered a lecture titled “From ‘Informing’ to ‘Resonating’: Considering Disclosure that Transforms Corporate Value.” Mr. Kamio demonstrated the importance of disclosure, showing that it can transform corporate value by addressing not only investor interest but also concerns and expectations—either meeting them or exceeding them. He also explained that IR is similar to corporate marketing activities. He shared a case study of an IR representative from a Growth Market company he had actually met, who successfully applied marketing experience, such as product planning, to IR operations. Mr. Kamio also explained the details of the evaluation criteria for specific disclosure examples.

After the lectures, a networking session was held for the lecturers and the participating IR representatives. IR personnel were also seen sharing their respective companies’ challenges and solutions with one another. A representative from a particular company stated, “This seminar provided insight into the investor perspective, prompting me to coordinate internally and urge management to take action.” QUICK plans to consider holding seminars that help to improve IR activities and market value.

(Reported on December 15)

Related article:

https://corporate.quick.co.jp/en/japanmarketsview/equity/tse-top-executives-regional-tour-journey-to-instill-the-investor-perspective1210/

QUICK Data Factory:

https://corporate.quick.co.jp/data-factory/en/

Disclaimer:

https://corporate.quick.co.jp/en/terms/#disclaimer