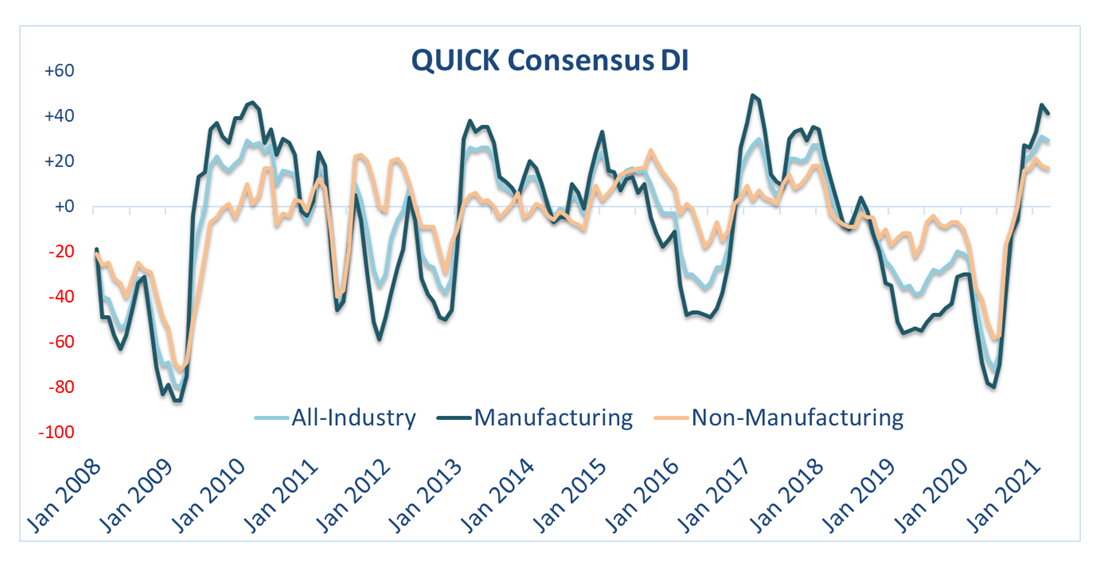

Japan Markets ViewQUICK Consensus DI for all industries worsened for the first time in nine months

Apr 14, 2021

The QUICK Consensus DI, which indicates changes in earnings forecast for major companies, was +29 across all-industry basis including Finance (as of the end of March), which was a fall by 2 points from the previous month. It was the first time in nine months that the index has worsened from the previous month. The DIs for the Manufacturing and Non-manufacturing also worsened from the previous month. DI worsened for 7 of 16 industries.

■ 12 out of 16 industries posted positive results

The DI for Manufacturing worsened by 4 points from the previous month to +41. While the index for Machinery and Pharmaceutical improved by 9 points and 3 points, respectively, the index for Food and Chemical worsened by 45 points and 33 points, respectively. It pushed down the overall index.

The DI for Non-manufacturing worsened by 1 point to +17 for the second consecutive month. The index for Service and Real estate worsened by 26 points and 16 points, respectively.

Among the 16 industries included in the calculation, the following 12 industries showed positive DI: Chemical, Steel, Non-ferrous metals, Machinery, Electrical machinery, Transportation equipment, Information & communications, Wholesale, Retail, Real estate, Banking, and Miscellaneous finance. The two industries with negative were Food and Pharmaceutical, and the two industries with zero growth were Construction and Service.

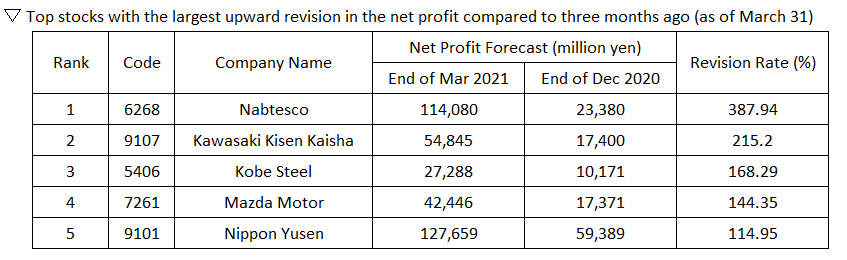

■ Nabtesco’s upward revision is large, driven by investment in EVs and recovery of the robotics market

Nabtesco (6268) had the largest upward revision in the net profit among individual stocks compared to three months ago. There is a growing belief that the investment in electric vehicles (EVs) by the auto industry and a recovery of the robotics market will boost the earnings. Kawasaki Kisen Kaisha (9107) announced an upward revision to its full-year consolidated net profit. Container shipping companies that made investments experienced healthy cargo movements. Analysts also had a positive impression, saying that the increase was larger than expected.

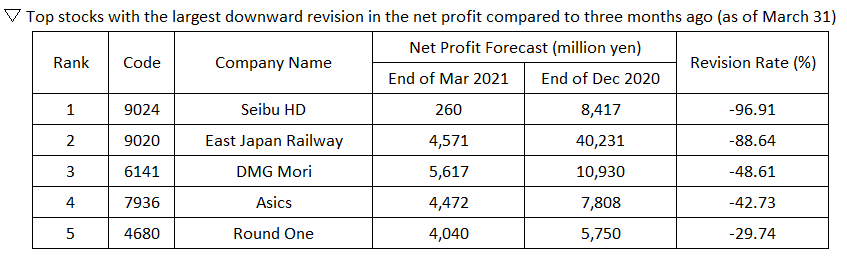

The company with the largest downward revision was Seibu HD (9024). Downward revisions in transportation stocks were notable with East Japan Railway (9020) next in line. The government has abandoned its plan of accepting foreign spectators for the Tokyo Olympics and Paralympics. In the hotel and leisure industry, the delay in the recovery of inbound demand was said to put burden on earnings.

*Stocks with final deficit are excluded as of the end of March.

The stocks for which at least five analysts have issued earnings forecasts both the latest and for three months prior are eligible.

<QUICK Consensus DI>

The QUICK Consensus DI classifies stocks as “Bullish” in the case of analysts revise their consolidated net income forecasts upward by 3% or more compared three months ago, while as “Bearish” in the case of downward. The DI calculates by subtracting the ratio of “Bearish” from “Bullish” to total stocks. A negative DI means that the number of downward revision stocks exceeds upward revisions. The stocks are for the forecasts of at least five analysts and the DI indicates whether the market-wide expectations for the performance of major companies are upward or downward.

QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/