Japan Markets ViewProptech Market is Attracting Attention This Year

Jan 11, 2022

The market for “proptech,” which combines real estate and technology, is expanding. Proptech refers to the value and mechanisms that result in the change in industry challenges and traditional business practices related to real estate through the power of IT (information technology) and other technologies. In May 2021, a package of bills related to digital transformation was passed. In response, the Real Estate Brokerage Act will be revised by May 2022, and the ban on using electronic contracts related to real estate, including documents explaining important matters and contract documents, will be lifted. We would like to focus on proptech-related stocks that are likely to attract more attention in the future as real estate transactions become more digital.

■ The Number of Real Estate-Related Services Has Increased 5.6 Times in 5 Years

According to the “Proptech Chaos Map” published by the Real Estate Tech Association for Japan, the number of real estate-related services utilizing advanced technology reached 446 as of the July 2021 release (7th edition). In June 2016 (the first edition), there were about 80 services, but the number of services has increased 5.6 times in about five years, and the market is expanding rapidly.

Businesses in the real estate industry have been slow to adopt IT compared to those in other industries. There are many time-consuming and complicated tasks such as viewing of the real estate and paperwork, and labor productivity tends to be low. There is a lot of information held by real estate agents, and the information gap between consumers and businesses is also an issue. In recent years, in addition to the need to solve the issues regarding the management and utilization of the increasing number of vacant houses, the COVID-19 pandemic has increased the need for impersonal services, and in order to address such needs, the use of proptech services is expanding.

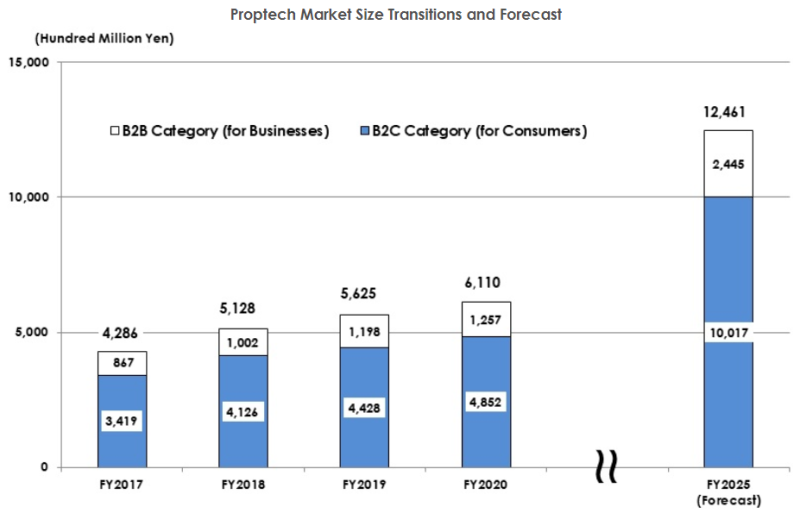

The Yano Research Institute estimates the size of the domestic proptech market to have increased 8.6% YoY to JPY611bn in FY 2020. It is projected to double from the FY 2020 level to JPY1.2461tn by FY 2025. In the area of BtoC in consumer services, there is a so-called “matching service” market. As the number of housing stock increases in the used home distribution market, we can expect to see growth in businesses that use IT and other technologies to promote efficient matching. In the BtoB domain of services for businesses, we expect the market for intermediary services, administrative support, and price assessment to expand due to the momentum from digital transformation (DX) adopted to improve operational efficiency and labor productivity.

*Excerpt from Yano Research Institute’s website

■ Proptech-related Stocks

There are a wide range of companies involved in proptech. SRE Holdings (2980), the subsidiary company of Sony Group (6758), is developing and providing proptech services based on IT and AI (artificial intelligence) technology. Consolidated operating income for the April-September 2021 period was JPY323mn, up 40% YoY, and demand for digitalization in the real estate industry and other sectors is driving earnings growth. In the proptech business, which accounts for nearly 80% of sales, brokerage services using AI real estate appraisal tools were solid. The company’s cloud services, such as real estate price estimation engines that use real estate data obtained through the business, and consulting business are also expanding steadily. The share price has risen 74% from 4,240 yen at the beginning of the year to 7,370 yen on December 28, and the favorable business environment is providing support.

Living Technologies (4445, Mothers) operates sites such as “Living Match,” a bulk appraisal site for selling real estate. The non-consolidated operating income for the fiscal year ending September 2021 announced in November was JPY139mn, 4.1 times higher than that for the previous year. The company expects operating income for the fiscal year ending September 2022 to be JPY500mn, 3.6 times that of the previous fiscal year, and the favorable outlook was seen as a positive factor and the stock was bought until its price reached its upper limit for consecutive days. The stock price rose to 6,950 yen on November 18, reaching a new high for the year. Although the stock has recently gone through correction to the level of around 4,000 yen, the number of clients for the company’s services has been growing steadily, and the company has stated that it will continue to engage in mergers and acquisitions (M&A) to expand its services and enter new markets. The company has not loosened the reins on growth investment.

With the lifting of the ban on electronic real estate-related contracts, GMO GlobalSign Holdings (3788) and Bengo4.com (6027), both of which provide electronic signature services, are also worth watching. The two companies have been in the spotlight as de-seal-affixing-related issues due to the COVID-19 pandemic, and have recently been expanding their services in anticipation of the digitalization of real estate transactions. In cooperation with real estate agents, the companies are working to improve the environment by launching an electronic signature service for real estate sales and lease contracts. The stock prices of both companies have been on a gradual downward trend since the beginning of the year, but this is likely due to the fact that the stock prices have been factored in as being de-seal-affixing-related by the second half of 2020 and the prices significantly rose, causing the prices to largely decline as a reaction to such upward trend. In 2022, when digitalization progresses, we expect the stock prices to rise again.

For alternative data on Japanese stocks

https://corporate.quick.co.jp/data-factory/en/product/